The Cyprus Financial regulator CySEC has just informed the public that it has wholly withdrawn the Cyprus Investment Firm (CIF) license of UBFS Invest, backed by broker Moneychoice Brokers Ltd., according to a decision made at a meeting dated November 28, 2016.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong

[gptAdvertisement]

As reported by Finance Magnates in May, UBFS Invest was initially flagged for non-compliance and had its license temporarily suspended by CySEC following several allegations of multiple violations. The watchdog then extended the firm’s suspension in June followed by a further extension in August, 2016.

UBFS Invest is a provider of FX trading systems for individual and institutional customers. It also offers portfolio management to its clients powered by Moneychoice Brokers Ltd.

In particular, UBFS Invest is being accused of noncompliance, in that it did not properly protect or provide safety of its clients’ funds. In addition, UBFS Invest appears to have a problem with capitalization, as its own funds have fallen below the requisite capital requirements set by CySEC. By extension, the group’s total capital ratio is also below the necessary requirements, based on European regulatory measures as well as the necessary levels set by CySEC.

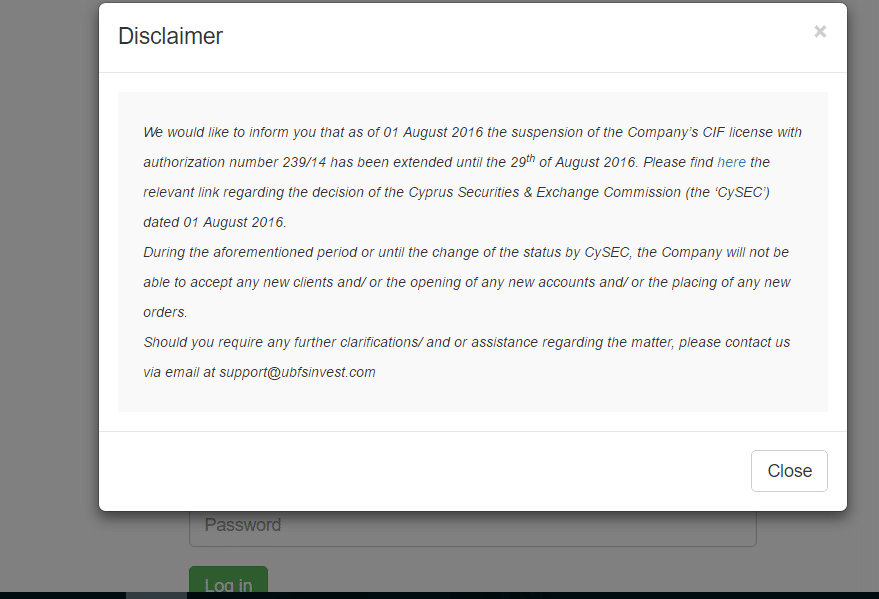

A visit to the UBFS Invest website now shows the following pop-up. However, this has yet to be updated to reflect the new status and the firm is also required to remove any references regarding authorization and supervision by CySEC.

As of this date, the brokerage is no longer licensed and regulated by CySEC and cannot provide financial or ancillary services. The regulator gave UBFS Invest three months from that date to settle its Obligations arising from the investment services that also lapsed, during which time it remains under the Cypriot watchdog’s supervision.

Under the Cypriot regulatory framework, the company must return all outstanding balances to its clients and handle all of their complaints. In addition, UBFS Invest must provide a confirmation from its external auditor that it does not have any pending obligations and must include details on each of the company’s clients, according to the same CySEC announcement.