MiFID II/MiFIR have been in place for more than two years, but there are parts of the regulations that still remain unclear for foreign exchange (Forex ) and contracts for difference (CFD) brokers. Namely, what is the difference between transaction reporting and trade & transparency reporting?

While most market participants are familiar with transaction reporting, many are not so certain on trade and transparency reporting, and whether they need to comply with this Regulation . So, with the help of TRAction Fintech, we have set out to clarify the differences between the two.

What is transaction reporting?

Under MiFID II, financial firms are required to report transactions for executed financial instruments to trade repositories. In these reports, information such as the type of financial instrument traded, the firm actioning the trade, the buyer and the seller, and the date and time the transaction was executed need to be included.

What is trade reporting?

Under European regulation, investment firms are also required to report the basic details of their trades almost immediately, so that the information can be circulated in the market. The aim of these reports is to improve the transparency of pricing and offer greater insight into how prices are quoted and formed.

In trade reports, the following needs to be included: trading date and time, instrument identification code, unit price, price currency, quantity, venue of execution, publication date and time, venue of publication, and transaction identification code.

As highlighted by Ron Finberg, Product Specialist, Regulation at Cappitech: "Receiving the trade reports are APAs which are chosen by the financial firm submitting the report. Once collecting the trade report, the APA is responsible for making the data available to the public. Similar to the obligation of financial firms to submit trade reports in near real-time, APAs are also required to publicize data as real-time as possible."

What are the differences?

A crucial difference between transaction and trade reporting is the length of time a firm has to send the report. Out of the two, transaction reporting is more relaxed and must be reported latest by the next working day (T+1).

Trade reporting, on the other hand, operates in near real-time. Therefore, trading venues and certain investment firms need to publish the volume and price within one minute of the completed trade of equity or similar products. Firms have 15 minutes to publish this information for non-equity products; however, that is due to change this year.

Another key aspect that sets the two apart is the motivation behind the reports. The aim of transaction reporting is to locate and prevent market abuse. Because of this, more details of the client behind the transaction and anyone working on their behalf is needed and the information is not made public. Alternatively, trade reporting focuses on ensuring transparency within the market.

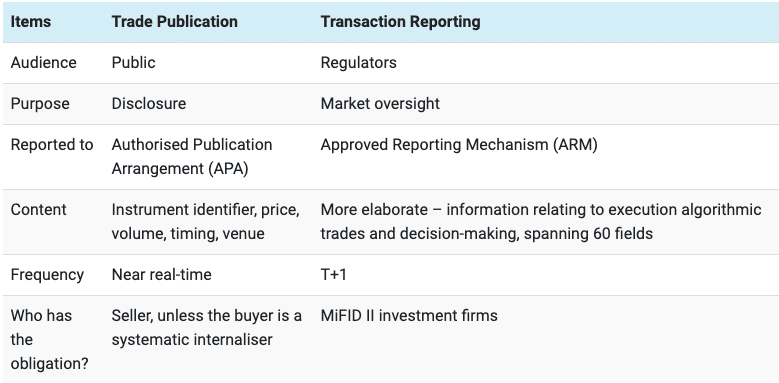

Below, TRAction Fintech has outlined the key differences between trade publication (TP) (also often called trade reporting) and transaction reporting (TR).

Source: TRAction Fintech

Which reports do firms need to prepare?

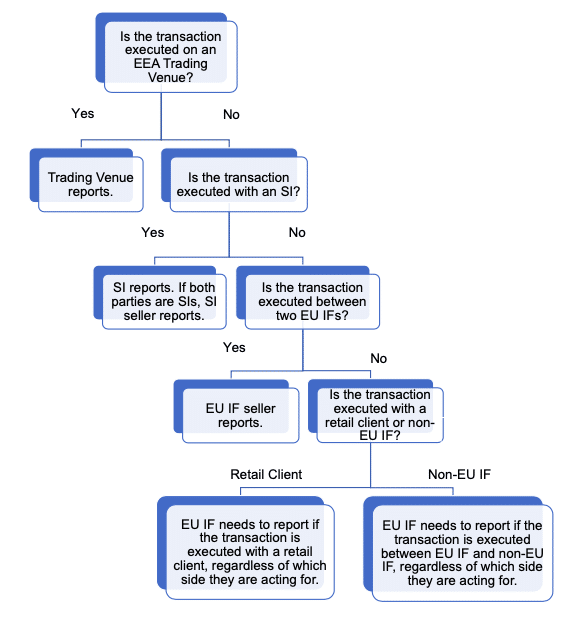

Your TP and/or TR obligations under MiFID II will depend on whether the instrument is traded on a European Economic Area (EEA) trading venue and if it isn't, whether it has an underlying instrument traded on an EEA trading venue.

The Financial Instruments Reference Data System (FIRDS), published by ESMA daily, will contain all the details of trading on the venue.

As highlighted by TRAction Fintech: "Articles 6, 10, 20 and 21 of MiFIR requires European Investment Firms ("IFs"), Systematic Internalisers ("SIs") and Trading Venues to make public, through an Approved Publication Arrangement ("APA"), post-trade transparency information in relation to financial instruments which are traded on a Trading Venue or traded Over-The-Counter ("OTC")/Off Exchange.

"The obligation only requires one counterparty to report the trade data. Where the transaction is executed on an European Economic Area ("EEA") Trading Venue, the market operators or Investment Firm who operate the Trading Venue have the trade reporting obligations (Article 12 of RTS 1)."

Below is a tree diagram to help you determine who has the reporting obligation under MiFIR Trade Publication. However, it is important to highlight that this is only applicable to products that are traded on a trading venue or traded off-exchange.

Source: TRAction Fintech

Speaking to Finance Magnates, Quinn Perrott from TRAction Fintech noted: "Not only is the obligation often confusing and mostly dependant upon who a broker hedges with, it doesn't help that the names' trade' and' transaction' can sometimes be interchangeable.

Quinn Perrott, Co-CEO of TRAction

"As a result, many brokers engage a specialist firm with experience in these requirements. It's often just too hard to understand and ascertain for the average overworked internal compliance officer that is trying to deal with constantly evolving regulations."