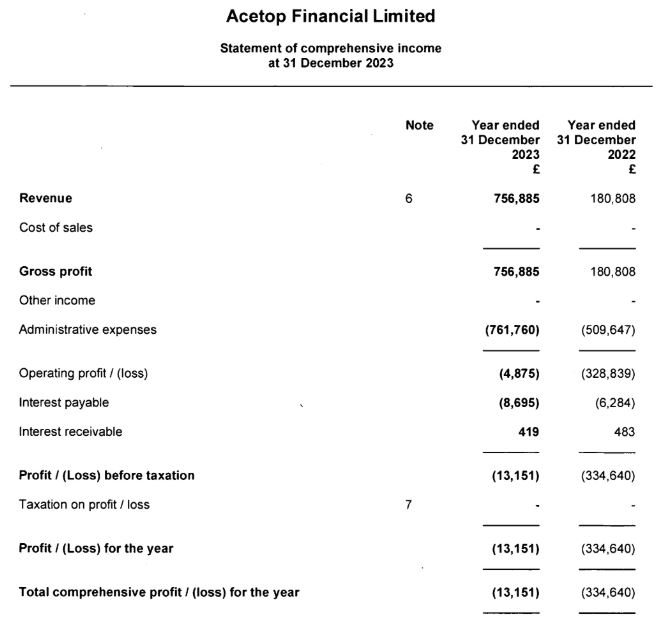

The UK-registered unit of Acetop, a retail broker offering contracts for differences (CFDs) and spread betting, ended 2023 with a 320 percent jump in its annual revenue, reaching £756,885. This massive surge in revenue significantly narrowed the losses to £13,151 from £334,640 in the previous year.

A Massive Surge in Revenue

“In 2023, we experienced an outstanding year in terms of financial performance. Our revenue has seen a remarkable surge,” Acetop Financial Limited noted in its latest Companies House filing. “This exponential growth can be attributed to a combination of strategic initiatives, innovative product offerings, and an adept response to the evolving financial landscape.”

The company highlighted that its main revenue source was from trading. Indeed, the notional trading volumes on the platform were close to $4.65 billion in 2023, an improvement from $3 billion in the previous year. Spot gold remained in the focus last year, the broker revealed.

However, with the increase in revenue, the administrative expenses of the UK-based company rose to £761,760 from £509,647 in 2022. Meanwhile, its payable interest reduced drastically to £4,875 from £328,839.

"Small Intake of New Clients"

Acetop offers leveraged trading services with over-the-counter derivatives, primarily CFDs and spread betting. While CFDs are popular globally, UK-based traders prefer spread betting as gains from such instruments are tax-free in the country. The UK-based company highlighted that it enables both retail and professional customers to trade CFDs in multiple countries.

According to the filing, the UK arm of the broker had a “small intake of new clients onboarded in 2023.” However, it did not reveal any number.

At the end of 2023, the balance sheet of the company remained strong, with total assets of £3.36 million compared to £2.74 million in the previous year. The net assets remained almost the same at £1.61 million, compared to £1.62 million in 2022.

“We continue to look at how we can become more diversified and also how we can innovate our services to appeal to a more global audience. We believe we have a strong offering in the multiple markets to give our clients a great range of products to meet their needs,” the company added in the filing.