Retail forex (FX) deposits of six brokers operating in the U.S. saw a modest increase in October, rebounding from a September low. However, the total of $518.4 million remained among the lower figures in recent months. This update comes from the latest data published by the Commodity Futures Trading Commission (CFTC), which showed a rise of 0.4% from $516.3 million.

US FX Deposits Rebound in October 2023

According to CFTC regulations, each Retail Foreign Exchange Dealer (RFED) and Futures Commission Merchant (FCM) must report their financial positions monthly to the CFTC, including adjusted net capital, customer assets, and total retail forex obligations.

Retail forex obligations represent the total funds an FCM or RFED holds, comprising all money, securities, and property deposited by a retail forex client across one or more retail forex accounts, adjusted for realized and unrealized net profit or loss.

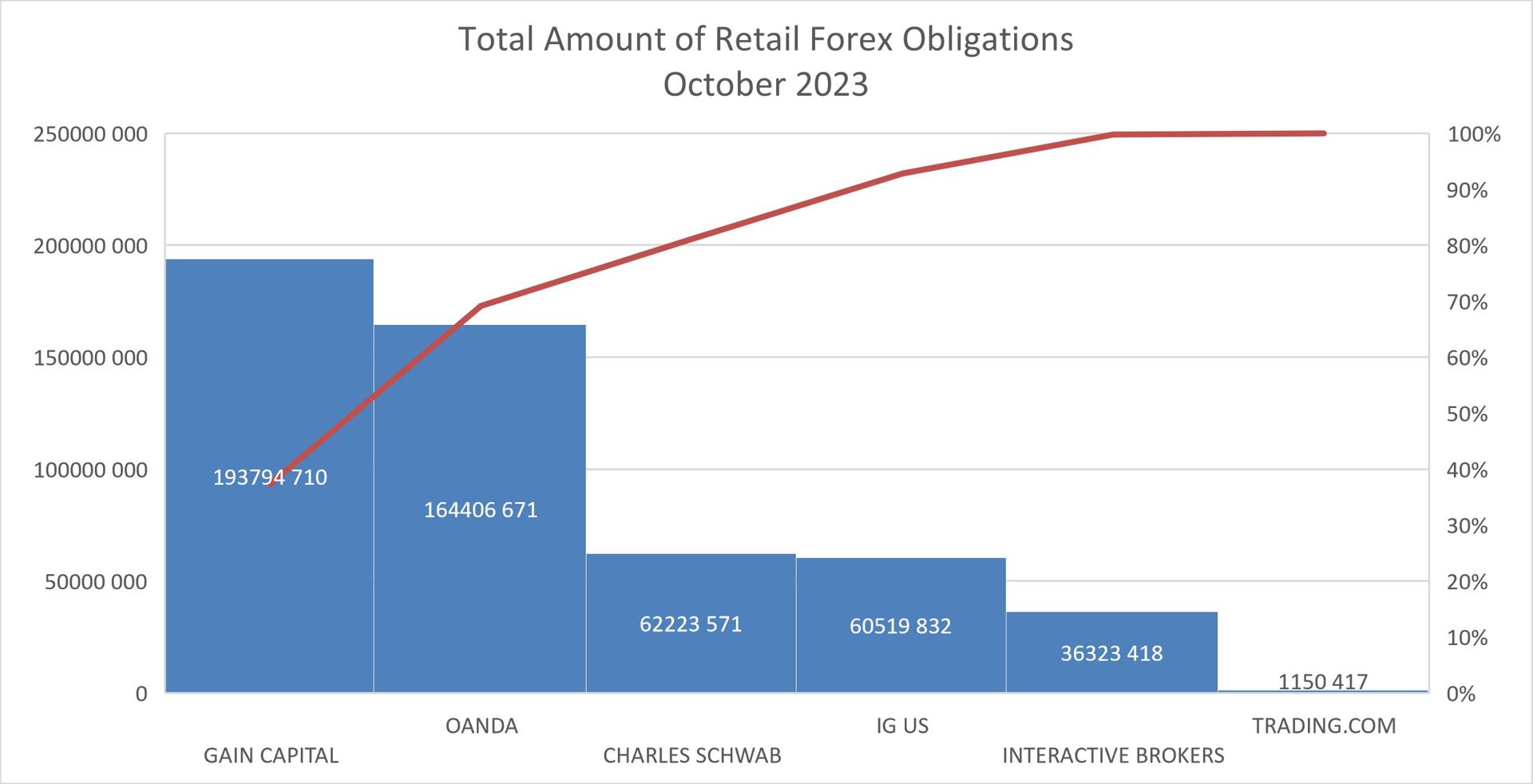

Among the 62 registered FCMs and RFEDs, six firms disclosed data on obligations . As usual, Gain Capital held the largest position, with deposits valued at $193.8 million. OANDA followed with $164.41 million, and Charles Schwab was third with $62.23 million. Others in order included I.G. U.S. ($60.52 million), Interactive Brokers ($36.3 million), and Trading.com ($1.1 million).

The outcome was an improvement not only month-over-month but also year-over-year. In October 2022, the total deposits for brokers were $504.1 million, marking an increase of nearly 3%.

Trading.com Sees Largest Growth

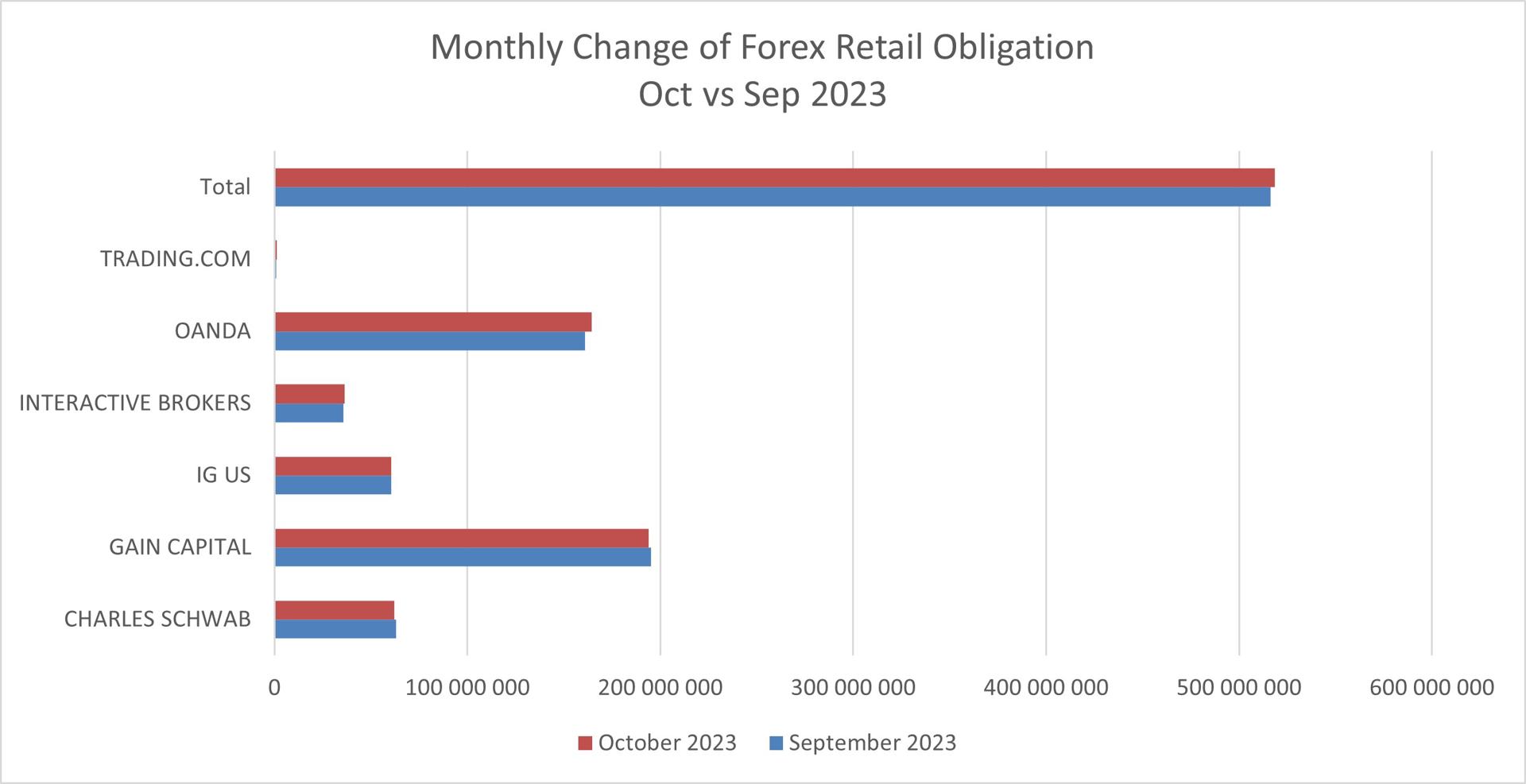

While the market share remained largely unchanged for most retail brokers, Trading.com, the smallest player in the list, saw a significant increase of 11% in deposits from $1.02 million reported the previous month.

The largest player, Gain Capital, experienced a decrease of 1% in deposits, shrinking by nearly $2 million. Charles Schwab also reported a similar loss. I.G. U.S.'s figures remained unchanged, and Interactive Brokers increased their deposits by 1%. In the same period, OANDA's deposits grew by 2% from $160.1 million reported in September.

Finance Magnates independently examines trends among retail investors. Using insights from CPattern, we present our indicators, tracking historical changes in average deposits, withdrawals, and initial deposits. The latest study highlighted a peak in deposit activity in September and an increase in the average single deposit to $2,135 from $1,855 in August.