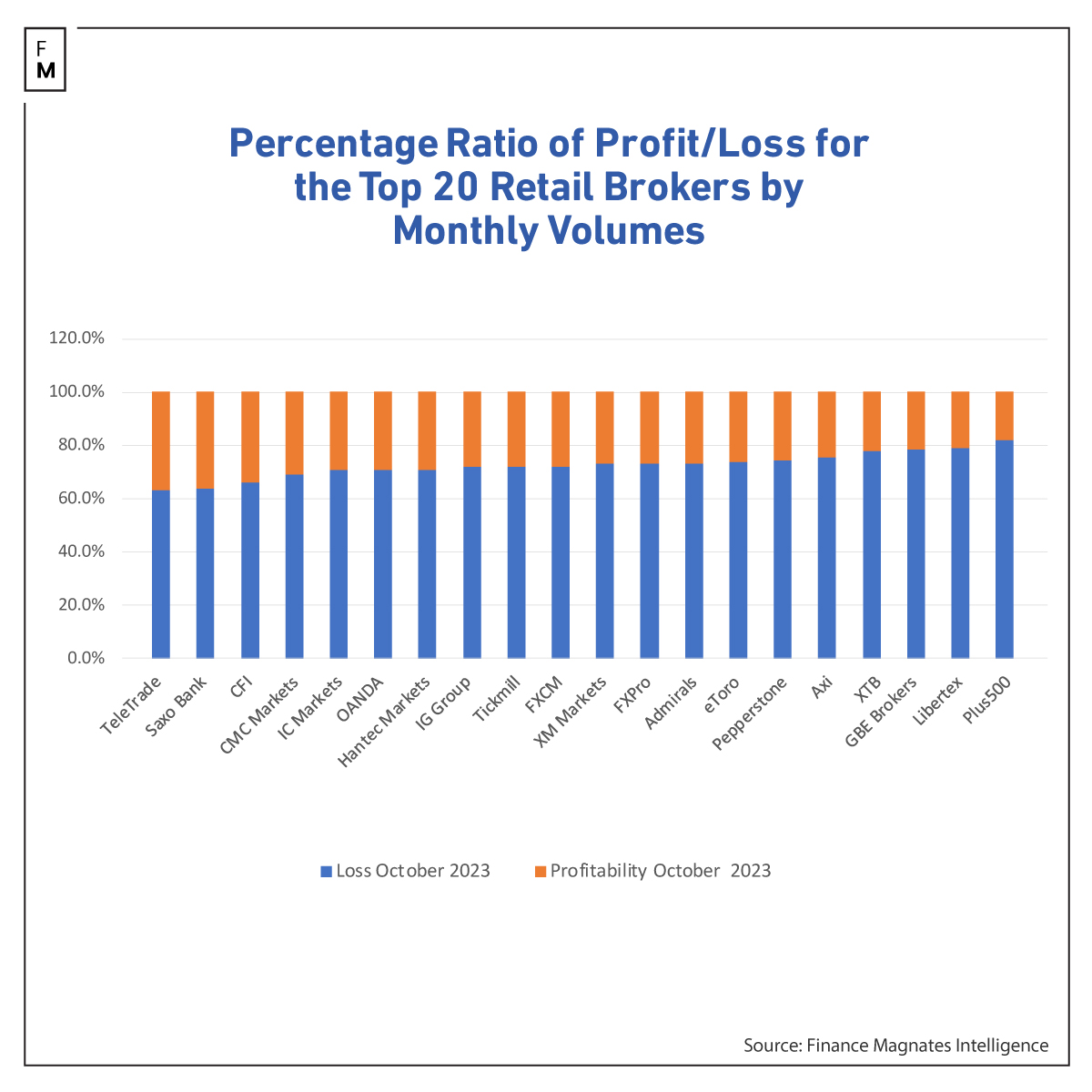

The profitability of FX/CFD broker clients in October remained at the same level as the previous month. Most of the 20 largest companies in terms of volumes reported an unchanged profit-loss ratio, and we only noted differences in the case of 25% of all companies. For another consecutive month, Saxo Bank and TeleTrade exchanged the leader's position, and currently, the latter has the highest retail trader profitability.

Retail Trader Profitability Unchanged in October

Based on data from the Quarterly Industry Reportprepared by Finance Magnates Intelligence, we selected the 20 largest FX/CFD brokers regarding volumes and checked their monthly profitability and loss levels.

In August, an average of 25.6% of retail clients were profitable, and this value jumped almost 2% in September to 27.4%. As October's calculations show, this area had no significant changes over the month.

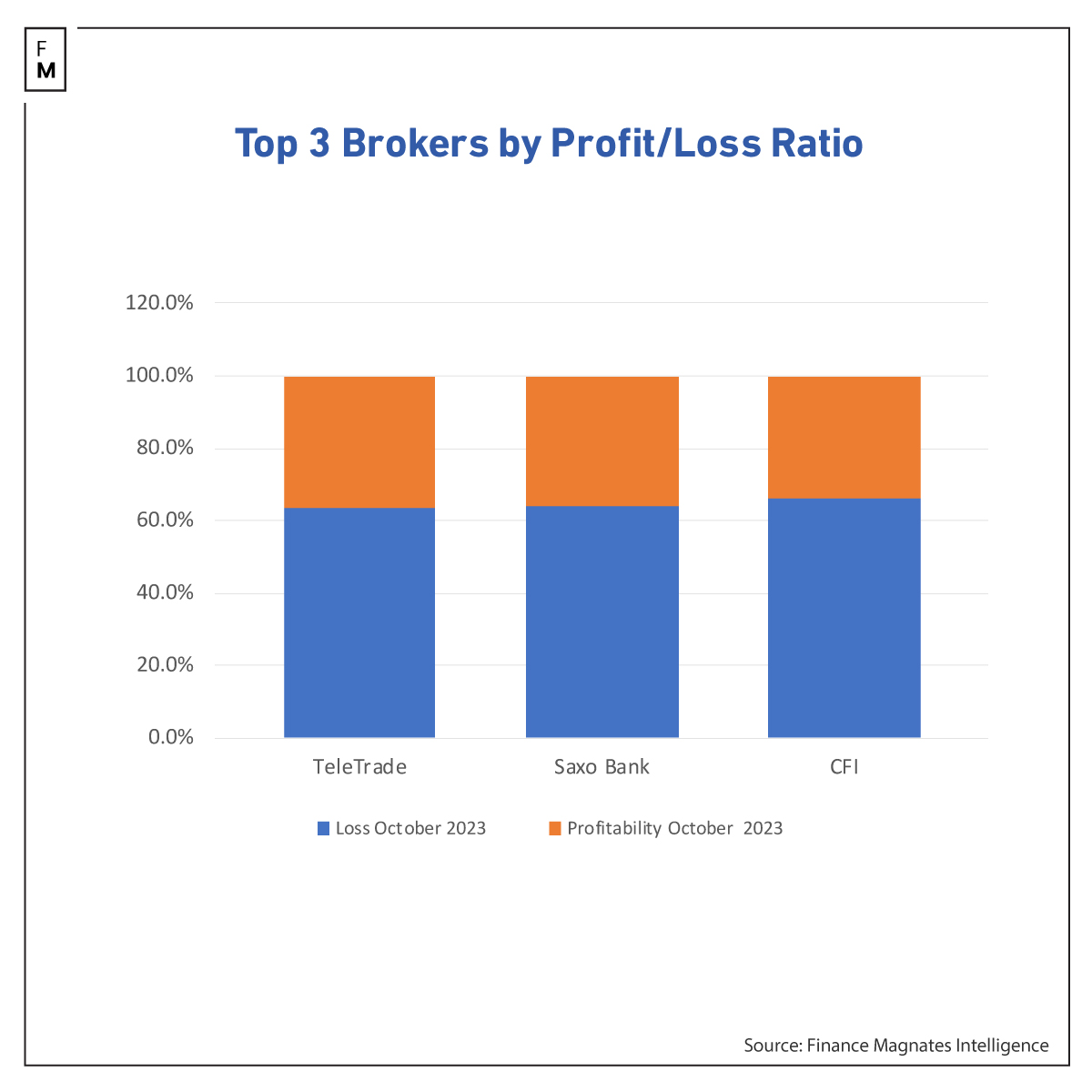

The podium composition also remains unchanged. Saxo Bank, TeleTrade and CFI still hold the top spots. However, the difference is that the profitability of TeleTrade clients grew 1.2% in October, while Saxo Bank remained unchanged. As a result, TeleTrade is back in first place with a result of 36.6%. Saxo scored 36%, and CFI 34%.

5 Firms Below 25% Profitability Threshold

The worst monthly profitability in October 2023, which includes brokers with a result below 25%, was recorded by five companies. Among them were Axi (24.5%), XTB (22%), GBE Brokers (21.3%), Libertex 21% and Plus500 (18%). The latter has kept its clients' profitability below 20% for another consecutive month.

It is worth emphasizing that the values did not change this time for as many as 14 out of 20 companies. Moreover, in the case of two, where changes were observed, they were marginal at 0.1%.

This week, Finance Magnates Intelligence also published the latest analysis regarding the change in the average value of deposits, withdrawals, and first deposits of FX/CFD brokers' clients. The indicators during the summer period seemed to move flatly. However, the value of the first deposit fell to its lowest level in a year.

The Pareto Principle Applies to Financial Markets

The 80/20 rule, also known as the Pareto principle, states that 80% of outcomes come from 20% of causes. This principle applies to many areas, including economics and investing. It suggests that 80% of the profits are made by 20% of retail traders.

This is likely due to greater skill, risk-taking, resources, diversification, and emotional discipline. Although the exact ratio of 80/20 should not be taken literally, as it is simply a principle rather than a mathematical law, the results historically reported by brokers are usually very close to this ratio.