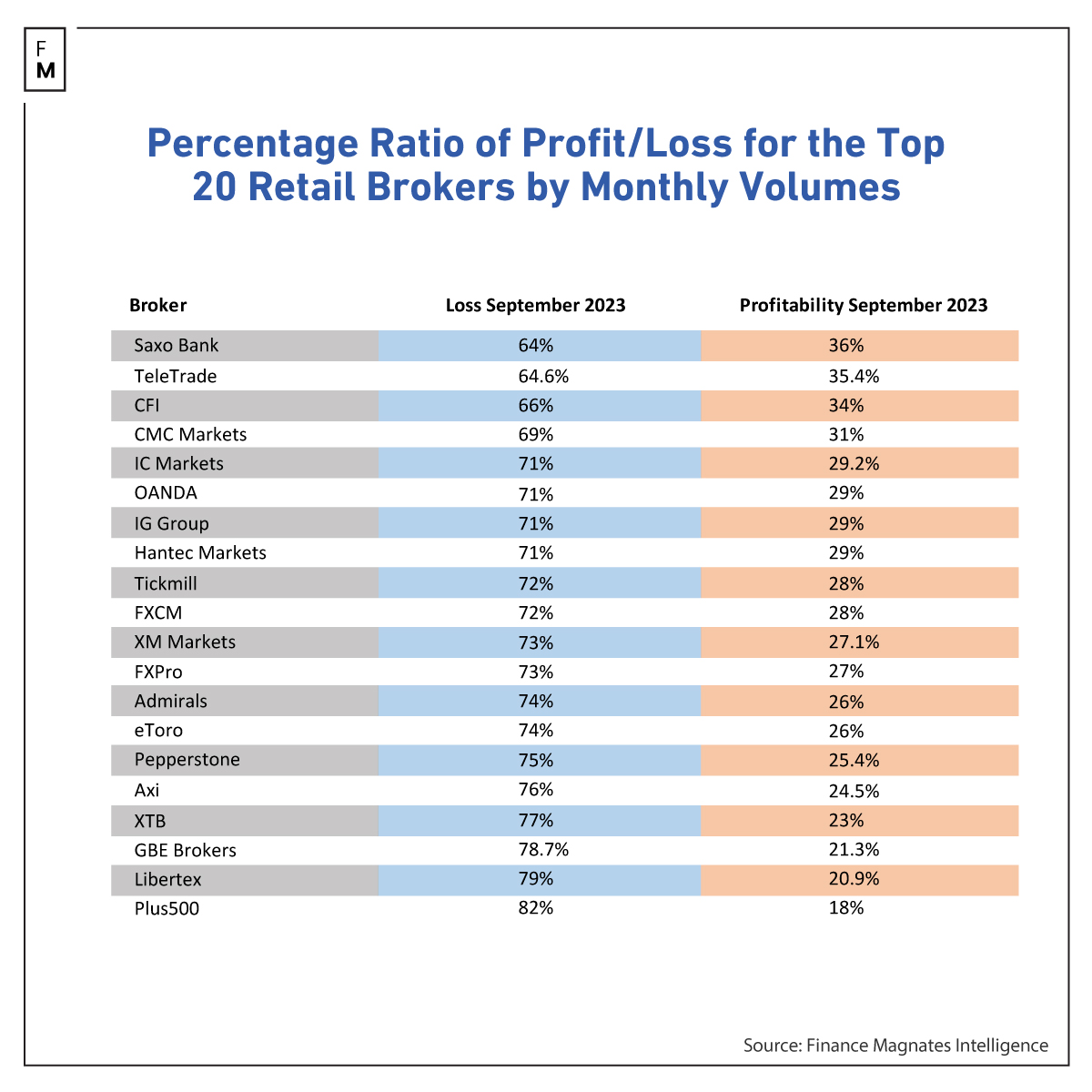

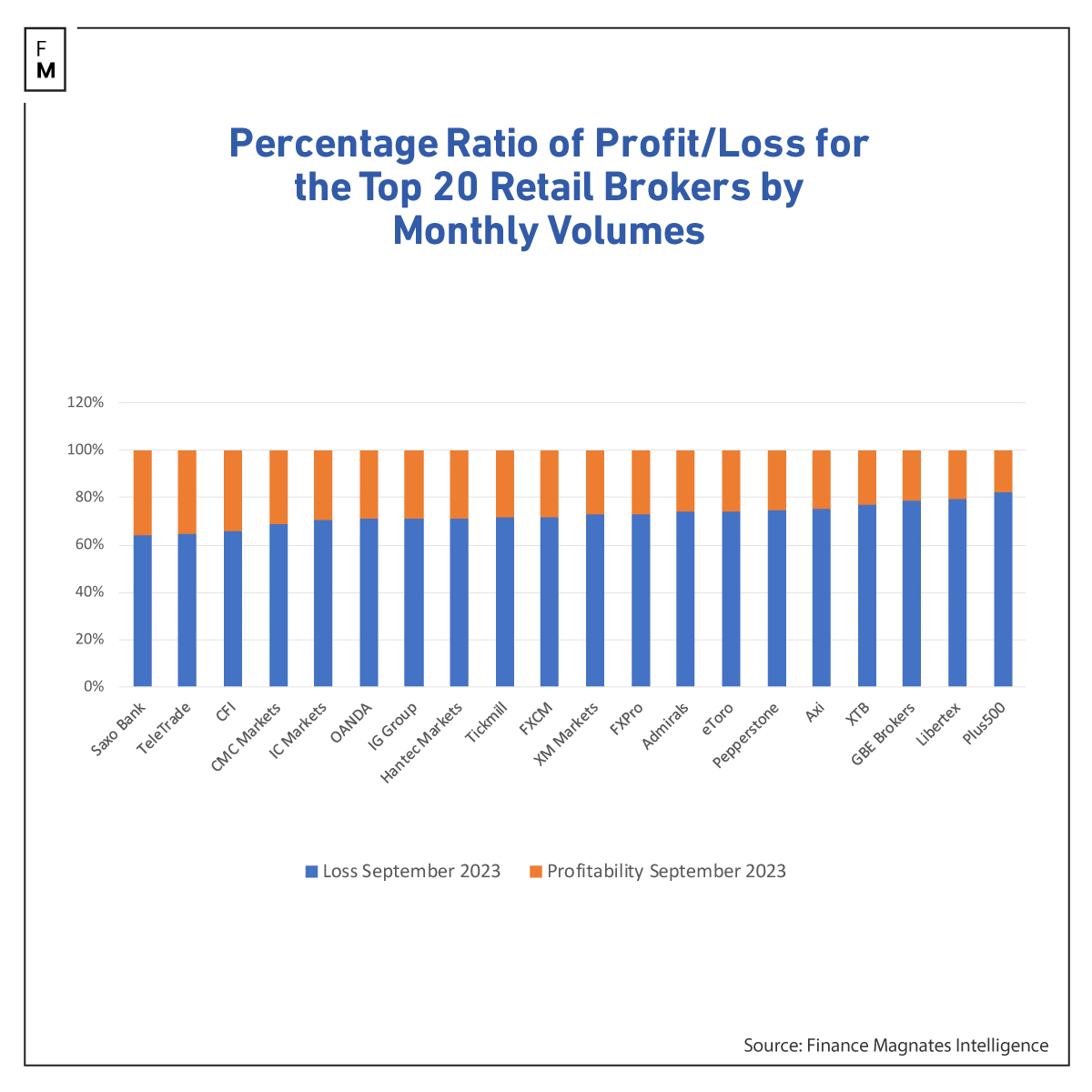

Last month, the top 20 retail FX/CFD brokers saw a modest increase of under 2% in client profits. However, losing traders still dominated the market, with nearly 73% of them in September. For the second consecutive month, clients found the most success in generating profits at TeleTrade and Saxo Bank, although the two companies switched places on the podium.

Retail Broker Client Profitability Rose in September

Finance Magnates publishes a quarterly list of the largest retail CFD brokers by volume (subscribe to our Quarterly Industry Report for access). Based on this list, we selected 20 of the largest retail brokers who publish their clients' profit-loss ratios and update them monthly.

While only one in four investors made a profit in August, this figure increased 1.81% to a total of 27.39% in September. The long-term trend remains the same, showing that usually only 20-30% of a given broker's clients make profits, while the rest are considered "capital donors."

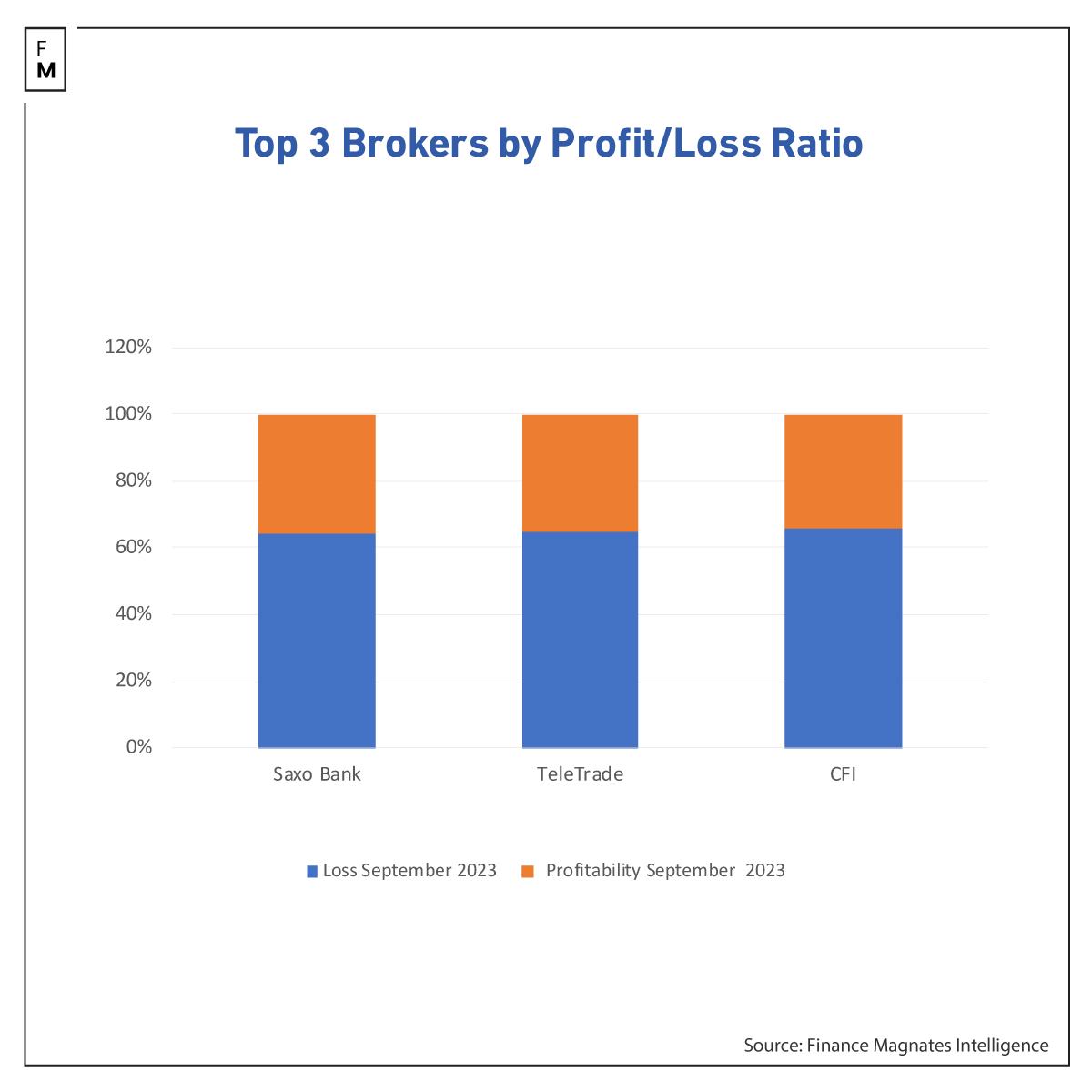

For another consecutive month, Saxo Bank and TeleTrade led with 36% and 35.4% profitability, respectively. The only difference was that TeleTrade held the primary position in August. In September, CFI secured third place with 34%, followed by CMC Markets at 31%, and IC Markets at 29.2%.

Plus500 Below 20% Profitability Mark

Compared to August, the number of companies with profitability below 25% decreased from eight to five. Only one broker reported a profitability ratio below 20% with Plus500, at 18%.

Seven out of the 20 reported companies had unchanged figures. CFI saw the largest increase, rising from 20.3% to 34%, an increase of 13.7%. Conversely, the most significant drop in this indicator was recorded by Libertex where profitability shrank from 22.3% in August to 20.9% in September, a decrease of 1.4%.

How to Boost Profitability

Based on a recent analysis by Capital.com, individual investors aiming to enhance their profit margins should consider spreading their investments across various asset classes and timing their entries and exits wisely. While many traders usually focus on a limited range of assets, expanding one's portfolio to include at least five different asset classes can notably improve average returns.

The report also revealed that novice traders earn higher profits when trading in commodities, FX and indices than equities. From May 2022 to April 2023, beginners who initiated their trading journey with commodities saw profits in 58% of their positions. In contrast, those who started with equities experienced profits in a lesser 46% of their trades.

Want to read more reports from Finance Magnates Intelligence? Check out our October analysis of spot volumes on the largest cryptocurrency exchanges.