In the latest report released by SIX Swiss Exchange and BME Exchange, the combined trading figures for the month of January 2024 reveal significant Momentum across both Swiss and Spanish markets. The key indicators demonstrate a notable year-on-year (Y-o-Y) growth trajectory, underlining the resilience and dynamism of the exchanges despite prevailing economic conditions.

Monthly Overview

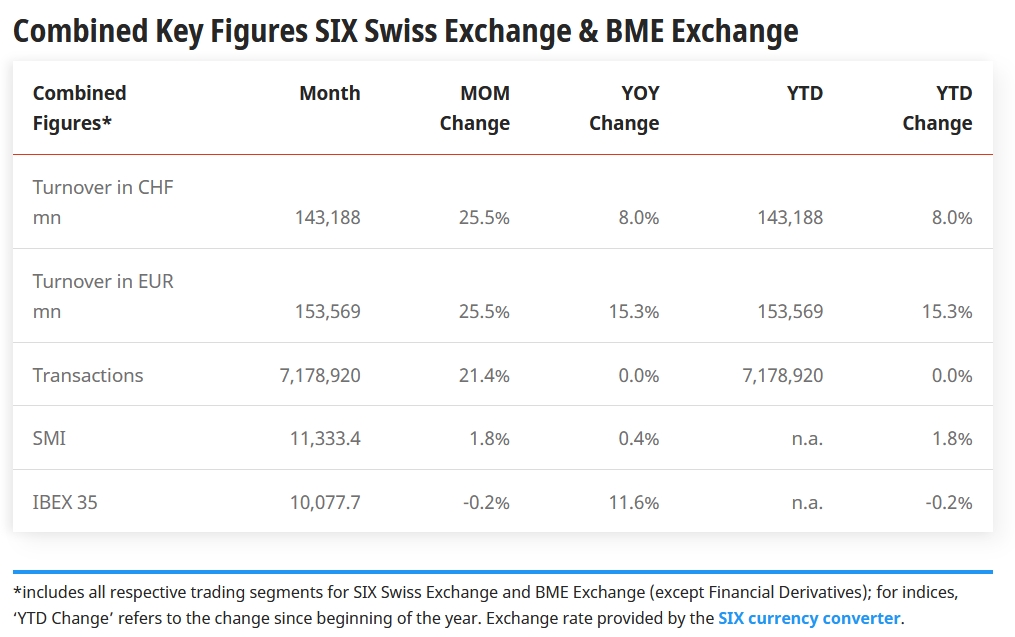

The combined turnover for both exchanges surged to CHF 143,188 million, marking a substantial Y-o-Y increase of 8.0%. In Euro terms, the turnover reached EUR 153,569 million, reflecting an even more pronounced Y-o-Y rise of 15.3%.

Transaction volumes remained robust, with a total of 7,178,920 transactions recorded during the month. Although the month-on-month (M-o-M) change showed an uptick of 21.4%, the Y-o-Y change remained steady at 0.0%, indicating sustained transactional stability over the past year.

During the month under review, the Swiss Market Index saw a moderate M-o-M increase of 1.8%, reaching a total of 11,333.4 points. Conversely, the IBEX 35, which reflects the Spanish market, experienced a slight M-o-M decline of -0.2%, with its value standing at 10,077.7 points.

The buoyant performance of both exchanges is attributed to several factors, including robust investor sentiment, favorable regulatory environments, and strategic initiatives aimed at enhancing market liquidity and accessibility. The influx of capital into both Swiss and Spanish equities underscores investor confidence in the stability and growth prospects of these markets.

ETF QOD Europe: Enhanced Liquidity and Competitive Pricing

Earlier, SIX Swiss Exchange introduces ETF QOD Europe, enabling trading across major European markets like LSE, Euronext, Deutsche Börse, and Nasdaq Stockholm, as reported by Finance Magnates. The platform offers access to 6,000 ETFs and ETPs, enhancing liquidity and providing competitive prices. Over 95% of trades execute at the European Best Bid Offer or better.

Christian Reuss, the Head of SIX Swiss Exchange, emphasizes innovation, efficiency, and best execution in ETF trading. ETF QOD Europe facilitates cross-EU trading, automates transaction processing, and reduces execution fees. The platform signifies SIX's commitment to revolutionizing ETF trading, offering a comprehensive and efficient trading experience. Dedicated Forex cloud solutions from Alibaba Cloud ensure secure and global operations for Forex traders.