Economies of scale remain a key factor in determining retail investment product costs across Europe, although a lack of harmonisation in national regulation and inflation are also contributing to cost disparity.

The headline finding from the sixth market report on the costs and performance of EU retail investment products published by the European Securities and Markets Authority (ESMA) last month was that despite a fall in the average costs of investing, there are significant differences across the continent.

Funds domiciled in the Netherlands and Sweden exhibited the lowest total costs, while the highest cost levels were observed for Italy, Austria, Luxembourg and Portugal. The difference in costs over a one-year investment horizon ranged from 0.9pp for bond funds to 1.6pp in the case of equity funds, fuelled by differences in distribution channels.

Challenges of Europe

Although the EU is nominally a single marketplace, the most attractive markets are inevitably the largest and wealthiest. There are fixed costs in operating a trading platform and customer support infrastructure in other languages, so the potential revenue needs to be more attractive to offer a similar service to smaller markets.

“More opportunity also means more competition,” says Nick Saunders, the CEO of Webull UK. “The one caveat to this is the availability of payment for order flow. Where this is permitted it provides an additional revenue source to the broker who can reduce costs to the end client.”

The importance of scale is underlined by the comparison between the US and EU fund markets where the smaller average fund size in the latter market attracts higher costs. Whilst passporting makes the distribution of eligible products easier across EU countries, each state has its own rules and regulations surrounding the distribution of products, increasing the cost of compliance.

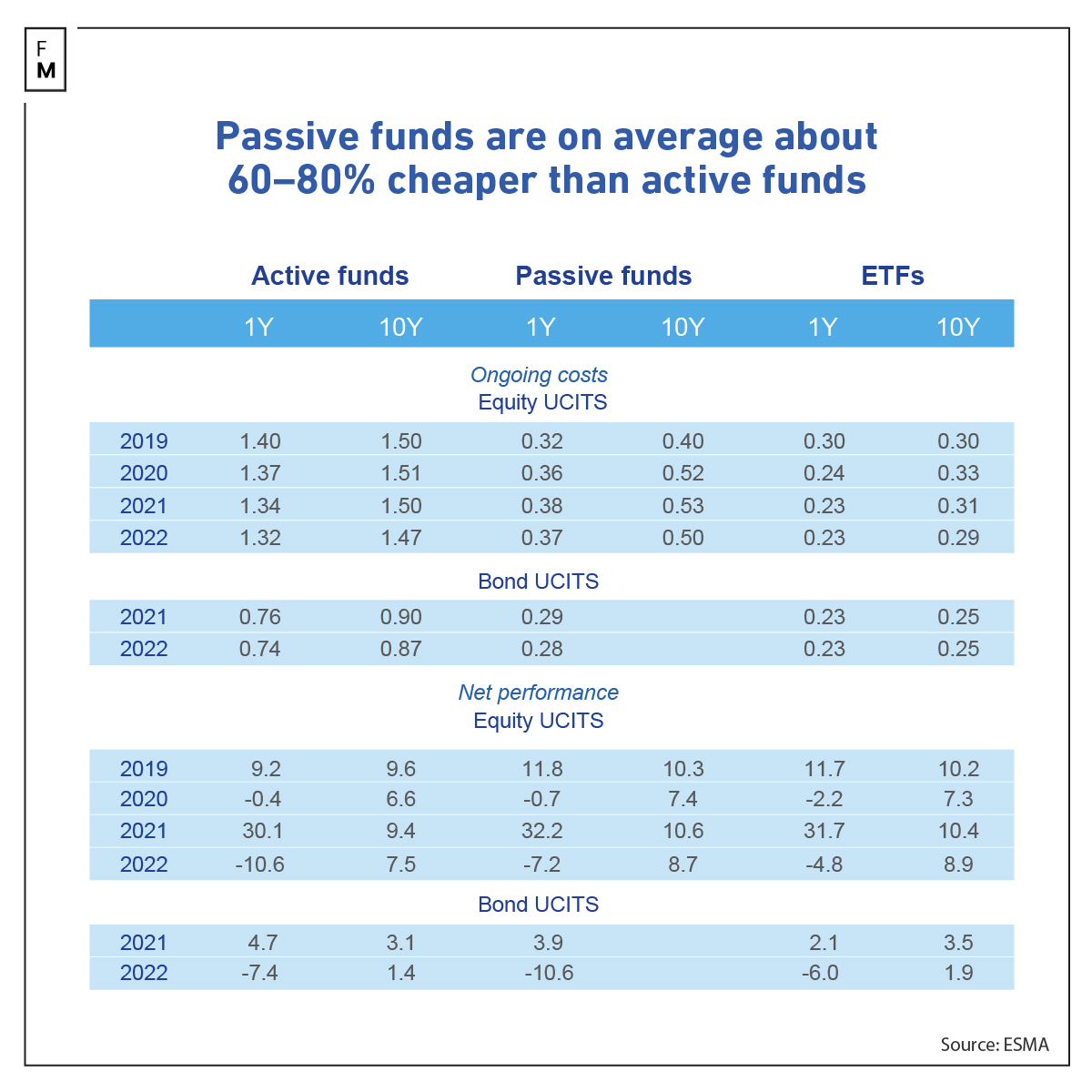

Although active equity fund costs have decreased, this category of funds remains more expensive than passive funds and ETFs, and net performance was therefore on average lower in comparison. The report noted an increase in costs for most types of structured retail products, although they vary substantially by geography.

“Passive investing (including via ETFs) is the growing part of the market,” stated Hal Cook, the Senior Investment Analyst at Hargreaves Lansdown. “However, if we are in an environment of higher inflation and higher interest rates - where the cost of capital for businesses is structurally higher - it will naturally be more challenging for some businesses to survive, which could bring active managers and their stock selection abilities back to the fore.”

With ETFs enjoying good liquidity and accessible on low-cost trading platforms, retail clients are asking why they are paying 1.5% for management that frequently fails to outperform the benchmark according to Saunders.

“Robo-advisors enable diverse, risk-graded portfolios to be constructed significantly cheaper from ETFs than the management fees charged by an active manager,” he said. “Active fund managers have failed to convince investors that the performance improvement over an exchange traded product is greater than the management charge.”

Maksim Shymanovich, a Senior Manager of International Growth at TradingView agreed that active equity funds have found it tough to beat market benchmarks consistently. One of the possible reasons for this is that key indices are mostly dominated by a handful of big stocks, making it challenging for active funds to beat these benchmarks unless they focus heavily on the largest stocks.

“However, recent trends suggest a potential shift with active management offering better opportunities due to the concentrated nature of indices and valuation disparities,” he mentioned.

This development, coupled with the success robo-advisors have enjoyed in attracting retail investment in passive ETFs, has led to increased interest in active ETFs.

“It seems like people are getting more into active management within the ETF world, driven by the opportunity for higher returns and new investment strategies,” added Shymanovich.

Alternative Investment Funds Dominate

The ESMA report also found that the alternative investment funds market is still dominated by professional investors. When asked what fund managers can do to make these funds more appealing to non-professional market participants, Cook observed that the challenge lies in explaining what these funds do and what they can add to an investment portfolio.

Professional investors tend to alter their usage of alternative funds in response to market cycles. They often increase exposure to these funds during periods of uncertainty, but reduce their exposure when markets are expected to rally. For example, alternative funds may be used as a source of funds if markets experience a shock, so as to buy equities and bonds when they are cheap.

“Retail investors are less likely to invest in this way as it is difficult to sell something that has held its value during a sell off and buy things that are still falling in price,” explained Cook. “This reduces the appeal of these funds because typically their long term returns are lower than a global equity fund.”

The Necessity of Simplicity

It is also the case that many of these funds are hard for retail clients to understand and at times performance simply doesn't align with retail investors' expectations. In 2022, for instance, numerous alternative funds failed to provide the desired protection during the extended bond market sell-off.

Fund managers need to reduce their management charges as it is hard to justify a percentage charge rather than a fixed fee suggests Saunders.

“The next step is education to convince investors of the benefits of a diversified portfolio,” he said. “In addition, many managers rely on IFAs to distribute their funds, ignoring the self-directed platforms entirely. These platforms find it easier to offer ETFs because the integration work is largely done.”

Government policy also has a role to play. Programs like the UK’s enterprise investment scheme and seed enterprise investment scheme provide tax incentives to ordinary investors, encouraging start up and scale up companies attract capital. Additionally, France has plans to introduce similar programmes.

“Asset managers who offer funds that comply with these regimes will attract a wider range of investors, rather than just wealthy or professional angel investors who can afford to write larger cheques,” suggested Nicholas Miller, the Director of UK partnerships at TradingView.