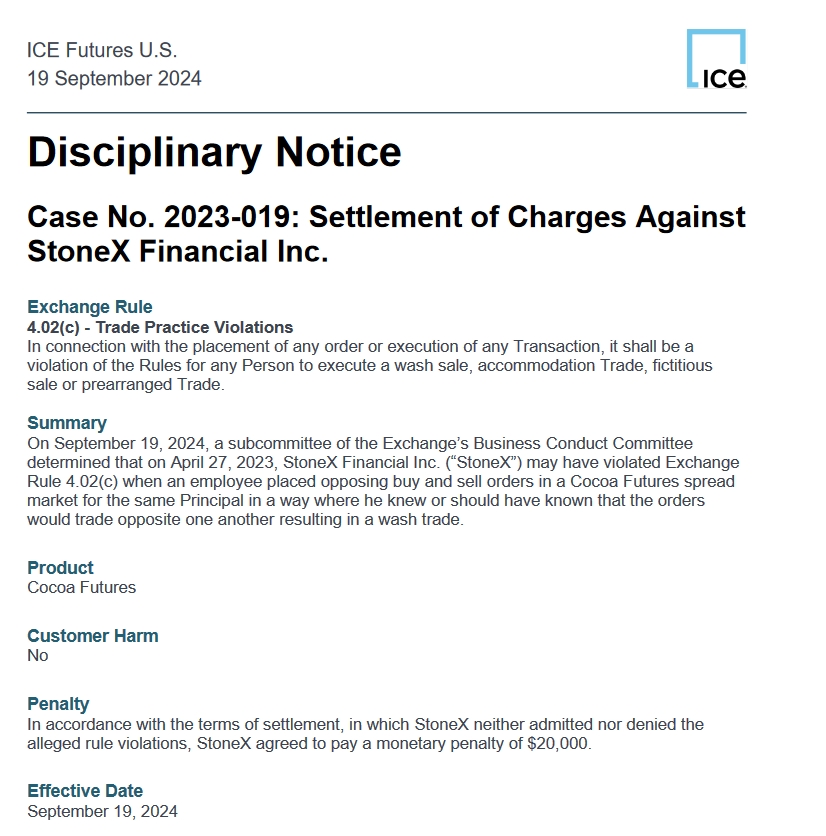

ICE Futures U.S. announced the settlement of charges against StoneX Financial Inc. yesterday (Thursday). The charges were related to potential violations of the Exchange Rule, which prohibits trade practices such as wash sales and prearranged trades.

The statement indicated that no customer harm occurred due to the incident. As part of the settlement , StoneX will pay a monetary penalty of $20,000. The firm did not admit or deny the allegations in the settlement agreement.

Charges Arise from Cocoa Futures

The charges originated from an incident on April 27, 2023. An employee of StoneX allegedly placed opposing buy and sell orders in the Cocoa Futures spread market. The Exchange’s Business Conduct Committee found that the execution of these orders could result in a wash trade. This suggested that the employee was aware or should have been aware of the implications of these transactions.

Finance Magnates reached out to StoneX for a comment. At the time of publication, no response has been received.

Rugby and Payments Unite

StoneX Financial Ltd, based in London and a subsidiary of StoneX Group Inc., has renewed its partnership with the UK rugby club Saracens, introducing several new features for the 2024/25 season. The StoneX logo will now adorn the front of both the men's and women's team jerseys, replacing City Index.

Since becoming a partner in 2020, StoneX has supported Saracens' success, contributing to league titles for both teams. The partnership also emphasizes community engagement, with StoneX backing the Saracens Foundation and providing work experience opportunities for students at Saracens High School.

In addition, StoneX has teamed up with NatWest Group PLC to enhance the bank's international payments capabilities, as reported by Finance Magnates. This collaboration allows StoneX Payments to offer third-party delivery and international FX payment services to NatWest.

It enables corporate clients to transfer funds to more countries and access an additional 10 currencies, thereby expanding the bank's local payment reach and facilitating cross-border transactions.