Over the past half year, we have been repeatedly emphasizing a key issue which the retail trading industry faces. We can continually debate leverage levels, whether brokers moving offshore are just ducking the issue or even the final implications of ESMA’s new regulations, but the critical issue is elsewhere.

Once again, it is all about client profitability. European regulators have been annoyed by how much money retail clients are losing. Market intervention by the ESMA was principally driven as an effort to reduce the number of unsophisticated investors that lose more money than they can afford. Regulators would no longer tolerate marketing schemes that attracted ill-experienced traders to products that preferred clients to lose.

For years we have seen promises on the part of companies that are engaged in social and copy trading that the solution was social; provide access to profitable traders and standards rise. That, however, hasn’t materialized for the time being. Win rates are still far below 50 percent even for those platforms that boast a social aspect to their offering.

About five years after the peak of the social trading platform boom, a firm with a new and different approach to an old problem is making a go at auto-copy trading. Pelican Trading comes as a partner for brokers with an app that connects so-called "trader mentors" with prospective followers of their strategies. While the concept of copying proven traders with a track record isn’t new, Pelican’s take could be the detail that differentiates the company from earlier companies that addressed the space.

FCA Regulation for Auto-Copying

Pelican Trading aims to stand out with an auto-copying license from the FCA which includes investment advisory and management. The regulator demanded from the company additional information as well as custom technology changes before granting it the lucrative permit and actively participated in the vetting of the firm’s software.

This may be a sticking point for other companies that have applied for such a license, but didn’t succeed in getting one from the UK regulator, preferring to rely on passporting from other EU countries.

The company’s management team shared with Finance Magnates that it was closely working with the FCA in order to get a better grasp of the rules and deliver to the market a product that is strictly compliant. While CySEC is increasingly scrutinizing auto-trading firms providing investment advice, the UK regulator has been very difficult to appease to the point where Pelican Trading is currently the only company that managed to secure this type of permit from the London-based watchdog.

Business Model

The introduction of the new ESMA rules made a change in the goals of EU-based brokers. The reorientation of the industry towards a more client-centric approach; i.e. brokers need to demonstrate that they want their clients to improve. Companies are now actively looking at how to make new products possible that improve the rate of client profitability.

Seminars, academies, and education efforts have been falling flat for a while and brokers are looking for new, more innovative ways to appease regulators. While some bigger firms have committed to developing their own social trading offerings, the asset management, and investment advice licensing process has been a difficult hurdle to overcome.

Whatsmore, there is a possible win/win/win solution for broker/regulator/client alike. Should brokers provide products that actually improve client profitability, the prospects for the interests of regulators, clients, and brokers to be aligned because the broker will be benefiting from increased trading volumes from more clients depositing larger amounts.

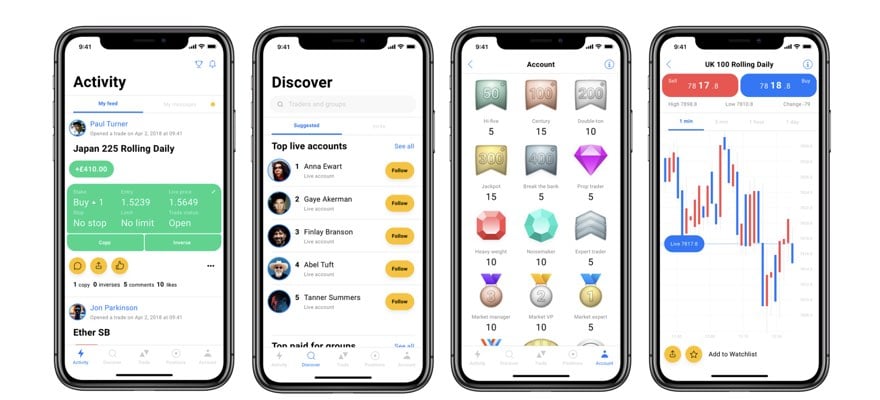

Pelican Trading aims to deliver not simply a copy-me platform but a product that extends all the interactive capabilities for users to learn from experts in real time. Pelican Trading chose to partner with major global brokers by white labeling its platform and extending its regulatory cover, whilst ensuring all partner brokers can access the central pool of traders. This solution ensures the highest level of quality traders can be accessed by clients from any partnering broker.

Mike Read, co-founder and CEO of Pelican Trading

The co-founder and CEO of Pelican Trading, Mike Read elaborated that the company's regulation status is one of the key advantages it has to share with broker clients.

"We used to see brokers as the enemy - when in fact brokers have been battling it out to provide exceptional execution and prices for years - and Pelican is simply the social ‘glue’ that brings accounts together," Read elaborates.

In the views of the CEO of the company, historically, social trading was provided as a service at the sacrifice of quality execution - some platforms even used their social solution to widen their spreads.

"We combine our social offering with leading brokers where best execution is standard," the co-founder of the company explains.

Time will tell if this new approach to social trading will pay off for the industry. Where the company did succeed is to deliver its platform via the appropriate channels, just as mobile trading has completely taken over the retail broking landscape.