In light of the new regulatory restrictions in the EU and the broad issues facing the retail brokerage industry, retention is now playing a key role. Brokers are scrambling to deliver to their clients new tools that can optimize their performance and increase engagement. A new company called ProQuant could be a breath of fresh air which a lot of legacy MT4 brokers are in need of.

A recently launched app, that is already available on the iOS and Android app stores, gives traders the opportunity to devise their own algorithms to trade the market. They can also use a set of pre-developed strategies which are available for live testing in the cloud.

Commenting on the launch of the new app, the founder of ProQuant, Ivan Ashminov commented to Finance Magnates: “Until now the barrier to entry into the algo trading space has been very high, requiring huge investments into infrastructure, data, development and know-how.”

“The individual traders were out of the big boys game. ProQuant is aiming to change that. Behind the free, easy to use app is a stack of tools running in the cloud for generating, backtesting and executing trading strategies for stocks, Forex , commodities and cryptos.”

Empowering Retail Traders

This new tool can be marketed by brokers to their clients are the long-awaited gap filler between them and secretive hedge funds. By elimination emotions from trading, retail clients can achieve better results and better profitability in the long run.

Of course, the tool is no panacea, and every person well versed in the financial markets knows that different altos work for different market conditions. ProQuant’s key feature is that it enables every brokerage offering an MT4 suite to provide to its end clients a comprehensive and simple algo-trading generator. Companies can also use an API to integrate the mobile up into their offering.

Cloud Infrastructure

ProQuant is using a full-scale technology stack located in the cloud to generate, backtest and execute trading strategies. Suitable for both novice and advanced traders, the product can be useful to brokers who are looking for key features to stand out with.

The app can also provide to brokers a gateway to a consistent and sustainable flow of trades. By automating the orders of retail clients, brokerage companies can generate more revenues on spreads and commissions at a critical time for the industry.

The cloud infrastructure which the app is based on makes the product suitable for integration with every company which is offering to their customers the MT4 platform or via API integration.

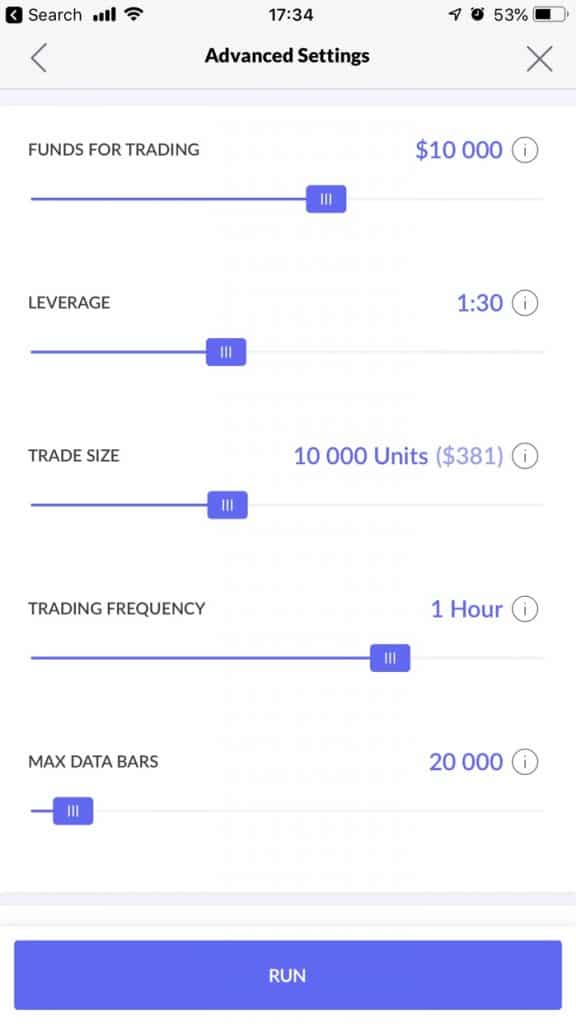

Clients can tailor the product to their own account, Source: ProQuant

ProQuant Bridge

Every client using the app can request a ProQuant bridge, which is an expert advisor that is designed to work with MT4. After the file is generated and sent to the client, clients of supporting brokers can easily automate their trading strategies.

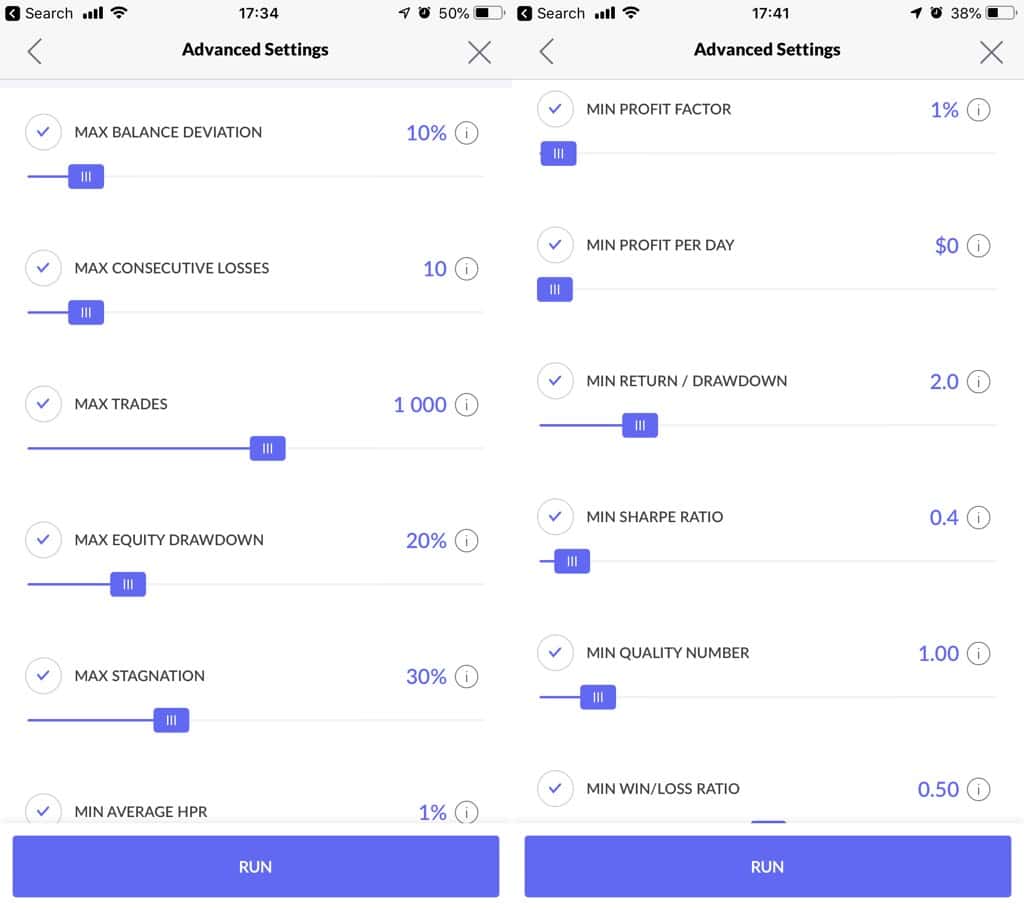

By using a set of parameters, customers can filter out the strategies which they deem fit. A simple view provides basic parameters. More advanced traders can select key KPI’s which they like to verify before committing to an algo.

More advanced settings and KPIs used by traders can be helpful for the customer, Source: ProQuant

Mobile trading has been the key driver for online retail brokerages over the past several years. Companies which are not in any way present on this market have been facing tough times in onboarding in contrast to mobile-focused brokerages.

According to data collected by Finance Magnates, major brokerage companies which are focused on mobile are getting between 70 and 85 percent of their revenues from either iOS or Android devices. Adding more mobile tools into the hands of retail traders could only further cement the importance of having good mobile software as the main gateway to interact with customers.