Last year, we wrote about InovanceTechnologies, a US based Startup that was creating TRAIDE, a machine-learning trading platform. Using technology found in block-box algorithms at hedge funds and institutional proprietary trading desks, TRAIDE was founded to allow users to create and deploy automated strategies. Using machine learning, the platform would then adapt deployed strategies to changing market conditions.

After over a year of beta testing with traders and funds, TRAIDE has recently made its public beta launch. Being released is the retail-focused interface, which allows for strategy discovery using machine learning for backtesting, but without features that adapt the algorithm as the market changes.

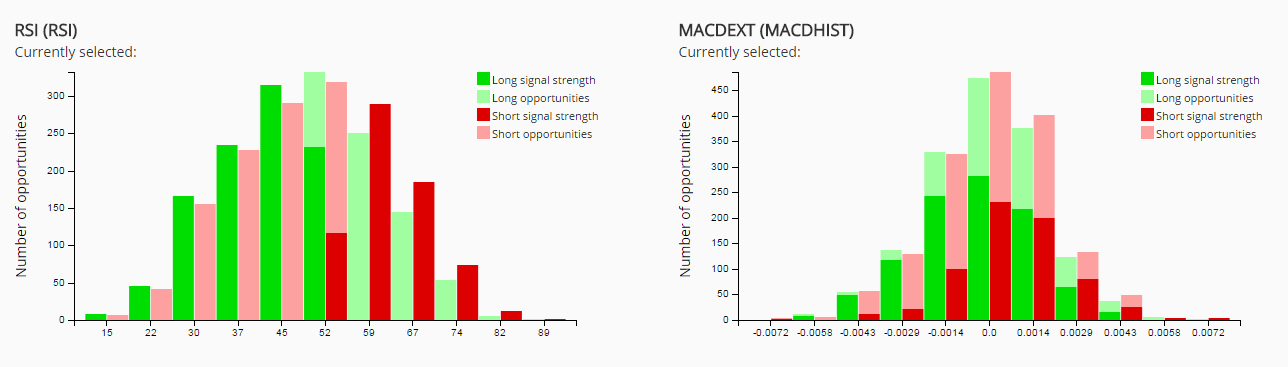

TRAIDE is similar to other automated strategy builders in that it offers a drop-down-like interface for creating algorithms for non-developers. Where it differs from other products is with its backtesting. Users choose between various technical indicators and fundamental news items. TRAIDE then back tests the indicators and news to reveal which combinations provided the best results. For example, users can choose the MACD and RSI indicators. TRAIDE then shows which combinations of RSI and MACD levels provided the best long and short results in the past. Users then choose the most profitable levels for the indicators to build their long and short strategy. Profitability results are calculated using the closing of trading for the next completed duration period.

Upon selection of the strategy, the results can be exported, adapted and developed as code for trading automatically. Currently, Inovance is finalizing a new version of the platform to allow for automatic exportation of strategies in MQL code for immediate deployment as Export Advisors on the MetaTrader 4 platform. Inovance has also partnered with MQL developers for users to customize development of their strategies. For EA traders, this offers the ability to add further exit strategies such as a longer duration of the trade.

Overall, the product is aimed at taking the guesswork out of having to backtest individual strategies by indicator level as the interface plots expected results across multiple technical-analysis price levels. Explaining the advantage of their visual reports and interface, Justin Cahoon, COO at InovanceTechnologies, said to Forex Magnates that “traders have a much better chance of finding a successful strategy by using TRAIDE’s Machine learning algorithm to find strategies than using conventional analysis.”

As part of TRAIDE’s public beta launch, InovanceTechnologies is participating in the free Forex Magnates beta testing program where they hope to gain user feedback on the interface and usability of the product. To signup to beta test TRAIDE and other new products, click here.