It’s been a tumultuous twelve months for technology company Leverate. We’ve seen the departure of a number of employees, new product launches and a reduction in the size of the company’s Israeli headquarters.

But for Yasha Polyakov, the firm’s CEO, what may look like chaos from the outside, is really his attempt at reforming the company from the inside. Speaking to Finance Magnates at Leverate’s revamped Tel Aviv office this week, Polyakov said that the changes he has implemented since taking charge just over a year ago have not been minor tweaks to business strategy, but vital efforts at restoring Leverate’s prestige.

“When I came in, I showed our team a film about a guy that was injured in the Gulf War,” said Polyakov. “He got depressed, fat and was unable to walk. After he met someone that mentored him, he got active and was able to not just walk again, but run.

“That’s how I felt when I stepped into Leverate. I saw a company that was about to hit its bottom. We needed to make a lot of changes to make sure we could run again - and we are there. This will be the first time, in over four years, where we finish the year with a very high profit. And that means a nice bonus for our employees this December.”

Leverate Slipping

To get the company back in the black, Polyakov has overseen several major internal shifts at Leverate. For one thing, there has been a change in personnel and mindset.

“We were slipping,” Polyakov told Finance Magnates. “We were used to people calling us, and we needed to change our state of mind so that we were the ones reaching out to clients and closing deals.”

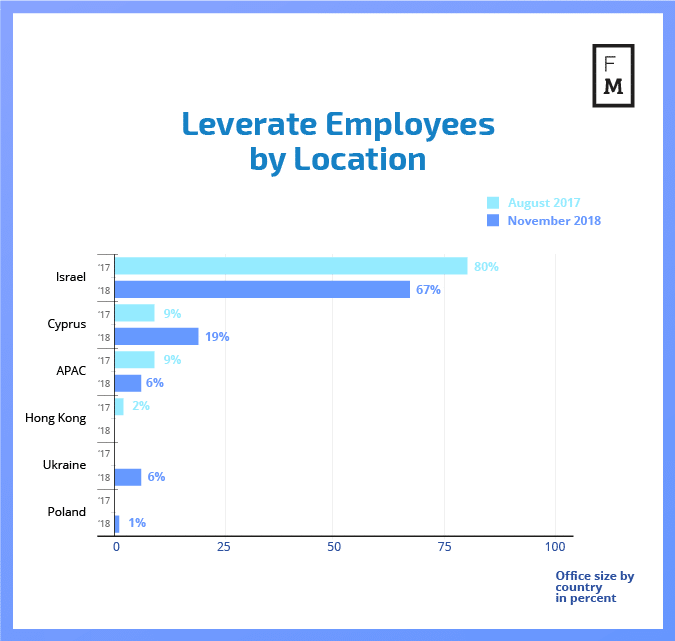

Changes in Leverate's operations since Polyakov took over as CEO

Perhaps as a result of this new, go-getter attitude, Leverate has been able to expand into new jurisdictions. Alongside growing business opportunities in South-East Asia, the technology company has been particularly successful in one Middle Eastern country.

“Turkey was not a big market for us previously,” said Polyakov. “We were able to establish some strong partners there and, due to that, we are now booming in that market. But we are creating a lot of good partnerships aside from Turkey, and that has had a very positive effect.”

Activ8 for Sale

Attracting those new customers has probably been made easier for Leverate as the company has diversified away from simply providing foreign exchange (FX) trading products. Whether its payment, regulatory or marketing solutions, the company is, to paraphrase Polyakov, providing added value, not just FX.

“Like everyone, we see demands for stability, connections to Liquidity , a trading platform that supports crypto,” said Polyakov. “But clients are increasingly interested in automation, marketing, and robot trading and we’ve been able to supply these things to them.”

Apart from developing new products, Leverate is also scrapping old ones. Over the course of our conversation, Polyakov revealed that the company is looking to sell one of its trading platforms - Activ8.

“We already have a trading platform, Sirix, which sells and works well,” said Polyakov. “There was a kind of cannibalism going on, with two platforms competing for the hearts of our clients. Activ8 is a great trading platform for B2C. We don’t do B2C. So unless we’re going to change our mind and decide we are a B2C business, there’s no need to continue working on that platform. We are already in communications with investors about the sale of it, and we’ll assist the new buyer, so things go as fast and smoothly as possible.”

"I have never seen so many licenses being canceled"

Changes at Leverate since Polyakov took up his current role have been mirrored by something of a crisis in the wider retail trading industry. Most notable has been the introduction of the European Securities and Markets Authority’s (ESMA) product intervention measures.

Those rules, which came into effect this August, put caps on leveraged trading and brokers’ ability to market their services. They also banned binary options and forced brokers to reveal what percentage of their traders lose money in three months.

As they have only been active for just under four months, one would expect some difficulty in assessing their impact. But for Polyakov, the results have been clear.

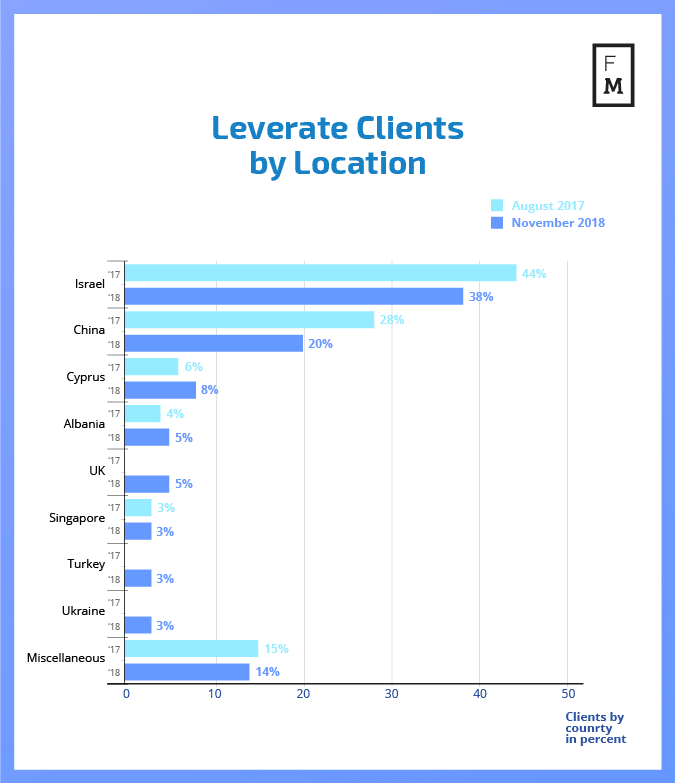

Changes in Leverate's client base since Polyakov became CEO

“I have never seen this amount of licenses being returned or canceled,” he said. “A lot of brokers have also decided to reclassify everyone as professional [so the rules won’t apply to them]. We are against it. If you think the regulators are stupid, they’re not. There is no way a housewife, sitting in front of the computer, watching YouTube videos and sometimes making a few clicks, is a professional trader.”

So, I asked, does he think the rules will have any benefits for the retail trading industry?

“I’m not sure that ESMA’s regulations have had any benefits for traders,” said Polyakov. “The amount of losing accounts didn’t decrease after the implementation of the rules - it just became transparent. For brokers, volumes are definitely getting lower. If you came to the market with a plan to collect as much as possible as quickly as possible, you are no longer welcome. Brokerages will have to cultivate long-term relationships with their traders in order to make profits. In that sense it’s definitely a positive change for the reputation of the industry”.

PSPs the Real Problem

Aside from regulatory pressure, brokers have been engaged in an ongoing struggle with payments service providers (PSPs). Both MasterCard and VISA have reclassified brokers as ‘high risk,’ making it much more difficult for them to accept Payments from traders. And for Polyakov, it is the PSPs and banks, not regulators, who are making life hardest for the retail industry.

“The regulator is not choking the market, the Banks and PSPs are,” said Leverate’s CEO. “At the end of the day, whether you’re unregulated or regulated, whether you have a good or a bad platform when you don’t have the means to receive money, you are stuck.”

One way around the problems with PSPs is to apply for a regulatory license - something any respectable broker should be doing anyway. Getting approved can result in you receiving a thumbs up from PSPs to process client funds. Unsurprisingly then, Polyakov has seen a marked uptick in the number of brokers wanting to start operations under a regulatory framework.

“Around 25 percent of our clients have asked for some kind of regulatory solution. That wasn’t common in the past,” Polyakov told Finance Magnates. “The attractiveness of a Cypriot license has gone down, though EU is still popular. The Mauritius license is very attractive - same as the Australian one. Everywhere is complicated and costly though. The fast solution that everyone had in Vanuatu is not working anymore.”

Liquidity Provision

In today's retail market there are a lot of problems for brokers to deal with. But that also means that there are a lot of possible solutions for a company like Leverate to put out onto the market. What then does Polyakov have up his sleeve to ensure brokers can stay ahead of the curve?

“We are going to be focusing a lot more on liquidity provision - way beyond the liquidity service we offer now - and we’ve already submitted our license to CySec for market making,” noted Polyakov. “Today you can also access equities - not just CFDs - through our prime brokerage and STP services. Other than that, our marketing solutions team has a lot of plans for lead generation and affiliate marketing products, so we expect them to become very profitable in the coming year.”

True, Leverate may have been slipping in recent years. But under Polyakov’s stewardship things seem to be moving in a very positive direction. He’ll just have to ensure that, like that Gulf War veteran, Leverate keeps running and doesn’t fall back to a walking pace.