We don’t typically post about trading competitions unless there is a unique angle. Fitting that description is a trading job challenge being launched by Chancery Lane Traders and powered using technology from Normann. A paid competition to enter, traders who successfully win on 55 out of 100 trades receive a salaried trading position at Chancery Lane, a proprietary trading shop focused on the algorithmic FX market.

For the challenge, Chancery Lane teamed up with Normann. For those unfamiliar with the company, Normann was among the startups launching on stage during our Forex Magnates London Summit last November. A behavioral science fintech firm, Normann utilizes an innovative model for trading. The product is the combination of a simple click trading based front end and sophisticated back end trading engine which utilizes behavioral science to handle Risk Management .

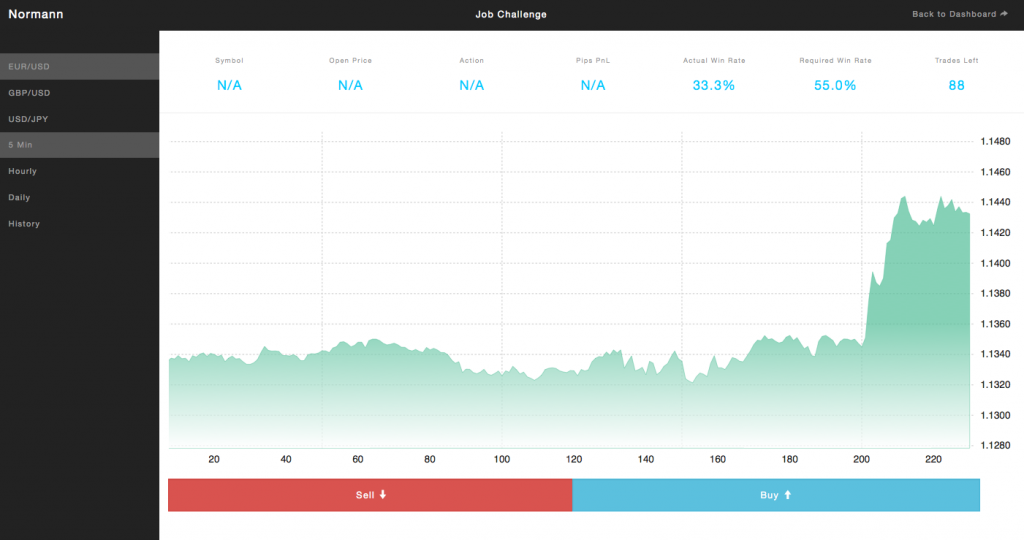

As pictured below, on the front end, users enter their buy and sell orders while also adding their accompanying stop loss and take profit levels. What traders don’t control is the size of the trade which is managed by the back end, and monitors user performance to decide when to ratchet up trade positions or reduce risk. The idea being that traders are good at picking trades, but poor in handling emotions and risks.

For the competition, traders will be using the Normann front end to enter their 100 orders. The back end then handles risk and is responsible for entering real traders for higher performers to help cover the potential costs involved for winners that get hired by Chancery Lane. Overall, the competition can be viewed as an interactive paid entry exam to a career in trading.

Francis Larson launching Norman at the London Summit

Speaking with Normann founder Francis Larson, he explained that the partnership with Chancery Lane provides a real world example of showcasing their platform, while offering Chancery Lane the ability to hedge its potential salary expense risks using winner profits. He added that they are also in discussions on incorporating their back end risk-management engine for continuous use by Chancery Lane. As such, upon succeeding in the competition, new traders will be initially assisting existing Chancery Lane traders in their trades, potentially being allocated capital themselves, with the risk management handled by Normann.