Protecting client details has become a great challenge for the entire business world in recent years with new stories of millions of hacked systems coming out every day. Whether it's Bitcoin exchanges, credit card companies or adult dating sites, none have been safe.

The retail financial trading industry, containing both FX and binary options brokers, is by its very online-focused nature more susceptible to hackers than traditional industries. In addition, the ease of rapidly setting up a new brand or white label using off-the-shelf technology has led to a situation where many new ventures were set up by employees who allegedly took their former employers’ client list with them.

Finance Magnates has recently learned about a new solution to Leads theft that is being soft launched these days. “We first learned about this problem from one of our customers, who suffered from a serious problem of stolen leads and reduced profit,” says Kirill Zlatolinsky, founder and CEO of PaynetEasy, a technology provider to the payment industry and the developer of LPS - Leads Protecting Systems. “The fact that such kind of unsolved problem existed was quite weird for us, a company that provides e-payment processing services, where data security is a cornerstone."

Zaltolinsky explains that after analyzing the weak spots of leads protection, they identified two major issues. First, sensitive data contained in the leads, such as phone numbers and e-mails, have no use during the trading process. Therefore, they should be separated from other client data and stored in another safe place. Second, a list of stolen leads with no valid phone numbers and no valid email addresses are worthless for thieves.

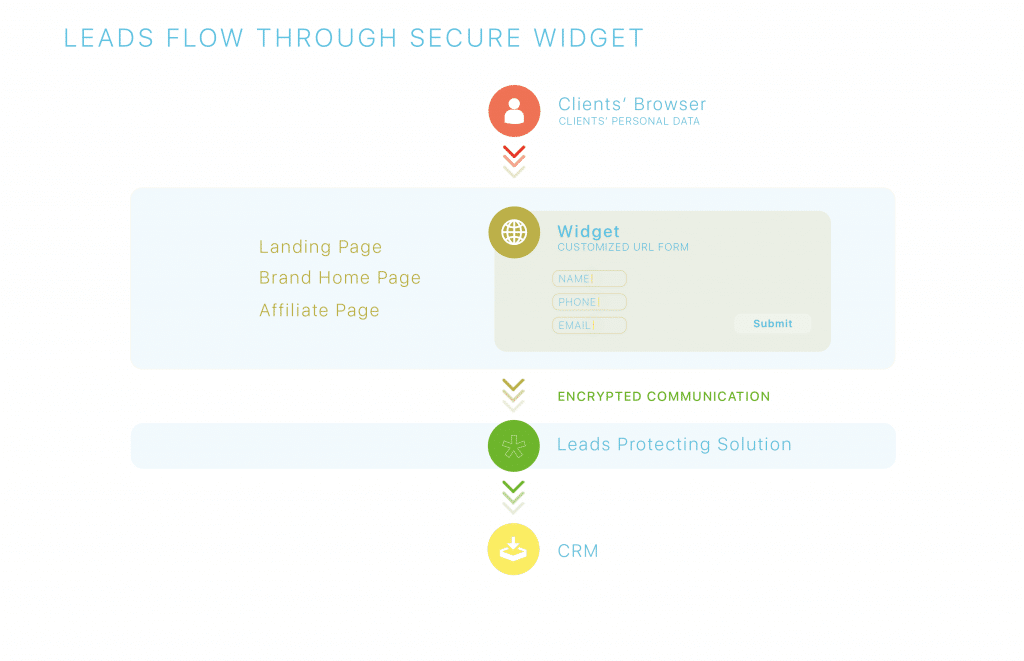

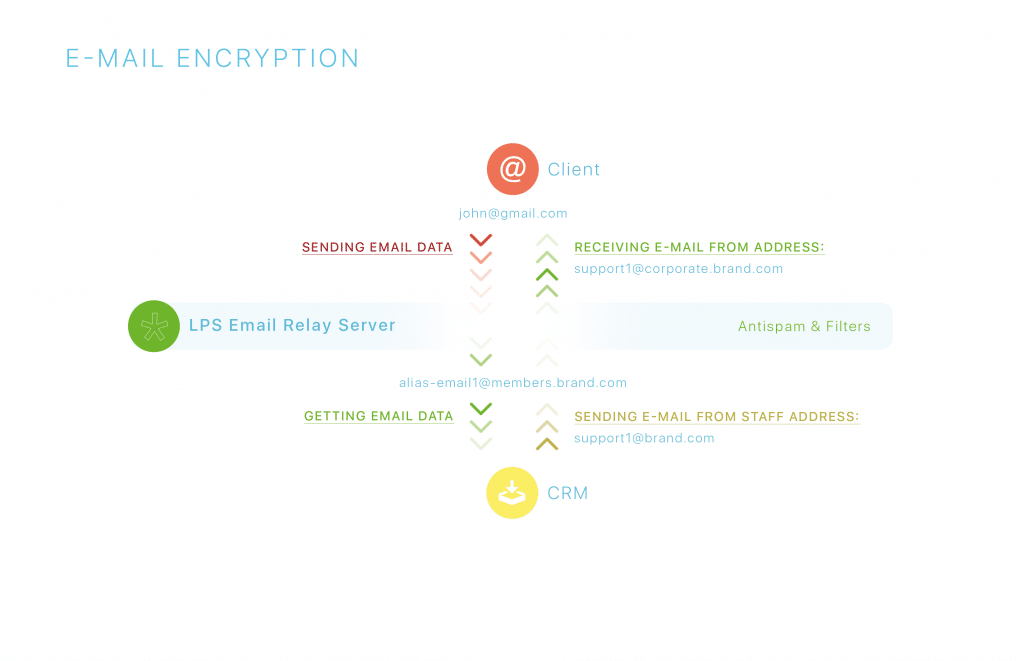

The LPS solution works by making sure the leads get first to the Leads Protecting System, which is hosted on the broker’s private cloud. They then send the leads to the CRM/Trading System, without the clients’ sensitive information. They also encrypt the sensitive data and save it on secured servers.

In practice, it means that broker employees that use the CRM systems can contact the clients via email and phone calls as necessary but they, or anyone that gains access to the system, won’t see the full actual contact details – making data theft useless.