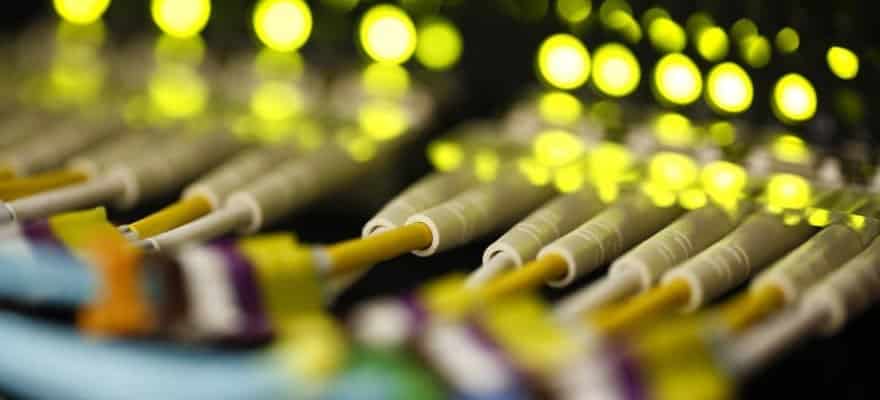

Pico, a provider of technology services for the financial markets, announced on Tuesday the launch of its ultra-low latency venue connectivity, which will be available across North America, Europe and Asia-Pacific (APAC) markets.

According to the press release shared with Finance Magnates, the network will support clients with latency-sensitive trading strategies requiring highly accurate views of the market and faster Execution times.

The company is claiming that Layer 1 switching technology can achieve market data latency of 5-87ns and round-trip latency of 140ns for order entry, which is a reduction of around 80 percent from standard Layer 3 access.

Commenting on the new offering, Roland Hamann, Chief Technology Officer & Head of APAC at Pico, said: “Layer 1 access is an important component for many trading strategies and Pico’s advances in optimizing exchange connectivity latency set a new benchmark which gives clients the ability to gain a significant competitive edge.”

Furthermore, the company is offering Corvil Analytics that will provide real-time analytics and monitoring, thus ensuring operational performance, transparency and visibility.

Market Technology Demand Is increasing

Pico primarily offers cloud infrastructure for financial markets participants with exchange connectivity spanning 47 data centers. The company is also going public as it entered into a definitive agreement for a merger with Nasdaq-listed FTAC Athena Acquisition Corp., a blank check acquisition company.

“Pico is committed to delivering a differentiated client experience, and we continue to invest in our next-generation network to remain ahead in performance, security, scalability and transparency. This launch further strengthens our comprehensive range of network products that meet the full spectrum of electronic trading requirements,” Hamann added.