Leverate, a technology provider specializing in brokerage solutions for the financial services industry, initially launched its Trading Platform Activ8 toward the end of 2016, at the Finance Magnates London Summit.

Discover credible partners and premium clients at China’s leading finance event!

The system uses a fully automated interface which is compatible with various trading platforms and CRM systems. Clients are able to alternate between the Activ8 system and other trading platforms effortlessly. The financial data used in Activ8 is equivalent to that of the highly utilized Metatrader 4 and MT5 platforms, thereby creating a fluid synchronization between all systems.

[gptAdvertisement]

Leverate’s integrated Optim8 platform intends on improving the conversion and retention rates of client brokerages. Moreover, through the platform’s admin, brokers can get access to clients’ trading habits and trends, as well as overall traders’ asset preferences during a given time period. The Optim8 platform acts as the backend system, and can help to analyze user behavior.

User Experience

The Activ8 platform is centered around ease of use, and enjoyable user experience for the end client. Traders want the ability to navigate through the platform with the path of least resistance, and to focus their efforts on obtaining valuable information as easily as possible. Moreover, for brokers interested in the platform, it is possible to customize the platform to appear individual to the broker itself, providing traders with a unique experience and feel.

Format and Build

Leverate’s Activ8 trading platform is generally divided into 3 underlying categories: 'Trading', 'Strategies', and 'Masters'. Each category focuses on its own features, and allows traders to navigate through the platform to easily locate their desired destination. The trading section includes all trading assets and instruments in an orderly fashion, inducing a simple interface that allows for a fast location of the desired asset.

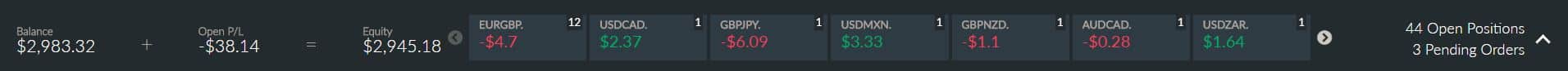

In addition, there is an implanted footer that can be viewed across all categories, which summarizes the account information, including equity, balance, and open P/L. The footer further details the total number of open positions, number of pending orders, and clearly shows a breakdown of open P/L spread across the account’s utilized assets and EAs, at any given time.

Categories

The trading category is further divided into several subcategories of each asset type: 'Commodities', 'Forex', 'Indexes', and 'Other'. Each brokerage can select which categories each user can see upon login to the system. This enables the brokerage to only offer certain categories (for example 'strategies') for certain users, and to use a category as a future selling point to retain or upsell a client’s account.

Users can 'favorite' any asset that will then be added to their respective favorites list. Traders can also simply type the name of the desired asset into a search bar to find it even faster. Once a trader clicks on an asset, the system knows to mark the asset for future use, and these assets will appear toward the top of the assets list upon the next login to the platform.

Upon clicking on an asset, its corresponding page will appear, showing the user a chart, and providing easy trading functions on the left side of the screen. The trader can then determine the size of the trade and easily enter into a position.

Following the execution of an order, the entry price will be shown with a black line on the chart. If the trade inputs a stop loss and take profit, their respective levels will be shown on the chart as well, allowing for a full view of the position details with very little effort on behalf of the client. Below the chart, users can see their full list of open positions or pending orders of that particular asset, and click on each order to smoothly navigate between them.

The 'Strategies' category provides an array of expert advisors (EA/bots), which generally focus on a particular group of assets or currency pairs. By clicking on a specific EA, users can view its historical performance, and then select whether or not they wish to enable its use across their own portfolio. Traders can select a percentage of their account equity that they desire to allocate to the use of that particular strategy (EA).

Leverate has really made using EAs much easier than in the past. By comparison, the widely popular Metatrader 4 platform requires a thorough process to implement any EA, which has to be added manually by each user, and can only be applied through files saved on an individual computer.

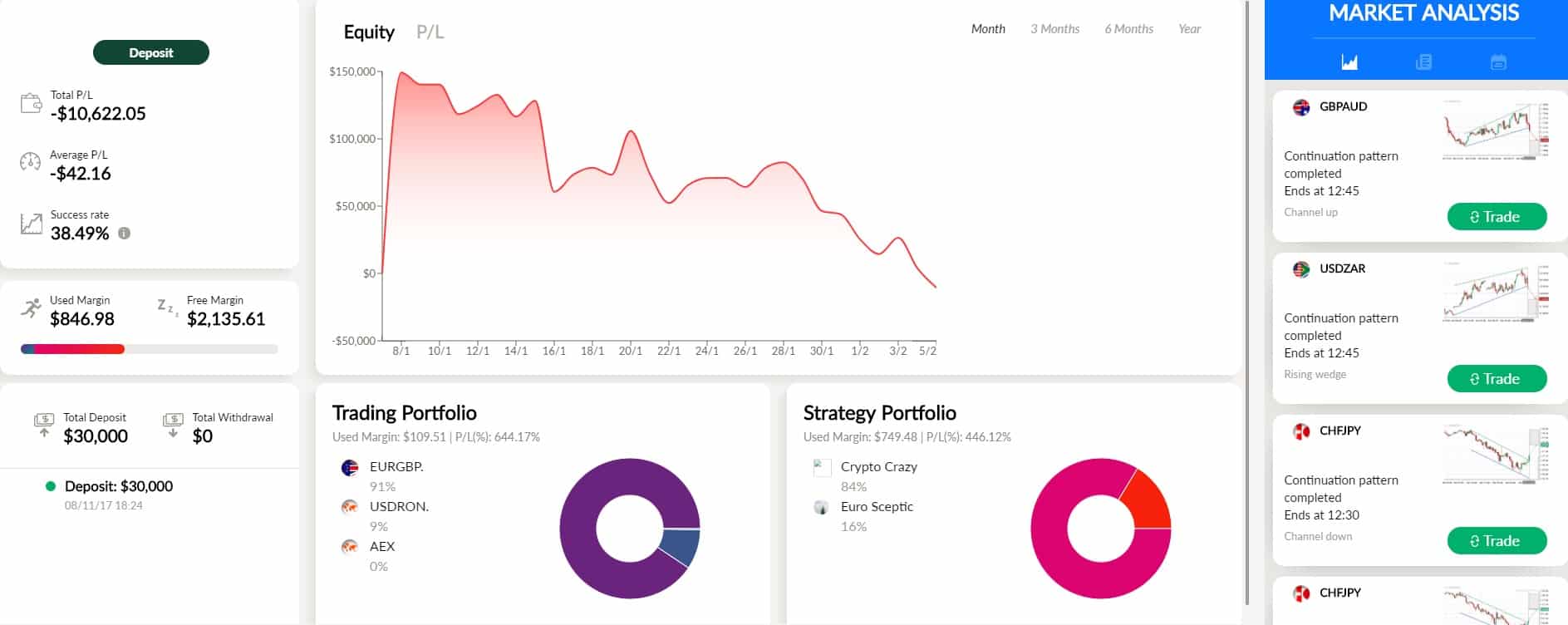

Dashboard

The Activ8 Dashboard grants the user a centralized point of information, pertaining to the portfolio. The segment shows a clear view of deposited amounts, a large-scale P/L and equity chart, used and free margin levels, and trading and strategy distribution charts. This section is quite helpful, as it gives the user a clear and concise overview of the account and the trading activity that is encompasses.

Side Display - Analysis

Leverate has also thought about how to incorporate external market analysis into its trading platform. On the right side of the interface, there is a display that is further divided into 3 categories: 'Market Analysis', 'News', and 'Calendar'.

The market analysis section includes external technical analysis provided by external content provider Auto chartist. Each entry in this section analyses a specific asset or currency pair, providing a short subtext description and a chart with technical indicators. A simple click of the mouse on the chart itself will enlarge the image to show the user the analysis on the chart itself.

Both the news and calendar sections implement information and data supplied by MTE Media, and give users additional information that can be used to reach a trading decision. It is worth noting that alternative or additional external content providers could be implemented by Leverate at any time.

Where to Improve

While the overall functionality of Leverate’s Activ8 platform is generally positive, there are a few areas that can be improved. For instance, there currently is no fund management system integrated into the platform. For brokerages that work with external portfolio managers to manage client funds, this can present an issue, since the platform does not currently support this feature.

By comparison, Metaquotes provides its Multiterminal platform to allow for the simultaneous management of multiple accounts. Additionally, there are financial technology providers who have developed MAM and PAMM systems that can be integrated into trading platforms through a plugin, thereby enabling fund management capabilities for FX and CFD brokerages.

Another facet of the platform that was rather lacking was individual Risk Management . Risk management is important to the long-term success of online trading, and the system currently lacks a centralized framework that will notify clients declining free margin, high exposure levels, and dangerous equity levels that can place the portfolio at risk.

Finally, the aforementioned 'Strategy' category is extremely user friendly. While the system allows for the simple allocation of an equity percentage to be attributed to a particular trading strategy (EA), some clients might find it confusing, since the platform does not allow for the allocation of an amount in USD, EUR, or any other fiat currency.

In other words, traders are forced to select a percentage level for a particular strategy, following a manual calculation of the percentage’s valuation at any given time. As the equity of the portfolio changes, so to does the value that be allocated to each strategy, based on the fixed percentage that was set by the user.

Overall, Leverate’s Activ8 trading platform provides both brokerages and traders with many features that are unavailable in some of the industry’s leading trading platforms. According to Leverate, the development of the Activ8 and Optim8 systems have been gaining momentum, as popularity increases among FX and CFD providers and end users alike.