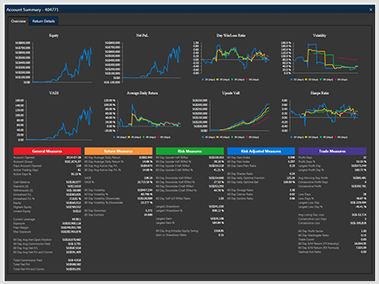

Introduced at the 2013 Forex Magnates London Summit, R3 Analytics is a Risk Management software platform that provides analytics on client trading patterns. The results provide brokers insights for classifying customers as A-Book or B-Book order flow (A-Book are customers who brokers hedge their orders in the interbank market while B-Book is flow on which brokers act as the counterparty and remains unhedged on a per trade basis).

Updating their offering, R3 Analytics has announced that it is adding new features to its cloud-based software. Integrating with MetaTrader 4 servers, R3 Analytics will now feature customizable B-Book optimization strategies and risk-management tools along with its existing analytical insights into trading accounts. The customizable solution will allow brokers to select from out of the box risk management strategies. Brokers can then optimize strategies with parameters that include tolerable drawdowns, risk per client and overall equity exposure.

Following the events of last

week’s Black Thursday, and losses absorbed by non-dealing desk brokers who were previously viewed as less risky than their market maker counterparts, it has spawned increased interest among firms for hybrid A/B-Book models. As such, the R3 Analytics upgrade fits timely into this trend.

In addition to the risk management features, also being added is SiBi, a sales and business intelligence model. The product includes aggregated broker data of spreads, commissions earned, account funding, volumes and marketing statistics.

Commenting in their public release about the news, Liam O’Brien, R3 Analytics’ Managing Director stated, “R3 is committed to the long-term prosperity of our clients. In lieu of the recent uncapping of the Swiss franc and the ramifications that followed, it is not enough for us to simply provide clients risk visualisation and management tools and leave them to their own devices. We offer our specialist risk management strategies and services to foreign exchange brokers so that their risk-return profiles are fully optimised and that they know their exposure to anomalous drawdowns.”