Saxo Bank has just announced that it is opening access to its trading environment for third parties. With the launch of the company’s new REST (Representational State Transfer) Open API (Application Programming Interface) developers will gain access to the company’s trading infrastructure, including the newly launched SaxoTraderGO platform.

The new architectural style under which the Open API has been developed is specifically used in Web services, such as the SaxoTraderGO platform. Using REST can be much more convenient for web services as it requires much less bandwidth when compared to SOAP (Simple Object Access Protocol).

In addition the SOAP architectural style requires the use of two subsystems - a provided server program which delivers the data and a client program which receives it.

REST is already widespread, but the financial industry has been late to the party

Saxo Bank’s Head of Platforms, Christian Hammer, explained, “REST is already widespread among tech giants who have built entire business models around Open API. The financial industry however has been late to the party. Some banks already offer access to third party developers to build specific features or apps but we are offering much deeper functionality and access to our entire trading infrastructure. We are essentially decoupling our infrastructure from the user experience to become a trading facilitator.”

The Open API uses SignalR and WebSockets for lower latency and increased performance, while for authentication and security control the solution relies on a combination of industry proven SAML and OAuth 2.0 protocols.

A realm of new possibilities for White Labels , developers and traders alike

The move made by the Danish Multi-Asset brokerage Saxo Bank is part of a pre-announced transformation of its services which started with the launch of SaxoTraderGO in May. The open API will be covering the trading and back office infrastructure side of business, and opening the doors for white labels and third party developers to introduce custom tailored solutions.

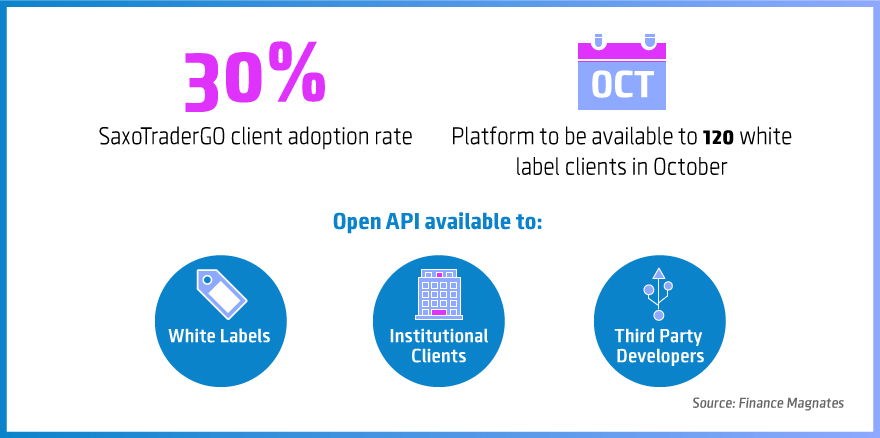

Key metrics of SaxoTraderGO, © Finance Magnates

Another very big segment of traders who are set to benefit are institutional players. Coinciding with the Open API launch, Saxo Bank has also revealed that it is launching a new subsidiary called Saxo Markets, which will focus on the firm’s institutional business worldwide.

Third party developers in the mean time may unlock new streams of revenue

Third party developers in the meantime may unlock new streams of revenue for both themselves and Saxo Bank by designing specific applications tailored to the needs of different traders. According to the Danish multi-asset brokerage, the adoption of SaxoTraderGO by its clients has been steady and due to this the firm decided to scrap its MetaTrader4 offering after the launch.

All developers who are willing to program on the new open API that Saxo Bank is launching will have a dedicated Developers Portal, which includes information on documentation, libraries, sample code and technical support.

about 30 per cent of Saxo Bank's clients have migrated to SaxoTraderGO

According to the latest information provided by Saxo Bank after the new platform’s launch, about 30 per cent of its clients have migrated to the new solution. The firm has also set a date on the rollout of the new platform to white label customers. About 120 institutions who are already clients of the Danish brokerage will be able to access SaxoTraderGO in October.

Commenting on the launch, the Head of Business Lines at Saxo Bank, Matteo Cassina, said: “For a long time the industry has grappled with the dilemma of building versus buying, but the pace of technological change has made it impossible for institutions to maintain an edge when it comes to innovation. The result is a paradigm shift from a business-to-customer economy to a so-called collaborative economy.

The accelerated adoption of technology and the increase in mobile business-to-customer interaction presents a huge growth opportunity for our partners, offering the potential to multiply trading volumes, create new revenue streams and protect their businesses against rapid digital change," he concluded.