When Tradable introduced their app based trading platform, they were arguably the first system to have a developer first focus. End-users would still be traders and brokers, but Tradable aimed to create an easy system for developers to integrate their technology on the platform. Speaking to Tradable CEO Jannick Malling when the platform was first introduced in 2012, he explained at the time that one of the hardest obstacles for developers when working with brokers is integrating their technology to work with broker products.

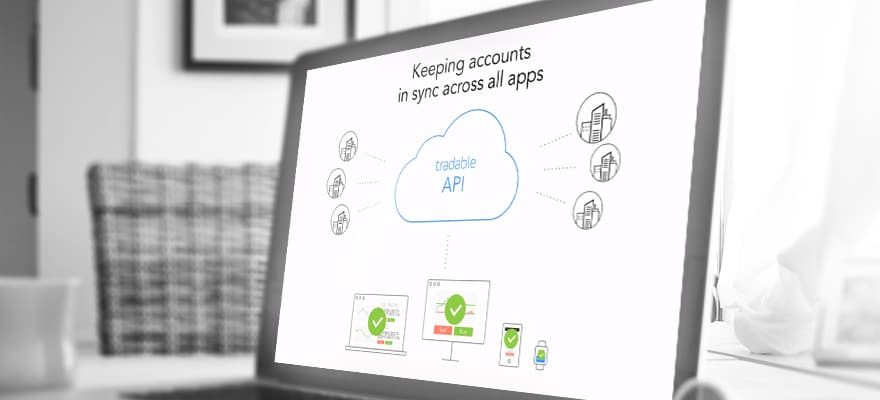

While APIs have evolved within the last few years from major brokers to enable the ability for developers to connect trading accounts directly from their apps, full integration with broker platforms remains difficult. As such, with Tradable, developers could integrate once, with Tradable having to do what they call the ‘heavy lifting’ to connect with individual brokers.

Tradable Embed

Jannick Malling, CEO, Founder, Tradable

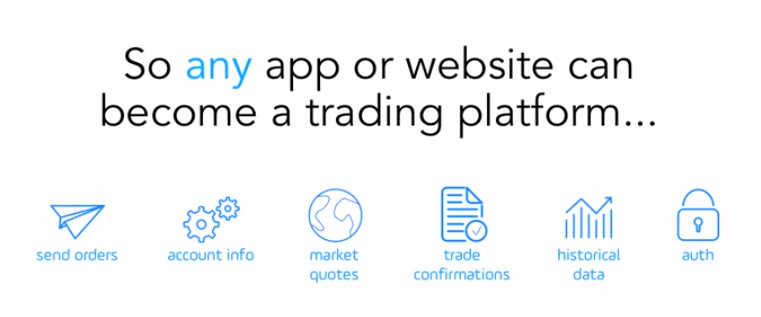

Expanding the ‘heavy lifting’ approach, Tradable is introducing Tradable Embed for developers as well as publishers. The new offering will allow app developers and financial content publishers to integrate trading directly from their products.

Being introduced is an embeddable or API based version of Tradable that can be integrated on 3rd party platforms. Once integrated, traders of the trading apps or website apps can access their trading accounts that are part of Tradable’s list of connected brokers.

Developer demand

According to Malling, the impetus of the project was two-fold; developer demand for the ability to integrate trading on their own apps as well as the increased importance of mobile in-trading. With regards to the former, the ability for developers to add trading to their apps has seen a lot of growth over the past two years.

As a result, beyond just FXCM and InteractiveBrokers that have provided APIs for forex developers, recent entrants in the past two years that have launched an API ecosystem include OANDA and IG Markets. In addition, for US stocks and options, Tradier has gained a lot of traction among 3rd parties with their brokerage API. For developers, the advantage of account integration is the ability to add volume based revenues as an alternative to selling subscriptions to their trading services.

Web and mobile strategy

With regard to mobile, Malling explained that one of the hindrances of their business model, where their Trading Platform includes an app store of third party developed products, is mobile. Specifically, Malling cited that Apple doesn’t permit the creation of “an app store within a mobile app”. As such, Tradable are unable to include their 3rd party developer app store within their mobile platform on iOS. Beyond Tradable, this is an industry wide tech issue, of which the most notable case is perhaps Amazon, where users of their iOS Kindle app can view books and other digital content on their iPhones, but need to use a desktop or mobile browser to enter Amazon to purchase new content.

We had to completely rethink our mobile strategy: Jannick Malling

Due to this problem, Malling explained that “we had to completely rethink our mobile strategy and come up with a new way of executing on our founding vision of enabling developers to build seamless trading features.” As such, Tradable Embed was created as a solution that would allow traders to download the mobile version of the app that they enjoy using on the Tradable desktop app, and still connect to their account through the embedded Tradable API.

Multi-Broker

Malling explained that through their multi-broker environment, Tradable believes it is bringing a unique value to the market. Rather than locking in with a single broker, Tradable Embed users will be able to offer their users a wide range of brokers to connect with. Currently connected to major firms such as GAIN Capital’s FOREX.com and FXCM, Malling explained that they will soon be expanding the list of forex and CFD brokers as well as adding equity brokers in 2016. This reveals a new shift for Tradable which had been focused on working with individual brokers in specific regions , opening itself up to a wider audience.

With regard to attracting new brokers, Malling expressed that “innovation of platforms on the front end is best done by those who are focused on it”. As such, Tradable’s API provides brokers the ability to empower their customers with new technology, while they can concentrate on the operational side of their business. Malling added that according to their research, their platform has shown higher rates of user retention than competing products.

An opportunity for non-MT4 brokers

Malling also stated that he believed their model will provide an opportunity for non-MT4 brokers to connect with more developers. He explained that many developers in the retail forex market focus on creating products that integrate for MT4 due to the massive array of brokers offering the platform. It also saves developers from having to adapt their products to multiple proprietary platforms. As such, Malling believed that brokers with proprietary platforms that connect to Tradable’s API will have an easier solution to appeal to more 3rd party developers.

Contextual trading links

In addition to app developers, Tradable believes that their product will offer an attractive solution for website publishers to increase user engagement. Like various marketing products that add advertising links when hovering over popular keywords, the Tradable API will enable trading related terms to become clickable. Doing so will create an order entry pop-up of the underlying asset. On this feature, Malling explained that they are “working on smart contextual features that can review positions and connect to a news story”.

Among 3rd parties that have signed up to be early partners of Tradable Embed are many developers that have connected to their desktop platform. They include NetDania, FXStreet, Tradimo, Dealer-Insight, and the most recent partner app, Lex van Dam Trading Academy.

Connecting a fractured market

By introducing Tradable Embed, Tradable has an ambitious plan to solve one of the industry’s greatest problems, and not only in the $5 trillion a day forex market. This is the largest asset class when ranked by dollar volume, although also arguably the most fractured- most trades are executed on non-centralized platforms and are based on direct client to dealer relationships.

In the retail market, this means that a trader’s broker account and positions are independent and non-transferable to any other broker. Due to the diversity of Liquidity , it has also led to scores of trading platforms emerging within the market.

By creating a two-directional API that uses the Embed product to connect all participating brokers and developers/publishers, Tradable plans to put a major piece in place to connect the overall fractured retail FX market. However, this may end up being easier said than done.

Arguably the biggest obstacle is how the connected firms will go about splitting revenues. Within the app marketplace, the revenue model was simple, with developers pricing their products and traders electing whether they want to purchase the offering. By embedding a broker’s trading account on a 3rd party developer’s platform, volume related revenues may also come into play (Tradable has yet to publicly reveal its revenue structure for developers/publishers).

Finance Magnates' internal analysis though has shown that very few brokers are willing to promote to customers external products where there is a notable revenue split. The only exceptions are for trading platforms such as cTrader and liquidity bridge providers which are viewed as a core cost of operating.

Another impediment that Tradable will need to overcome is truly creating a vast cross-broker eco-system. Without it, specific publishers may feel little desire to provide any of their valuable web real estate to Tradable if very few of their readers can open trades using Tradable Embed.

Overall, with the introduction of the API, Tradable is aiming to continue to add value to the trading industry by making it easier for brokers, traders, developers, and content providers to integrate with each other. But the firm still has its work cut out for it to truly connect the four.