One year after the launch of Tapaas Analytics at the Finance Magnates expo in London in 2015, we are seeing the company gain significant traction with brokers, as it is now live with six. Tapaas Risk Management has facilitated several companies in transforming their business from a pure STP model to confidently warehousing risk knowing that they have Tapaas risk management and alerts.

The main focus for Tapaas throughout the year has been to make all the alerts that the firm’s analytics and visualization platform is generating, actionable. Finance Magnates caught up with David Hall, co-founder of Tapaas, at the London Summit to discuss the latest developments in the platform.

David Hall, co-founder and CEO of Tapaas

“We believe that a complete business solution must provide a facility to Act on insight. Delivering analytics and visualisation alone, is not enough today,” Mr Hall expalined.

Elaborating on the partnership with oneZero, he said: “We have found this year that our customers are very excited about how our platform helps them 'profit from insight' we derive from their data. But the number one request was 'make it easy for us to take action from these insights.' So, along with development of several new alerts and risk metrics, we have made them Actionable through integrating our dashboards and email alerts with the oneZero API.”

Andrew Ralich, Co-Founder and CEO of oneZero

The co-founder and CEO of oneZero Andrew Ralich said: “The capabilities Tapaas have built into their platform represent what we at oneZero see as the next generation of reporting and analytics for Retail brokers. We are happy to be working closely with David and his team to integrate their real-time analytics and automation, via our APIs for client book switching and execution controls.”

The main potential beneficiaries from the company’s solution are brokers and prime brokers who profit from insight derived from the data that Tapaas Analytics delivers to them. The company launched its solution last year with a number of functionalities that brokers can use - monitoring of positions, risk, PnL, and client trading analytics, that can successfully identify scalpers and suspicious activity, among other risks.

Tapaas Analytics Drives Visualisation and Email Alerts

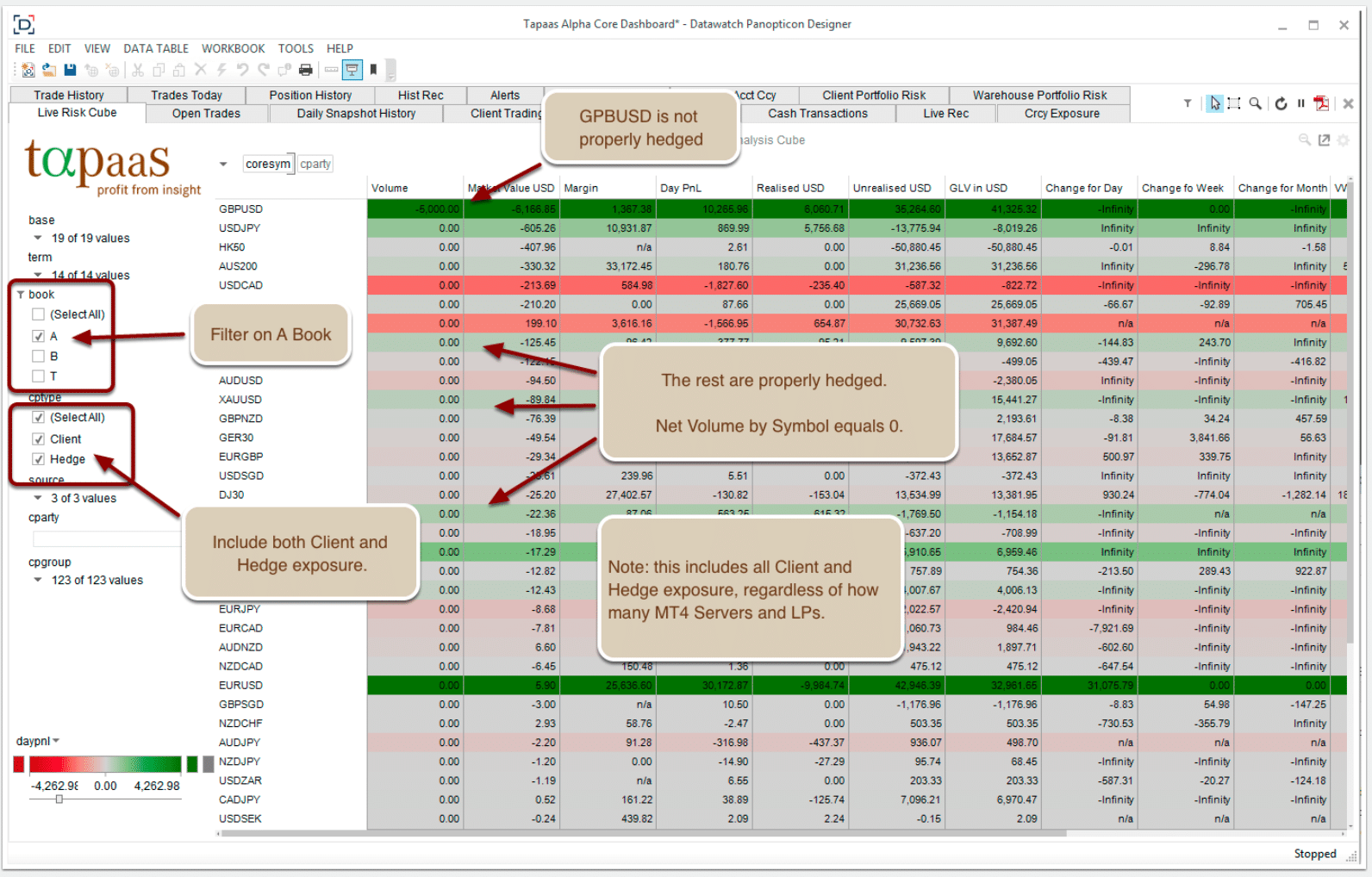

The full functionality of Tapaas’ data analytics solution is enabled via live streaming data from a broker’s MetaTrader servers, bridge and LP’s. The system is performing real-time reconciliation in order to verify the data and assess its accuracy. Tapaas tracking enables hedging as a result of a book switch and brokers can optionally do re-hedging.

Tapaas Analytics is applied to both real-time and historical data. The results are then visualized richly and enable brokers to analyze the insights and alerts that are delivered in a user-friendly way. Brokers and PBs are getting all the information that necessitates their attention.

Tapaas Analytics

The Tapaas Alpha analytics platform has been very well received by the market and is live at five brokers with several more in the queue.

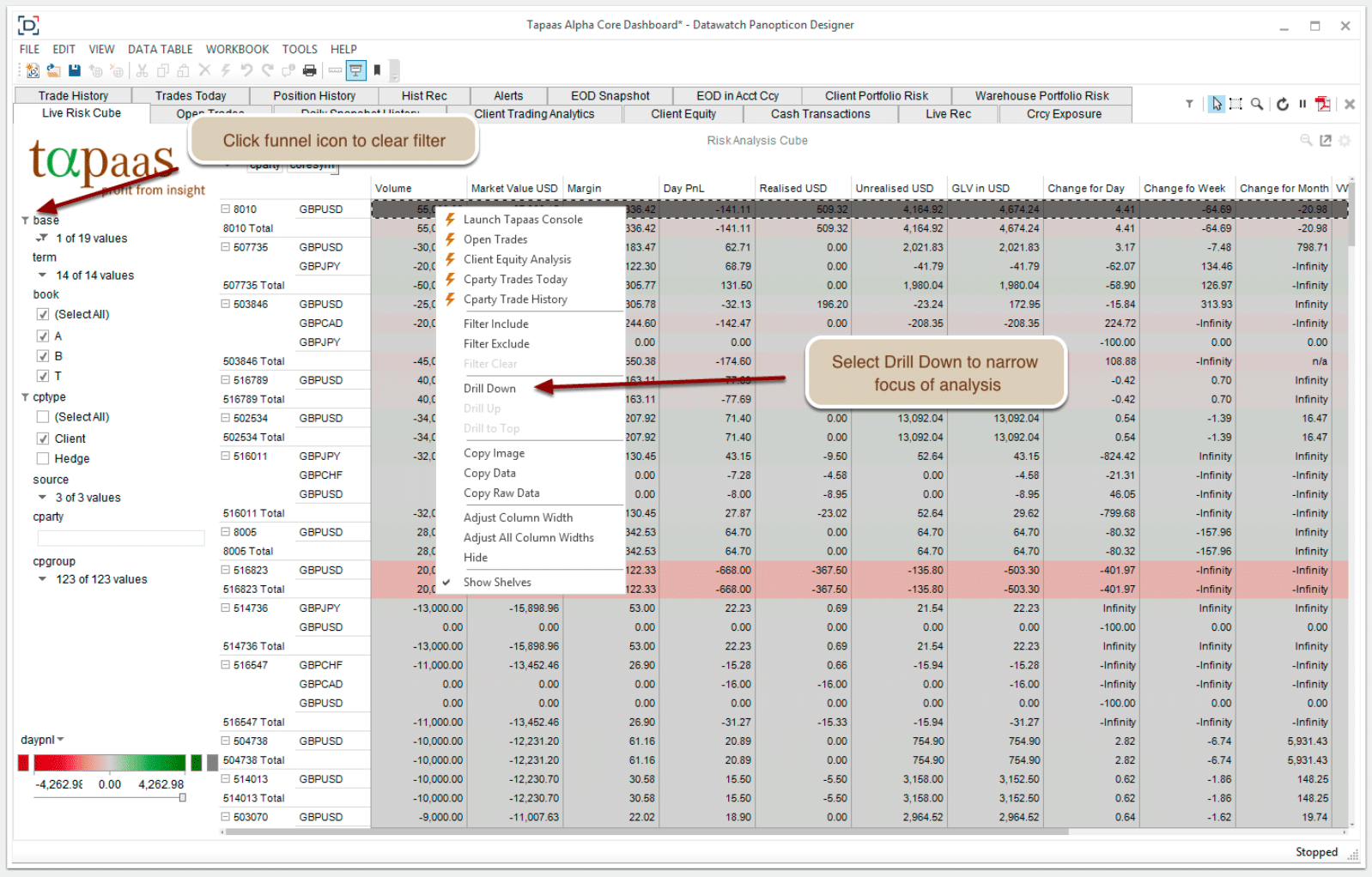

This year, the firm’s solution has added another layer - Tapaas has added actions to the analytics. Brokers can take immediate action, such as switch a trader from a market making model to a Straight Through Processing book, with one click of the mouse, just after they’ve received an alert from Tapaas.

The solution has been made available to clients in conjunction with one of the industry’s leading connectivity providers, oneZero. Tapaas has worked closely with oneZero to leverage the oneZero API for filtering market making alerts and making them actionable.

The end product allows Tapaas to trigger book switches in the bridge either automatically based on Tapaas Analytics or after being acknowledged by the broker from an alert email or from the Tapaas dashboard, with the click of a mouse.

Tapaas Analytics