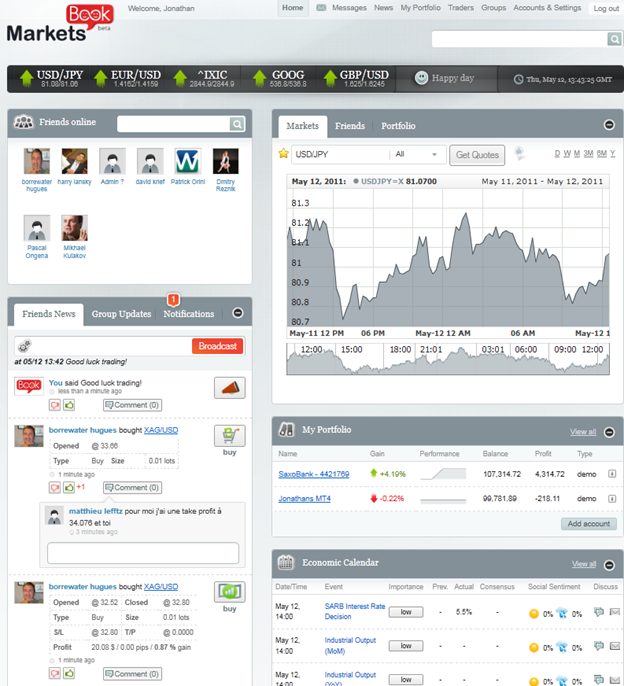

I recently caught up with Jonathan Adest, CEO of Marketsbook.com – a new social networking platform for traders. Marketsbook.com’s slogan, ‘Invest Together’ (much similar to Currensee’s ‘Trade Together’), summarizes how Marketsbook.com takes the current Forex social networking trend a step further by allowing members access to a platform that allows both forex and Equities . The site is one of the first to show built-in stock and forex charts.

The forex social networking arena is a developing and very innovative section of the forex industry. Social networking is the latest internet buzzword, especially in forex. It is also a very amorphous term as it is not easy to define what is a social network and what isn’t. Forums, blogs and portals all allow social interaction of this type or another while other, for instance Currensee, provide more advanced networking options. The leading sites in the forex social space are Currensee.com, FXstat.com, and MyFXBook.com, to name a few. eToro is the only broker that currently runs its own forex social networking site called Open Book. These sites offer various services from networking, trading advice, and forex research to market news and the ability to follow other successful traders. Some of these sites are registered with the NFA in the US and the FSA in the UK as Introducing Brokers.

For Jonathan, a social networking platform is more about finding a new friend or connecting with existing relationships than looking for the next hot strategy. This is evidenced by the fact that the site, for now, lacks a Trade Leaders feature as seen on Currensee. They also offer private groups where members need to be invited in to chat. I think that this will be a good tool for signal providers, education providers, and brokers, as well as for introducing brokers seeking to offer an exclusive service for their users on Marketsbook.com.

While the service is still in Private Beta, Jonathan provided a walkthrough of the site and pointed out some unique features that will be beneficial for members:

- Vote and comment on trades made by friends on the site.

- A social Sentiment function that allows you to vote on the outcome of economic events.

- Privacy settings that allow a user to decide what to share, and with whom. For example, many Beta users are only sharing trades, but not trade size or account balance.

- A “Twitter”-like feature, that allows you to instantly share what’s on your mind with all of your friends.

- Investors you may like – this recommendation is based on location, instruments traded, age, common friends, and win ratio.

Jonathan provided some additional answers and we thank him for his time.

What is a Forex social network to you?

MarketsBook.com is intended to foster an online community where traders can meet, connect, chat, collaborate, and share ideas. Very simply put, a Forex social network is an online environment within which participants can utilize their connections with other traders to maximize their own financial returns. MarketsBook.com is not solely a Forex community; we’re interested in (and involved with) everything in the international financial world. We currently support around 60,000 different financial instruments. We started with Forex simply because it’s a market with which we’re very familiar, and it will provide the foundation for a highly adaptable platform.

What sets you apart from your competitors?

We currently offer connections to MetaTrader 4, FXCM, Saxo Bank, GFT DealBook, and IG Markets, with many more to follow over the coming months. Since we plan to be the ‘dashboard’ of a trader’s day, we’re offering full market information (charts and quotes), as well as an advanced economic calendar. We’re working on a smart news widget to generate a customized feed of topics of interest to each individual trader. Based on our years in the capital markets, we don’t believe that it’s a competition or a game. We don't think you should choose your friends based solely upon their performance. Not everyone is alike in these markets, and one's person strategy isn't always suitable for another. Additionally, personal security is extremely important, so, while MarketsBook.com is open to everyone, and we’ll recommend other traders to you, you decide on whom to befriend. You only share what you want, with whom you want - on a fully customizable, friend by friend basis.

What is your revenue model at present?

We’ll be honest about our revenue model: we’re simply not sure yet. We can say with conviction, however, what it won’t be: we won’t open our own broker, we won’t fill up the screen with banner ads, and we’ll never sell our traders’ information. We’re working hard and offering a great product for free - and it will always be free to our community members. That said, we’re planning to strategically team up with major banks and brokers as a means of attracting their traders. We plan to launch Open Beta within 1-2 months. Meanwhile, feel free to contact us for an invite code (jonathan@marketsbook.com). Brokers seeking a social solution for their clients are also welcome.

For the past several weeks, I have been in touch with the owners and CEO’s of the several leading forex social networking sites for a detailed analysis in our next quarterly report. While they all differ in their definition of social networking, their revenue models and how they plan to attract traders, two things are common among the major players: their desire to help retail traders and equally important, a marketing platform for brokers. The first one needs no explanation. Let me explain the marketing advantage they offer. Each of the social platforms is able to offer a targeted audience for brokers. If a broker wants to reach out to traders who primarily trade the GBPJPY, the sites can provide that data. If a broker’s education team wants to reach out to new traders who are struggling with losses, the networking sites can provide that demographic. Just like my LinkedIn account shows me targeted ads in the industry that I am researching, the forex social networking sites are striving to do the same. The vast majority of marketing budget at leading brokers is spent on forums which are not able to offer targeted data, since a wide array of traders, from beginners to experienced, visit these forums. What’s the payout for sites such as marketsbook.com and other leading forex social networking sites? In Q1 2011 alone, FXCM and Gain Capital had a marketing budget of $7 million and $10 million respectively. I suspect the marketing budget at other brokers such as Alpari, GFT, Saxo, ACM is similar. Social networking sites are vying for a piece of that and are offering a better ROI for marketing departments. Stay tuned for more details in our next quarterly report.

[youtube https://www.youtube.com/watch?v=Um2A-ykyAVY&w=590&h=349]