Today is Apple day, or maybe better termed: “How many millions of iPhones did Apple sell?” day, as the company is set to announce its quarterly financial report after the close of US trading today. Wall Street is estimating that the company will announce $2.60 per share in earnings on revenues of $67.555 billion. Traders will be watching the company’s headline revenue, profit figures as well as product sales numbers to understand just how well the latest iPhone is performing, and iPad lagging.

While traders focus on Wall Street estimates and research, analyses from "Main Street" investors are becoming more powerful when it comes to forecasting accurately. Leading this revolution is crowdsourced financial-estimate site Estimize.

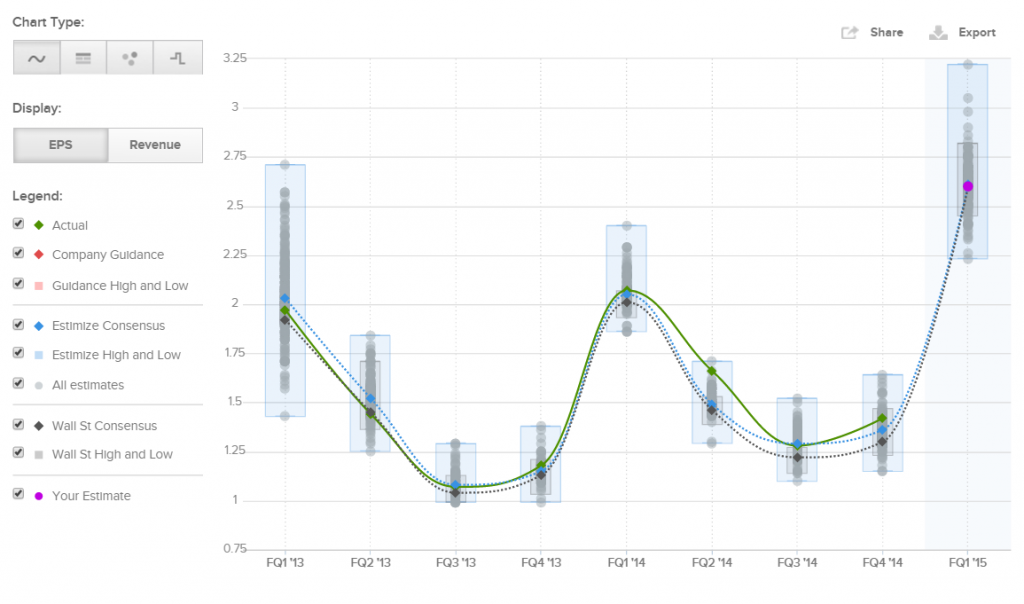

Tracking Wall Street estimates, company forecasts and actual reports, Estimize provides non-professional users the ability to enter their estimates for companies set to announce their financials. The platform then aggregates forecasts to produce an average estimate. Over the last five Apple earnings announcements, Estimize users have been closer to meeting Apple’s actual results than Wall Street users.

As a result of the positive track record from Estimize users, the community’s data has attracted the likes of hedge funds and money managers who monitor the crowdsourced findings to find an edge in the stocks they follow. Like popular Wall Street analysts who are noted for their accuracy in covering specific sectors and stocks, Estimize provides historical accuracy figures of forecasting users. Users are then able to follow them and get alerted when these forecasters provide new estimates or update their older ones.

While not every stock will garner the amount of forecasters like Apple does, the Estimize platform does provide a diverse array of forecasts from users that are typically attached in some way or another to the stocks that they forecast. As such, the crowdsourced platform can provide a wide ranging opinion on stocks from users from around the world and various backgrounds with insights not necessarily available from traditional equity analysts.

Overall, Estimize fits into the Fintech trend of aggregated data becoming easier to access and curate for investors. A similar data trend being aggregated is Twitter sentiment, alerting of changes in market opinion and also being used to formulate forecasts for economic indicators.