The Social Trading concept was introduced for the first time over a decade ago, in 2008. It quickly gained popularity among many retail traders and today over one-third of brokers offer it. How has it evolved since then? Does it benefit brokers and their clients? Finance Magnates looks at this in the most recent Intelligence Report and tries to understand its future.

When discussing social investing phenomena we use a ‘social trading’ term. However, this broad category handles several different subcategories which differ from one another. We have so-called ‘mirror trading’, ‘copy trading’, or sometimes only ‘chat platforms’. All of these elements are considered to be a part of the so-called ‘social trading’ category.

ZuluTrade was the first but not the only provider of social trading functionality. There were other similar platforms. The growth of its popularity would not be possible without Facebook, which was the first and the most popular social network at that time. The rapid success of Facebook showed all market participants that a new era has come: an era where social interactions on the internet were becoming a real thing and a function, as opposed to being only a hobby of a few tech geeks.

Peak at 2017

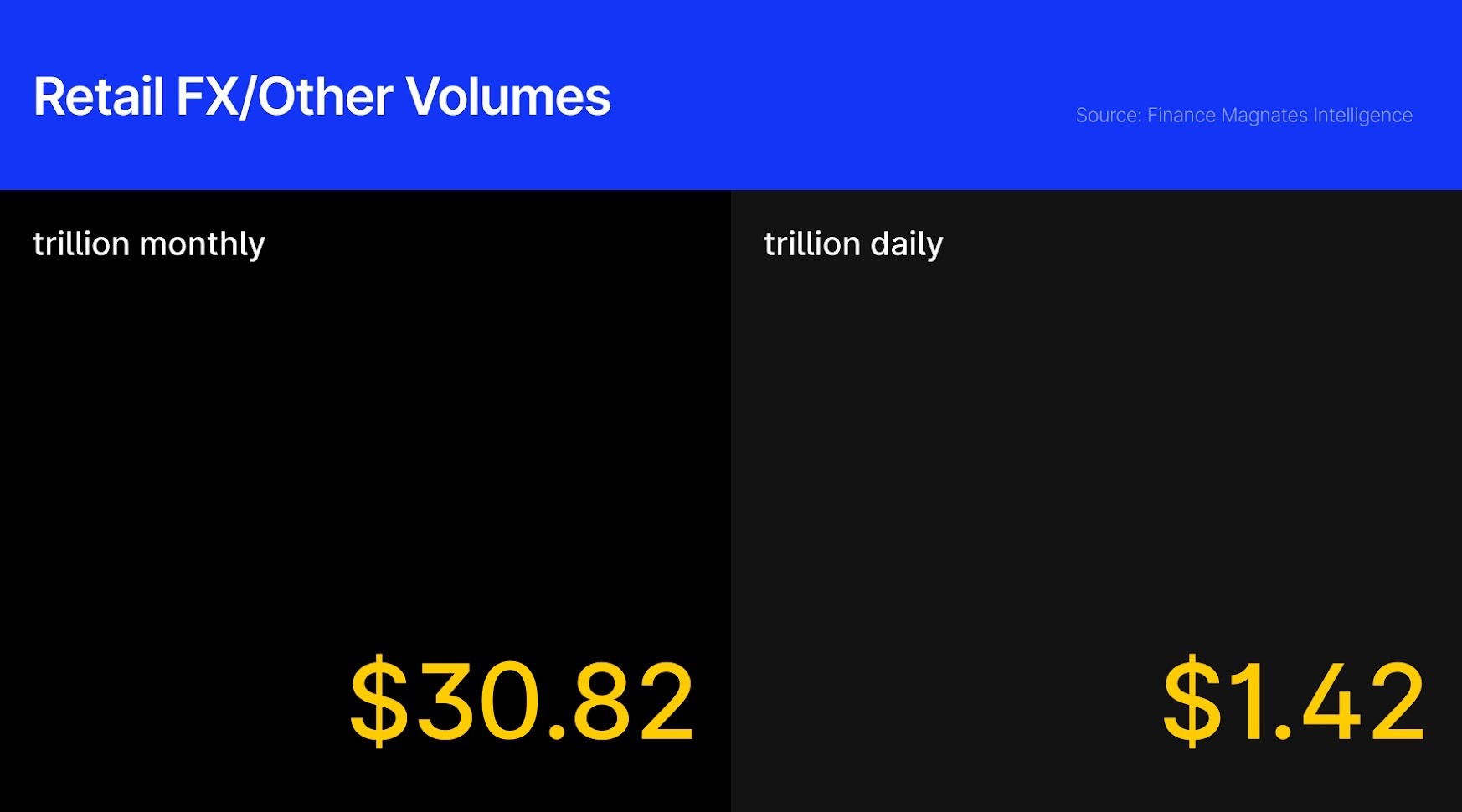

The first social trading services emerged back in 2008, which means we have been familiar with them for 15 years now. One could imagine that after so many years social trading should dominate retail trading. But, none of this can be seen. While we do not know the data for all brokers providing such a service, most firms that share data with Finance Magnates report social trading volumes in the range of 1-3% of their total volumes (excluding ‘social brokers’ like eToro or NAGA).

A short analysis of Google Trends for the term ‘social trading’ seems to confirm, that interest in this form of investing is growing. We can see, that starting from 2008 popularity of this term in a google search grew rapidly up until 2017. While it retracted a bit for the next two years, it once again became an uptrend from 2019.

The bigger picture

Finance Magnates Intelligence conducted research on the popularity of social trading services among FX/CFD brokers. For this purpose, we have taken all the brokers from the Finance Magnates Volume Rank which can be seen in every edition of our Quarterly Intelligence Report. Following that, we checked to see if brokers from this rank provide any form of social trading functionality. Our findings showed, that 37.7% of brokers from the volume rank give some form of social trading for their customers.

To get the full article and the bigger picture on the future of 'social trading', get our Latest Quarterly Intelligence Report HERE.