In recent years, the world of finance has witnessed a significant shift in gender dynamics, with an increasing number of women taking charge of their financial futures and venturing into the realm of investing, choosing gold, EUR/USD, Tesla and indices ETFs as the most popular trading instruments.

Despite long-standing stereotypes and barriers, data from XTB gathered to celebrate International Women's Day (IWD) on 8 March revealed that the proportion of female investors is steadily rising around the globe.

The Rise of Female Investors: Breaking Barriers and Challenging Stereotypes

The rise of female investors is not limited to the single markets. Data from XTB revealed that countries such as Romania and the Middle East have the highest equality in financial matters, with the percentage of women among new investors exceeding 20 percent.

“We are slowly disenchanting the myth that women are a separate entity on the capital market, or even something exotic,” said Dr Anna Grygiel-Tomaszewska from the Warsaw School of Economics.

Although men still make up the dominant part of retail investors, and in some countries, women's participation rates are lower, in many markets where XTB operates, a positive change in trend is visible. Especially among the group of new investors, where women in 2023 accounted for an average of 12%, and in the MENA region where every fourth new trader was a woman.

Several factors have contributed to the growing interest in investing among women. Katarzyna Sekścińska from the University of Warsaw, attributes this change to a visible process taking place in women's attitudes and beliefs, both in terms of their perception of investing and their own opportunities in this field.

"This change does not come from nowhere," Sekścińska explained. "Recent years have brought an explosion of easily accessible sources of investment knowledge, often not requiring leaving one's home and dedicating long hours of study."

Independent research conducted by the French financial regulator last year, on the occasion of IWD, showed that in 2022 that women constituted 30% of the local market's active participants.

Interestingly, women have completely different motivations behind investing. In the United States, they do so primarily not for profit but to ensure a better future for their children.

Favorite Instruments of Female Investors

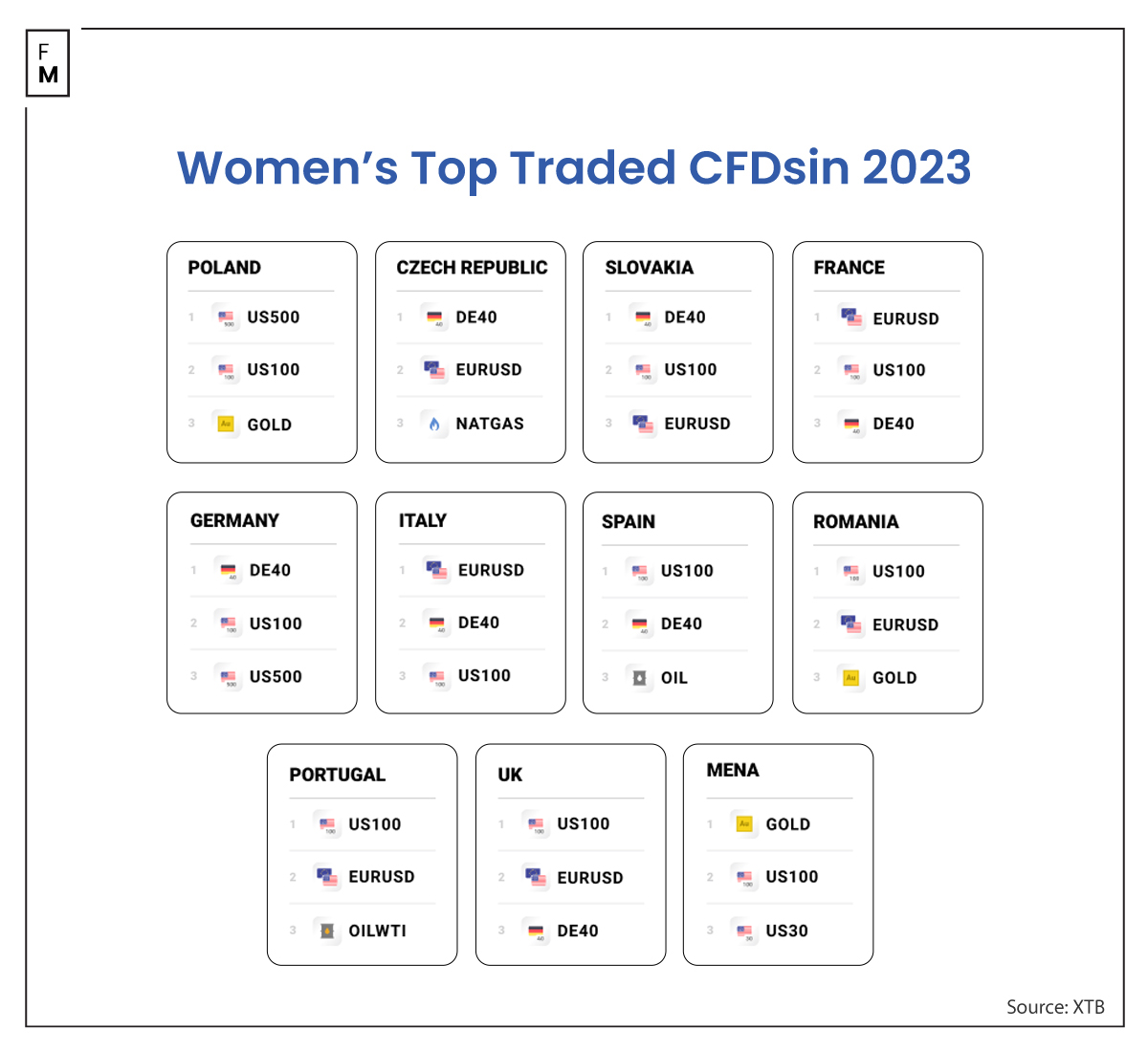

In 2023, among the CFD instruments traded by women, stock indices, commodities, and the major currency pair EUR/USD dominated. In the category of indices, the S&P 500, Nasdaq 100, and DAX 40 took the lead, while in commodities, gold, oil, and natural gas were the top choices. It showed that trading interests between males and females are almost the same.

Karolina Nowicka, a popular Polish financial influencer known as the "Lady of Saving", has emphasized the impact of social media on the growing popularity of investing among women, stating that the knowledge provided by female investors is more accessible and relatable to other women.

“Judging by how many women have recently started to take care of their money and increase their awareness of taking care not only of the here and now, but also of their future, I am sure that the percentage of women as investors will increase year by year,” Nowicka forecasted.

Shifting focus to more traditional investment vehicles, ETFs enjoyed considerable popularity, particularly those allowing investment in entire indexes, including IShares for the S&P 500 and Nasdaq and global stocks within the MSCI World Index. In the Slovak market, women primarily selected ETFs, providing exposure to the American debt securities market. This demonstrates that women, who according to separate research, have a greater aversion to risk, prefer to choose safer investment instruments.

As risk aversion among women is higher and more common, a natural inclination towards saving rather than investing presents itself. https://t.co/gQANZfPWy5 #gambinfinancial #financialplanning #womeninfinance pic.twitter.com/TYjopknrkc

— Claudio Gambin (@GambinClaudio) October 8, 2021

The stock market is a blend of local powerhouses (such as Poland's Orlen and France's BNP Paribas) and global tech giants. The most frequently occurring companies in female investors' portfolios were Tesla, Apple, and GameStop.

Bridging the Gender Gap through Education

Despite the progress made in recent years, the gender gap in investing remains significant. Experts agree that education is the key to bridging this divide. What is more, data from the Central Statistical Office constantly show large differences in earnings between the two sexes, even in the same positions. A smaller amount of capital automatically means a smaller amount of funds available for investing.

Despite this, women deposit more money into their investment accounts, as shown by a recent GOBankingRates survey from November 2023. Every third woman and every second man hold a brokerage account with funds below $15,000. Meanwhile, 35% of female investors accumulate more than $35,000, whereas this figure is 30% among men.

In addition to the need to bridge the pay gap, Dr. Grygiel-Tomaszewska emphasized the importance of accessible and meaningful education that extends beyond mere promotion and applies to everyday life.

“It is gratifying that more and more female educators have been appearing recently to show by their own example how to take care of the financial sphere,” she explained. “Women speak to women with the same voice and communicate this in such a way that they understand each other. In turn, understanding seemingly complicated issues can only positively influence their presence on the financial market.”

Furthermore, the way financial services are marketed, primarily targeting men, does not encourage women to invest. The "macho marketing" approach is a huge turnoff for them, as revealed by a 2023 study from Futura, a network for women in fintech .

By providing women with the tools and resources to make informed financial decisions, the gender gap in investing can be narrowed, empowering more women to take control of their financial futures.

The rise of female investors is a testament to the breaking down of barriers and the challenge of stereotypes in the world of finance. As more women recognize the opportunities presented by investing and take charge of their financial destinies, the gender gap in this field will continue to narrow.

We wish this to all women on the occasion of International Women's Day.