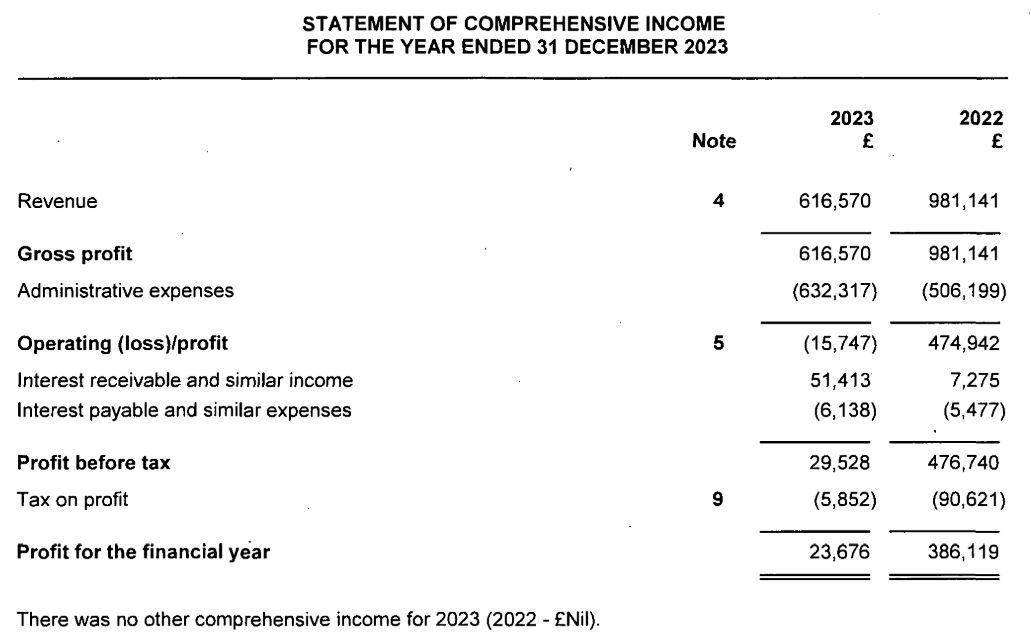

The UK entity of GMI Markets, a forex and contracts for differences (CFDs) broker, ended 2023 with a revenue of £616,570 and a pre-tax profit of £29,528, according to the latest Companies House filing. The company closed the year with a net profit of £23,676.

The broker's latest annual revenue, which operates through a straight-through processing (STP) model, declined by 37.2 percent from the previous year’s £981,141. The pre-tax profit also dropped by over 93.9 percent.

A Stressful Year for the Broker

Global Market Index Limited provides professional and ECP clients access to online trading for financial products, including FX and CFDs. The London-based company pointed out that “following the success in increasing the ECP and professional clients’ trading volume in 2022, [it] continued to maintain existing relationships and onboard professional clients during 2023.”

The company elaborated that it expects its 2024 revenue to be driven by liquidity and white-label solutions for institutional clients targeting MT4, MT5, and FIX brokers, along with the continued focus on professional traders.

It is also recruiting sales teams and increasing local and global geographical reach to attract and convert more clients.

Interestingly, the administrative expenses of the company increased last year to £632,317 from the previous year’s £506,199. Meanwhile, it earned £51,413 from interest income, compared to £7,275 in 2022.

Trading Remains Strong in Volatile Markets

Apart from the UK entity, GMI also offers retail trading services with its entities registered in Saint Lucia, St. Vincent and the Grenadines, and Mauritius. However, the figures showcase the performance of only the UK-registered entity.

Meanwhile, pointing out the impact of the geopolitical tensions, the company noted: “Despite the negative impact on many businesses by such events, the FX trading market has witnessed remarkable growth… creating trading opportunities as markets remained volatile.”

“The company services institutional brokers who have benefited from the market volatility and trading opportunities during and after the pandemic, and as such, the Company benefits from the trading volume generated by this volatility and client trading activities.”