The Financial Conduct Authority's latest complaints data revealed shifting trends in consumer grievances with financial services firms in the second half of 2023. While overall complaints dipped slightly by 1% to 1.87 million, not all product categories followed suit.

What Did the Latest FCA Report on Financial Complaints Reveal?

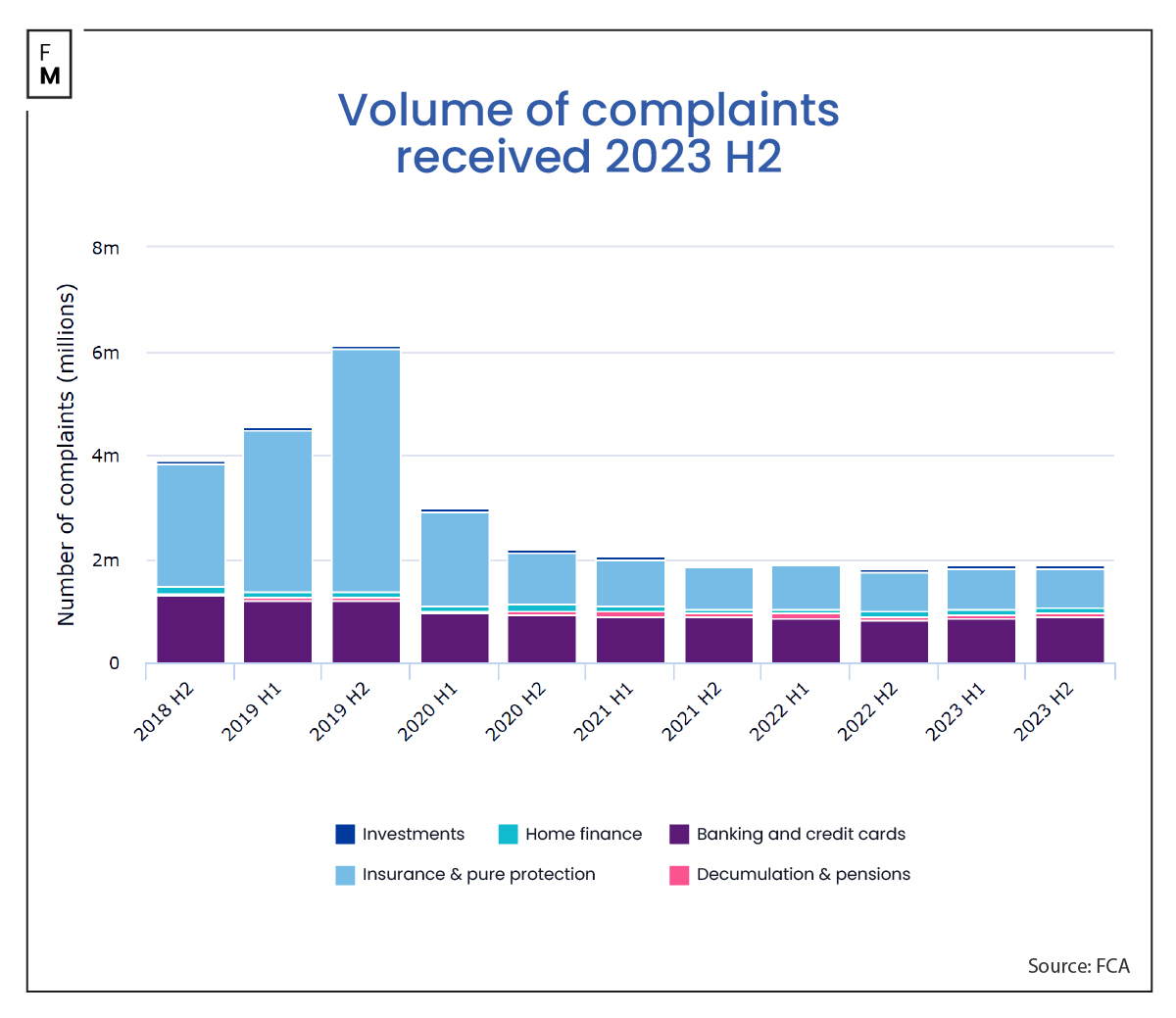

Since reaching a peak in 2019, the number of financial services complaints has remained relatively stable, fluctuating between 1.8 and 2 million, according to the data published last week by the FCA.

Record results were observed in the second half of 2019, when the total number of complaints exceeded 6 million, largely due to insurance and pure protection products, which reached a record level of 4.6 million.

"We use this information to guide our supervision of firms and markets, and to identify any potential concerns related to specific financial products," the FCA explained.

Additionally, as the FCA data shows, the number of complaints per 1,000 products sold remains constant and unchanged. Nearly 45% of all complaints were resolved within 3 days. However, the percentage of complaints that were closed within 8 weeks was also high, amounting to 49%.

According to another recent publication, the FCA ordered the amendment or withdrawal of 2,211 financial promotions in the first quarter of 2024. Approximately 11% of these alerts were linked to clone scams.

Credit Cards and Current Accounts Buck the Trend

Banking and credit cards saw a rise in complaints of 3.2%, with credit cards alone jumping 7.5% to 217,032. This continues the recent fluctuating pattern of credit card complaints. Current accounts, the most complained-about product, ticked up 1% to 515,336 complaints.

Home finance and investment products also saw modest increases of 3.7% and 3.4%, respectively. In the investments category, the number of complaints jumped from 59,417 reported in H1 2023 to 61,446 in H2 2023.

However, complaint volume declines of 2.8% and 5.8%, respectively, were experienced in decumulation, pensions, insurance, and pure protection products.

Australia additionally reported similar data a few months ago. The number of disputes involving financial services firms in Australia is rising. The country's ombudsman registered 102,790 complaints in 2023, marking an increase of 23% from the previous year. Moreover, Australians' compensation and refunds surged 38%, reaching AU$304 million last year.

Firms Uphold Fewer Complaints, but Redress Payments Climb

Interestingly, while the overall percentage of complaints upheld by firms decreased from 61% to 58%, the total redress paid out rose 10% to £259 million. This suggests that while fewer complaints were decided in consumers' favor, those upheld resulted in higher compensation on average.

The FCA uses this complaint data to evaluate how firms treat their customers, guide its supervision of financial markets, and identify potential issues with specific products. For consumers, it provides valuable insight into the current customer pain points across the financial services industry.