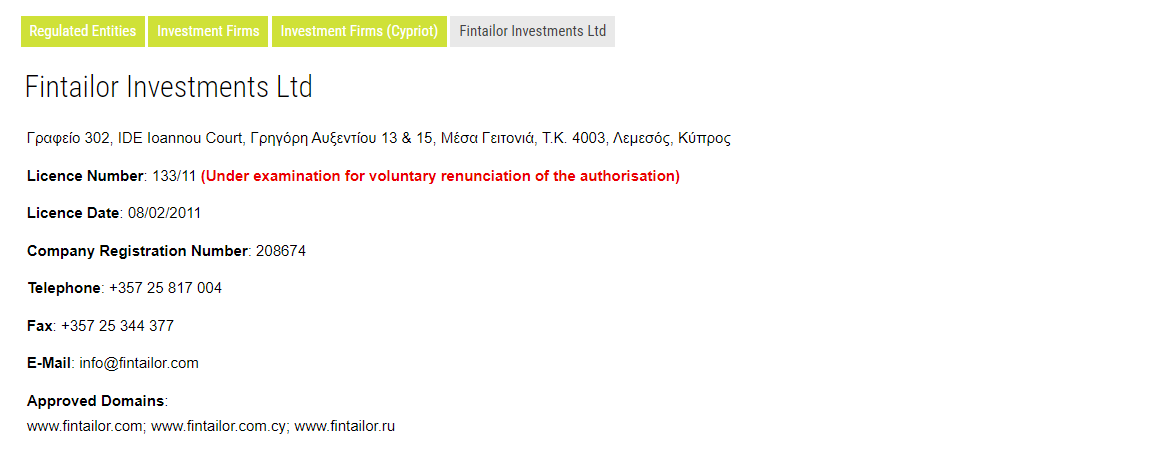

The Cyprus Securities and Exchange Commission (CySEC) has made the decision to revoke the Cyprus Investment Firm (CIF) authorization previously granted to Fintailor Investments Ltd.

CySEC Revokes Fintailor Investments Ltd's CIF Authorization

Fintailor voluntarily relinquished its CIF authorization, leading to CySEC 's decision to withdraw it formally. The company's choice to expressly renounce its authorization was cited as the primary reason behind the regulator’s action.

Finance Magnates last reported on Fintailor, which has held a CIF license since 2011, over three months ago. This was in February when CySEC announced a settlement with the company for €200,000. According to the statement at the time, the regulator highlighted potential breaches in anti-money laundering laws. The investigation covered the period between 2016 and 2019.

The settlement agreement from February highlighted several critical issues within the Company's anti-money laundering and counter-terrorist financing framework. These issues included inadequate policies and procedures for customer identification and due diligence, a failure to thoroughly examine transactions that may be vulnerable to financial crimes, particularly complex or unusually large transactions and unusual transaction patterns lacking clear economic or legal purpose.

Furthermore, the settlement revealed shortcomings in the Board of Directors' responsibilities in ensuring compliance and deficiencies in the Compliance Officer's duties in overseeing and implementing effective anti-money laundering measures.

Leverate Financial Services Ltd, a popular brand in the brokerage market, also recently renounced its CySEC license. A month ago, the company was also excluded from the Investors Compensation Fund (ICF).

CySEC's 2024 Supervisory Focus

CySEC is set to intensify its oversight of firms involved in cross-border activities, particularly in handling complex financial products like Contracts for Difference (CFDs). The regulator's supervisory priorities for 2024 include bolstering investor protection and ensuring market integrity through an enhanced supervisory framework. This plan entails a thorough evaluation of the risks and responsibilities of the entities under its supervision.

In 2023, CySEC carried out more than 700 on-site and remote inspections of supervised entities, resulting in over $2.2 million in fines. These thematic audits were conducted to ensure regulatory compliance and safeguard investors' interests.