Is timing really everything when it comes to trading FX? It's an age-old question in any type of trade, but in today's fast-moving FX markets, understanding this is more important than ever.

The First and Last Hours

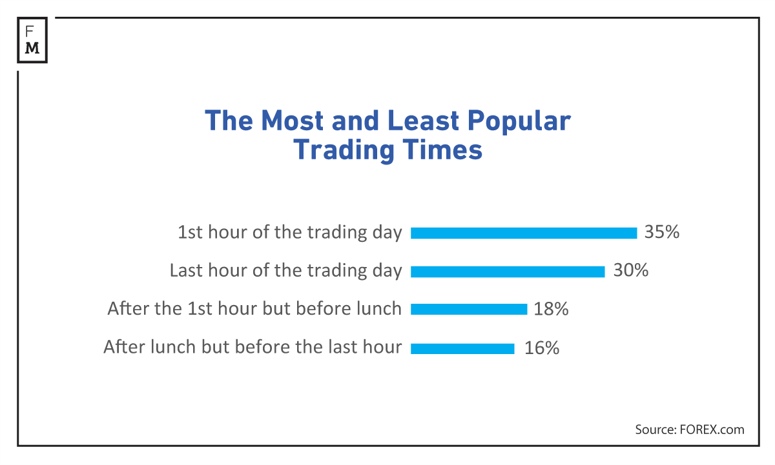

A survey of 3,000 traders conducted by FOREX.com earlier this year - our coverage of which you can dig into here - underlined the importance of the first and last hours of the trading day for FX traders. No surprise there.

Stefano Gianti, education manager at Swissquote notes that intraday traders frequently exit their positions to secure profits considering market direction. In some cases, this is also done to avoid negative swaps - particularly on Wednesdays when charges for several currency pairs are tripled.

According to Alex Kuptsikevich, senior analyst at FxPro, trends do not unfold intraday very often though as there is usually some defining mood formed either by the end of the US session or Asia’s trading performance.

“For the most part, the markets remain within this trend until the news from the US although not everyone is ready to transfer market risks to the next day and beyond,” he says. “Traders often prefer to avoid a fee for carrying a position to the next day, especially over the 18 months during which time central bank rates stopped being zero in the US, UK and euro area, leading to higher rollover fees.”

However, Michael Boutros, senior technical strategist at FOREX.com urges traders to look beyond daily timing patterns to take account of seasonal trends that could lead to reduced trading volumes and increased market volatility .

Adam Button, chief currency analyst at ForexLive observes, FX trading gravitates towards economic data which tends to be released early in the day, while trading at the end of the day is often about position squaring and risk mitigation by traders who prefer to finish the day without positions on

Time Zones and Public Holidays

By utilizing data on the impact of public holidays or seasonal trends, for example, traders can enhance their strategies by precisely timing their trades to coincide with periods of increased liquidity and volatility suggests Kate Leaman, chief market analyst at AvaTrade.

“Moreover, understanding the impact of public holidays and seasonal trends allows traders to anticipate potential shifts in market sentiment and periods of lower liquidity,” she adds. “For instance, trading volumes typically decline during major holidays, which can lead to unexpected volatility or lack of movement, impacting trade execution and risk management. As such, awareness of these factors is imperative for effective trade execution.”

It is important to note that the G10 FX market trades from the Monday open in Auckland all the way through to the Friday close in New York and that there isn’t really a ‘start’ and an ‘end’ to the trading day, though individual trading centers come on and off line as the day progresses.

"It is unsurprising that traders often seek to trade when these sessions overlap, particularly during the London-New York overlap, as this is typically when liquidity is at its best and trading volumes are at their highest,” says Michael Brown, market analyst at Pepperstone. “As the below EUR/USD chart may help to evidence, hourly trading ranges also tend to be greater during these periods - an obvious attraction for short term traders.”

When it comes to using this information there are a few factors to consider. Seasonal trends are a matter of frequent debate as to their effectiveness and utility, with some market analysts suggesting that they are only worth following if they can be combined with other factors (such as fundamental/technical analysis or positioning) to formulate a trade idea.

“As for public holidays - particularly as we approach the Christmas period - capital preservation is likely to be key for the majority of traders, who will be seeking to hold onto the gains that they have already made this year by treading carefully (reducing position sizes) as volumes typically thin out into year-end,” observes Brown.

Busy Periods

David Morrison, senior market analyst Trade Nation agrees that despite the fact that we now have apparently ‘seamless’ 24-hour trading, the FX market is busier than usual during the switchover between Asia Pacific/European-London/US-New York sessions.

“I would recommend making sure that you are aware of the exchange opening and closing times for the financial instruments you are trading,” he says. “I don’t know if one can build a successful trading strategy around such information. But at such times traders may be able to benefit from greater liquidity, although it is dangerous to rely on this as liquidity can dry up without warning.”

Covering FX Risk

Michael Quinn, group trading manager at Monex Europe says his clients have real-world requirements to cover FX risk, which means their trading patterns tend to be defined by underlying commercial requirements.

“That said, we do see a tendency for clients to trade higher volumes of their flow in the morning of their working day, a pattern that is repeated across all jurisdictions,” he says. “Alas, the currency markets we mainly operate in are so liquid that even detailed insight into corporate commercial flow generally provides little benefit to speculative FX traders.”