The Financial Conduct Authority (FCA ) is keeping a close eye on trading apps due to concerns that certain digital engagement practices (DEPs) may be encouraging excessive risk-taking among investors, according to the results of a recent online study.

FCA Scrutinizes Trading Apps over Gamification Concerns

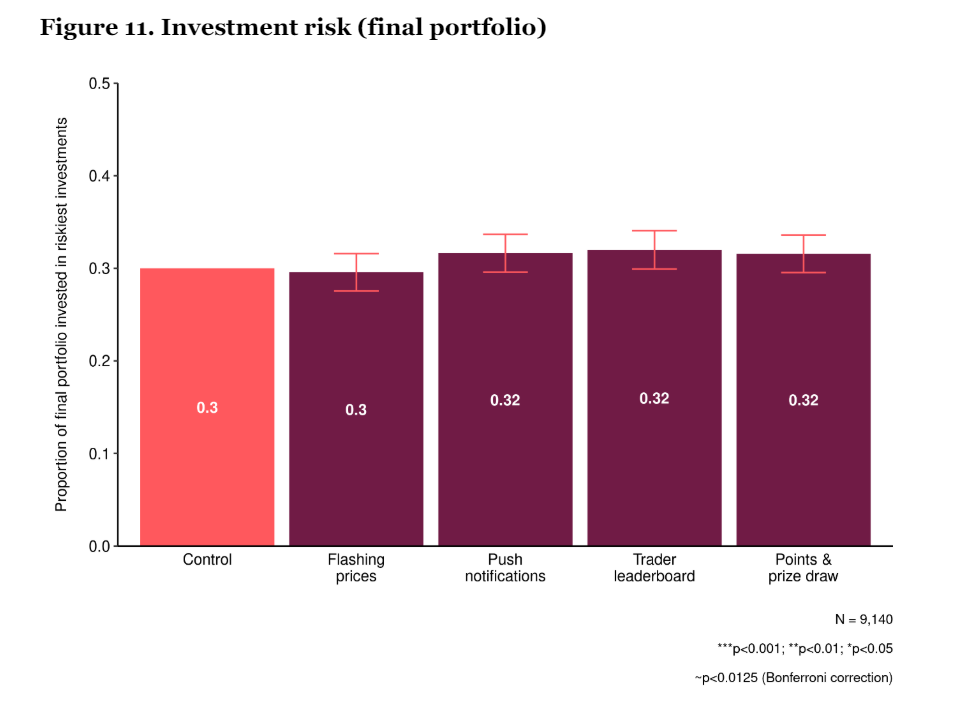

The FCA constructed an experimental trading app platform to test the impact of various DEPs on trading behavior. The study, which involved over 9,000 consumers, found that features such as push notifications and prize draws can lead to more frequent trading and riskier investment decisions by 11% and 12%, respectively. Additionally, these gamification strategies increased the proportion of trades in risky investments by 8% and 6%.

The regulator also discovered that DEPs had a more significant effect on certain subgroups, including those with low financial literacy, women, and younger participants aged 18-34. Under the FCA's Consumer Duty, trading apps are required to design and test their services to ensure they meet consumers' needs and allow them to make well-informed investment choices.

"Trading apps have the potential to transform retail investments, but some in-app features might be pushing consumers towards more frequent or riskier trading, which isn't right for everyone," said Sheldon Mills, Executive Director of Consumers and Competition at the FCA. “With usage and popularity of trading apps growing, we’ll be keeping them under review to ensure customers can make investment decisions that suit their needs.”

Gamification Becomes a Growing Concern

The FCA initially cautioned stock trading apps to review game-like design elements in 2022 before the implementation of the Consumer Duty. With these apps' growing popularity, the regulator plans to continue monitoring them to ensure customers can make suitable investment decisions.

Gamification in trading refers to using game-like elements in trading platforms and investment apps to engage users. This approach incorporates features such as push notifications, competitions, rewards, and levels that are commonly found in games, aiming to make the trading experience more interactive.

However, It can encourage overtrading or prompt users to take unnecessary risks due to the game-like environment that might downplay the real-world financial risks involved.

In addition to the app review, the FCA is also educating consumers about making better investment choices through its InvestSmart campaign and has recently brought charges against “finfluencers” promoting financial products on social media.

The issue is serious, as studies indicate that retail investors trust financial influencers more than their family, friends, or economic experts. One in three respondents surveyed by CMC Markets in April reported that popular financial influencers most impact their trading decisions.