The Cyprus Securities and Exchange Commission (CySEC) has announced enforcement measures against local investment firm Triumph Int. (Cyprus) Ltd, the operator of the TriumphFX trading brand, due to concerns over the influence of its sole indirect shareholder, Chong Chun Hseung.

CySEC Takes Action against TriumphFX Operator

In a statement released on 21 December, CySEC said it has suspended Hseung's voting rights, exercised through the firm's direct shareholder CCH Triumph Cyprus Trust. The regulator has also prohibited Triumph's executive directors, Christoforos Christoforou and Joel Prakash Benedict, from performing management duties for two years.

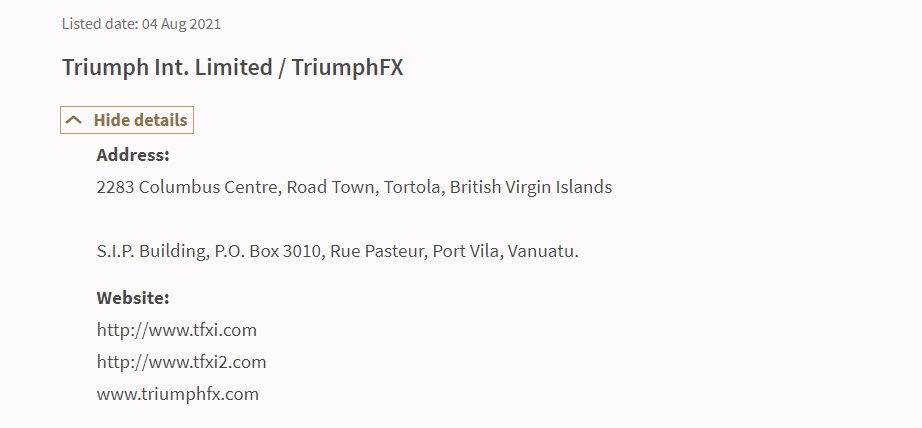

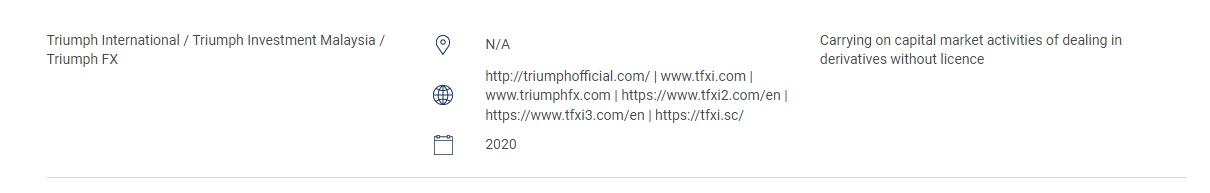

These actions are linked to TriumphFX and other associated companies being named on investor alert lists by regulators in Singapore and Malaysia. According to CySEC, Hseung's influence over Triumph is seen as detrimental to the sound and prudent management of the firm.

The measures will come into effect after two months and remain until Triumph FX and related entities are removed from the investor alert lists in the foreign jurisdictions. The company can seek a judicial review of CySEC's ruling.

Interestingly, TriumphFX has been on the Singaporean MAS warning list for over two years, specifically since 4 August 2021. It was added to the Malaysian regulatory commission's list even earlier, in 2020.

CySEC said its decision aims to address the situation and protect investors. The regulator has powers under local legislation to take such enforcement actions when it deems management issues, or shareholder influence are undermining licensed investment firms.

Also this week, CySEC informed it is searching for experts specializing in identifying potential regulatory violations. The regulator has posted a new public tender, seeking two experts in the undertaking, valued at €240,000.

Justification for CySEC’s Enforcement Measures

Although the English document from CySEC did not provide additional details, the original Greek statement outlined the factors considered when determining enforcement actions against Triumph. The regulator views the influence of shareholders as a potentially serious issue that could undermine investment firms, and local legislation provides authorities the power to address such situations.

Suspending Hseung's voting rights as the ultimate beneficial owner removes his decision-making ability over the company. Prohibiting the executive directors he appointed from management duties similarly limits his influence over operations. CySEC sees these measures as effectively targeting the problematic shareholder influence while allowing Triumph the time to address the outstanding investor warnings.

The two-month implementation timeframe allows the firm to seek removal from the Singapore and Malaysia alert lists. In essence, CySEC has deliberately targeted mechanisms through which Hseung exercises control to incentivize the resolution of these alerts. The agency states that this approach safeguards sound governance and prudent management of the regulated entity.