Unregulated trading venues will never disappear as long as there are traders willing to swap consumer protections for high leverage and lower fees. The challenge for regulated platforms with significant compliance costs is to convince these traders that the risks outweigh the perceived advantages.

In September, the Foreign Exchange Professionals Association (FXPA) published a white paper on trading venues operating in OTC FX derivatives markets. It cautioned that the benefits of trading on unregulated FX derivatives venues may come at the expense of reduced customer protections.

Many traders opt for unregulated platforms due to perceived advantages around cost, legacy connectivity, or flexibility. However, the risks associated with unregulated trading venues are far from theoretical.

Traders Ignore Regulatory Warnings

Warnings from regulators and industry bodies are often dismissed on the basis that they refer to events that might happen rather than actual incidents. However, the likes of YoutradeFX and IronFX serve as a warning to traders who think it couldn’t happen to them.

“There have been numerous cases where traders suffered significant losses,” observed Patrick Bartle, managing director LMAX Exchange. “These venues often lack proper oversight and safeguards, leading to situations where traders may find themselves without recourse when issues arise.”

Regulations are not just red tape—they are there to protect customers from fraud, shady practices, and overly risky trades that could seriously impact their funds, said Gerard Melia, head of FX sales at StoneX.

“In addition, regulations help keep the market steady, block financial crime, and make sure everyone has fair options,” he continued. “Unregulated platforms don’t have any of this oversight, so if something goes wrong, the customer is left without a safety net.”

In light of the above, Melia reckons choosing an unregulated FX derivatives trading platform is a bizarre move when regulated platforms already offer a wide selection of spreads, leverage options, and diverse products across multiple regulated jurisdictions.

But Alexander Kuptsikevich, chief market analyst at FXPro acknowledges that regulation tends to come with severe restrictions on leverage and initial capital. In addition, regulators often prohibit the provision of exotic instruments to retail clients, limiting the offering of regulated brokers to a narrow range of the most popular instruments.

The FXPA paper also warned that unregulated FX derivatives trading platforms introduce the possibility of regulatory arbitrage for FX markets.

“Brokers are looking to increase the number of licenses, often going to relatively easy jurisdictions to compete with other brokers in emerging markets,” he added. “In developed markets, strict compliance and regulatory rules prevent brokers from providing what active clients in much of the world—particularly in Asia—need.”

Kate Leaman, Chief Market Analyst at AvaTrade refers to an increase in the number of unregulated FX derivatives platforms popping up to take advantage of gaps in regulatory frameworks, particularly in jurisdictions with lax enforcement or where there is limited cross-border oversight.

The rise of cryptocurrencies and decentralized finance has made it easier for these platforms to operate under the radar. They sometimes even offer anonymous trading, which appeals to a certain type of customer but also magnifies the risks involved.

“We have seen new entrants providing FX derivatives where their regulatory status is unclear,” said Nicolas Jegou, CEO of Euronext FX. “Most operate as a technology partner in their offering.”

PlusToken Scam Pointed to the Massive Risk

Leaman points to the risk posed by hybrid crypto-FX platforms such as PlusToken, whose organizers withdrew in excess of $3 billion in Bitcoin and other cryptocurrencies in June 2019 and informed investors that they had ‘run.’ “With crypto's growth, some unregulated FX platforms now mix crypto and FX products,” she said. “The PlusToken Ponzi scheme caught out many unsuspecting investors who thought they were trading legitimate crypto-FX products.”

Cryptocurrency has become a major focus for criminal activities, whereas the regulatory framework for FX in most developed economies has significantly fewer gaps. That is the view of Filip Kaczmarzyk, head of trading at XTB, who agrees that the cryptocurrency market remains relatively new and unregulated, which has led to a rise in fraud.

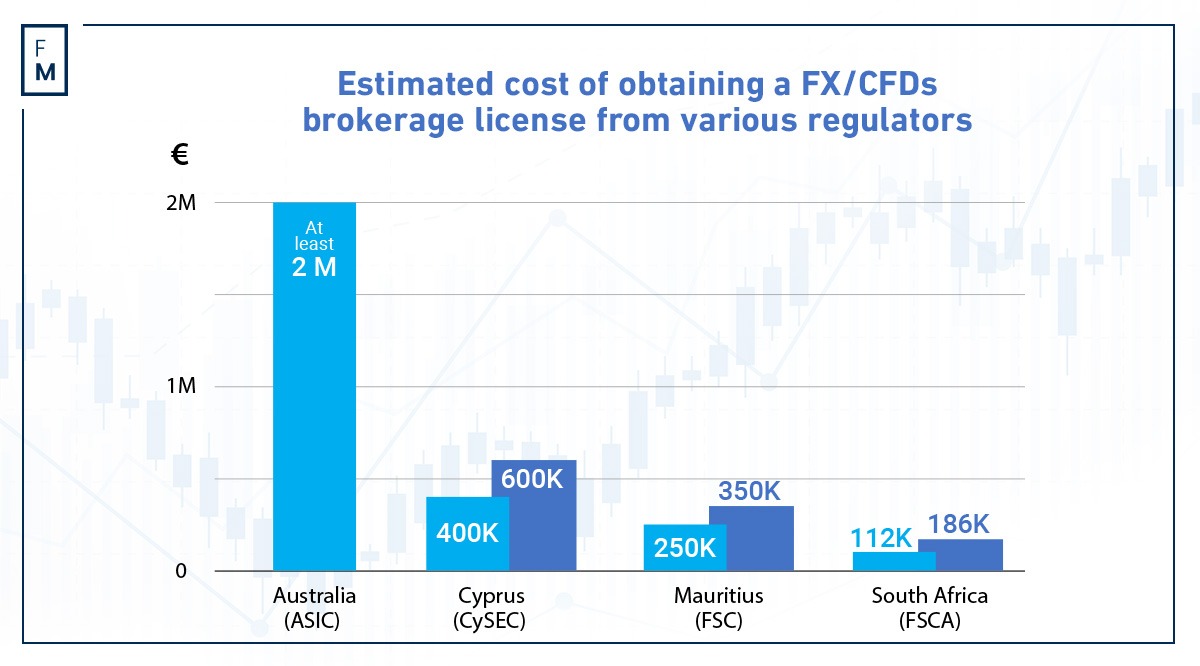

Internal analysis conducted by one FXPA member concluded that operating a single regulated FX derivatives trading venue costs between $1.3 million to $1.5 million per year. That figure would obviously be higher for an entity operating more than one regulated platform.

“Running a regulated FX derivatives trading venue comes with significant costs, from initial capital and advanced technology to operational overheads, skilled personnel, and physical infrastructure,” said Melia. “The most effective approach is to treat a regulated venue as a high-value asset, justifying these investments for the benefits of stability and market trust.”

Rising Costs Forcing Brokers to Surrender Licenses

Melia acknowledges that the industry has witnessed an unusual trend of some trading venues surrendering their regulatory status over the last 18 months or so, largely due to the rising expenses associated with maintaining these standards.

Leaman agrees that the financial commitment is not insubstantial, adding factors such as registration fees, legal consultations, capital adequacy requirements, and maintaining ongoing oversight relationships with the relevant regulators to the list of expenses.

“Then you need to ensure that your platform meets the high standards of transparency, reporting, and client fund segregation that regulatory bodies demand,” she said. “This can amount to millions of dollars depending on the jurisdiction and the size of the operation.”

Entering a saturated market comes with significant costs, primarily due to the need for investments in technology and human capital, said Kaczmarzyk.

“Additionally, the products offered are often homogeneous—making it challenging for companies to differentiate themselves from other venues,” he added. “As a result, these companies tend to invest heavily in marketing.”

Furthermore, operating within a market-maker model requires substantial capital to maintain open positions and earn a profit, he explained.

Finance Magnates contacted a number of unregulated FX derivatives trading venues in relation to this article but none were willing to discuss the issues raised.