The last month of the third quarter proved to be the worst for six registered retail forex (FX) brokers operating in the United States. According to the latest data from the Commodity Futures Trading Commission (CFTC) published this week, the value of client deposits fell to $516.3 million, the lowest in Q2 2023.

CFTC Data Shows FX Deposit Decline

According to CFTC regulations, every retail foreign exchange dealer (RFED) and futures commission merchant (FCM) must report monthly financial positions to the commission, including adjusted net capital, customers' assets, and the total amount of retail forex obligations.

Retail forex obligations represent the total amount of funds held by an FCM or RFED, which is the sum of all money, securities, and property deposited by a retail forex customer into one or more retail FX accounts, after adjustments for realized and unrealized net profit or loss.

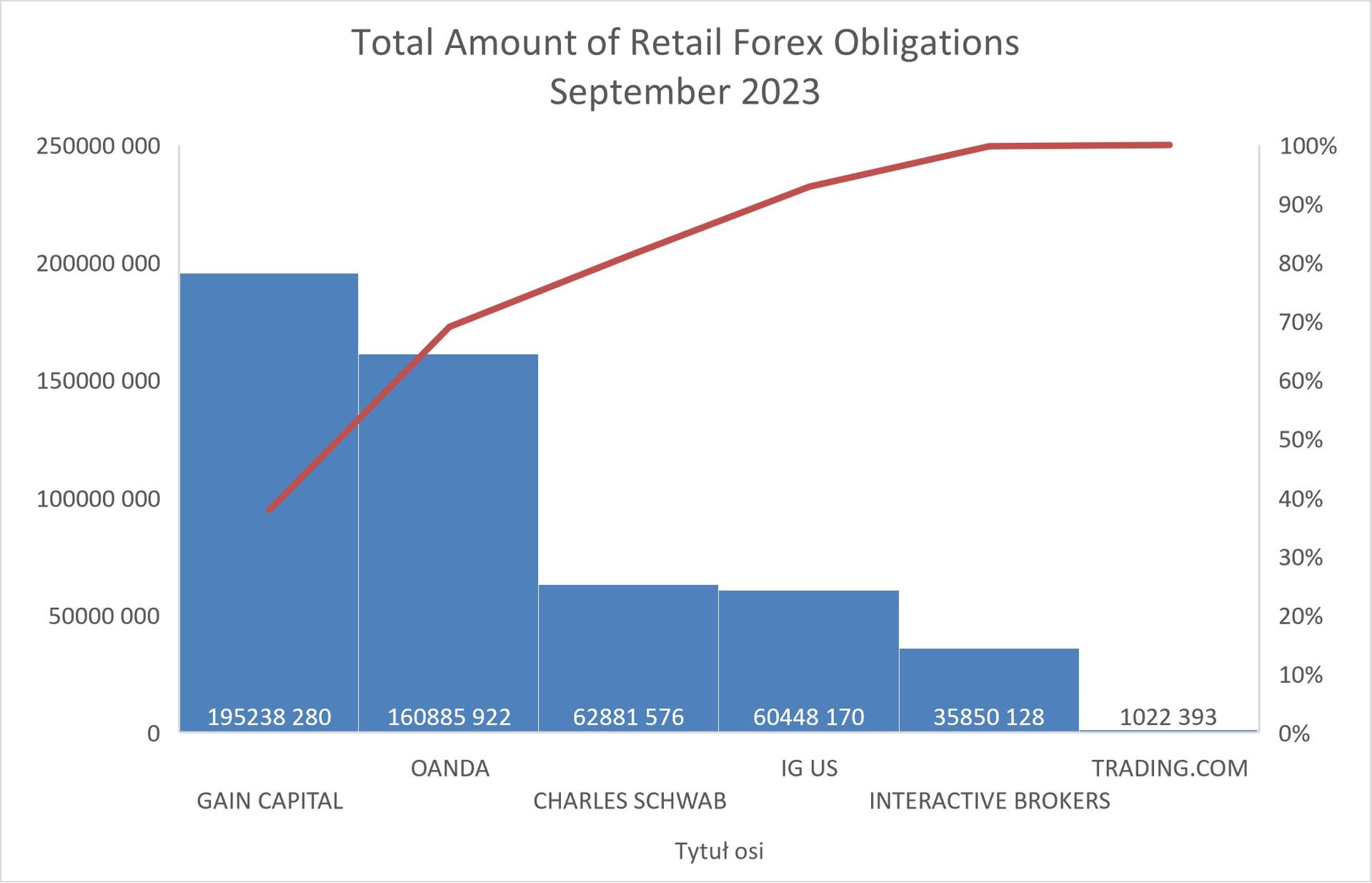

Out of 62 registered FCMs and RFEDs, six firms disclose data on obligations. The largest position is held by Gain Capital, with deposits valued at over $195 million. In second place is Oanda, with $161 million; in third place is Charles Schwab, with just under $63 million. Following in order are IG US ($60 million), Interactive Brokers ($36 million), and Trading.com ($1 million).

The market share remains relatively unchanged compared to previous months, but the total amount of retail forex obligations has decreased to the lowest quarter levels. In July, it was $518.5 million, and in August $525 million.

Despite a month-over-month decline of over 1.5% to $516 million, compared to September of the previous year, the indicator recorded a growth of 5.5%, rebounding from $489.6 million.

How Have Individual Brokers' Results Changed?

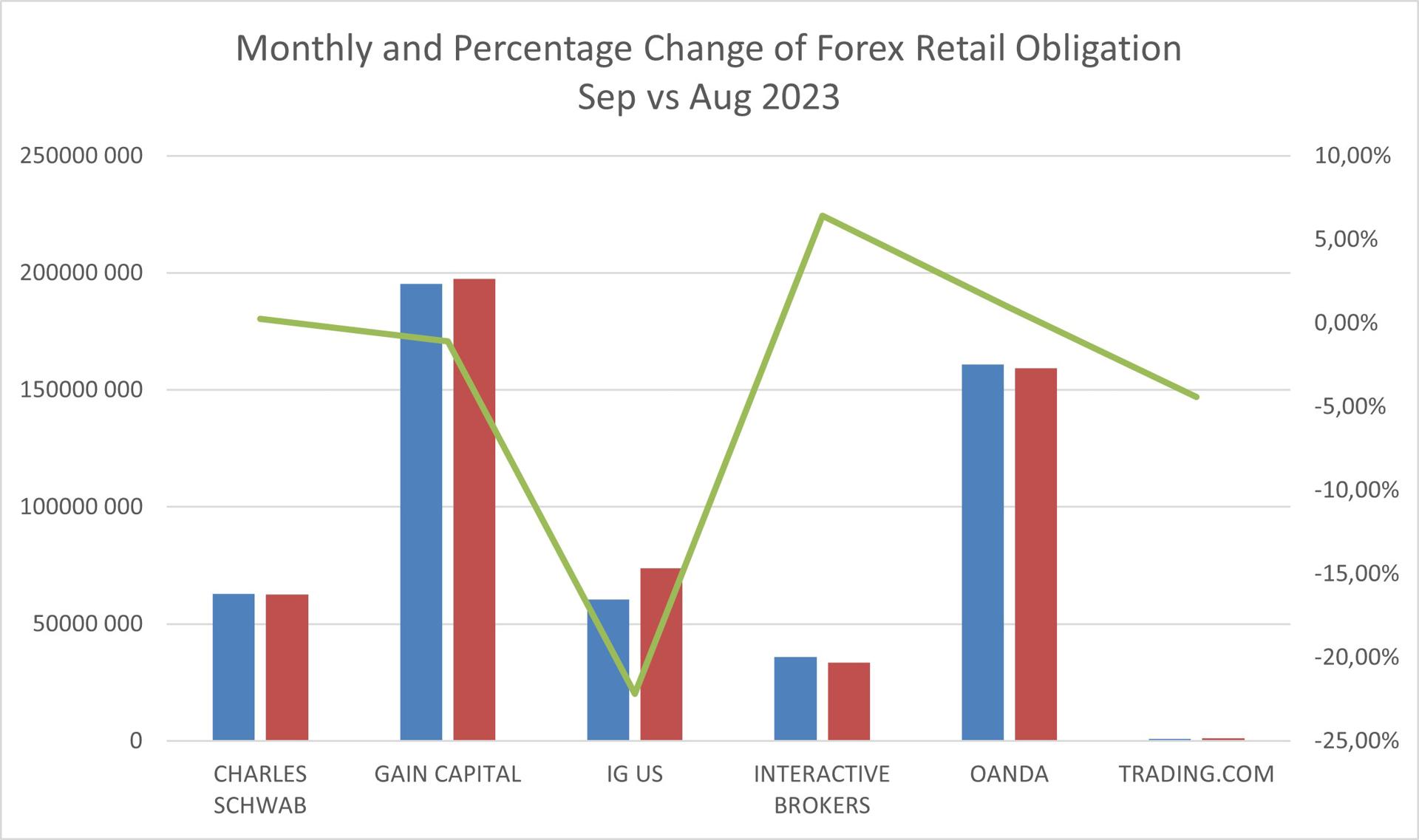

Three firms recorded declines in FX deposits, although, for Gain Capital, they were minimal. Trading.com lost 4.5%, while the results of IG US fell the most, with a loss exceeding 22%, or nearly $7 million.

On the gaining side, Charles Schwab and Oanda reported marginal gains below 1%, while Interactive Brokers increased their retail forex funds by nearly 6.5%, or about $2 million.

Finance Magnates independently researches retail investor trends. Employing CPattern's insights, we showcase our metrics by tracking historical shifts in average deposits, average withdrawals, and initial deposits. The most recent study highlighted a peak in deposit activity not seen in the preceding months.