Revolut Receives The UK Banking License after 3 Years of Efforts

Fintech giant Revolut finally obtained its long-awaited UK banking license this week, marking a significant turning point for the London-based company after a three-year application process. The Prudential Regulation Authority granted the license with restrictions, a common practice for new entrants to the UK banking sector.

This status allows Revolut to build out its banking operations before a gradual full-scale launch. This approval comes after Revolut addressed several regulatory hurdles, including concerns about its financial reporting. The company recently received an unqualified audit opinion from the UK’s accountancy advice firm BDO, resolving previous issues related to revenue recognition and IT systems.

Revolut Becomes a UK Bank, but What Does a 'Mobilisation' Stage Mean?

it is important to note that Revolut's license is currently in the “mobilization” stage, also referred to as “Authorisation with Restrictions.” Many new banks, including challenger banks like Monzo, Starling, Atom Bank, Zopa Bank, GB Bank, and Kroo, have reportedly gone through a similar “mobilization” stage.

In the mobilization state, one of the major restrictions on the banking license recipient is the £50,000 annual deposit limit by customers. Revolut plans to circumvent these restrictions by continuing to offer services to UK residents under the existing e-money institution license authorized by the Financial Conduct Authority.

Revolut said it received a preliminary British banking license from regulators https://t.co/OgNo2S7BvW

— Bloomberg UK (@BloombergUK) July 25, 2024

IG Group’s FY24 Profit Plummets: Sides £150M for New Share Buyback Program

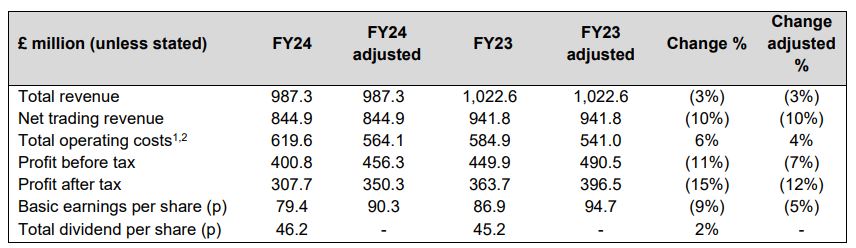

IG Group Holdings ended its fiscal year 2024, which concluded on May 31, with a pre-tax profit of £400.8 million, an 11% YoY drop, while the adjusted figure declined 7% to £456.3 million. Factoring in taxes, the company netted £307.7 million in profits, a 15% decline, while the adjusted figure dropped 12% to £350.3 million.

Interestingly, IG expanded its share buyback program, allocating an additional £150 million to it, which is expected to be completed by January 31, 2025. The London-headquartered company had a total annual revenue of £987.3 million, a 3% YoY decrease. The broker's annual net trading revenue also declined 10% to £844.9 million due to reduced trading activities.

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets released its first-quarter results for fiscal year 2025, where it described its performance as in line with management expectations. The firm mentioned that it is currently on track to achieve its projected net operating income of £320–360 million for the full year.

In the latest update, CMC Markets highlighted consistent progress on its institutional and business-to-business strategy, including a recent partnership with Revolut. The initial onboarding of Revolut clients has begun, and some are reportedly actively trading on the platform.

Alpha Group’s H1 2024 Revenue Jumps 16%

Alpha Group International released its trading update, revealing that it generated £64 million in group revenue, a 16% yearly jump, in the first six months of 2024. Out of the total, corporate revenue came in at £30 million, an increase of 12%, while institutional revenue jumped by 15% to £33 million.

When it comes to the total income, it came in at £107 million, a jump of 19% from £90 million in the first six months of 2023. The total income was also boosted by an additional £42 million in net treasury income. The average client balances increased by 16% to £2.07 billion.

UK’s FCA Gives Green Light to Kuwait-Based Broker NCM

NCM Investment, a financial brokerage firm headquartered in Kuwait, was licensed by the Financial Conduct Authority (FCA). According to the company, this authorization indicates that it meets the FCA's standards for financial operations and consumer protection.

NCM Investment was established in 2009. The company specializes in financial instruments, including FX, commodities, precious metals, CFDs, and related products.

F1 Racing Legend Shifts Gears to Financial Markets with CFI Deal

Online trading provider CFI announced a multi-year partnership with seven-time Formula 1 world champion Lewis Hamilton, naming him as its new global brand ambassador. According to a press release, CFI has entered into a multi-year partnership with Lewis Hamilton, who has been competing in the Formula 1 World Championships since 2007, currently for the Mercedes AMG Petronas Team.

As part of this collaboration, CFI will be able to use Hamilton’s presence in its marketing materials. Additionally, the broker made a donation to Mission 44, a foundation run by Hamilton aimed at building a more inclusive future for young people.

Blueberry Markets Is the Latest CFDs Broker to Launch Prop Trading Platform

Blueberry Markets, a forex and contracts for differences (CFDs) broker that previously provided services to many prop trading firms, launched a prop trading service under the brand Blueberry Funded.

Although Blueberry Funded's website is now live, it is yet to show any details of the services to be offered. It only displays a countdown of more than 12 days, which might be for the platform's launch.

Spot Ether ETFs to Start Trading Today Amid SEC’s Final Approval

The Securities and Exchange Commission (SEC) gave the final approval to spot Ethereum exchange-traded funds (ETFs), which will follow the listing and trading of these instruments on three American exchanges.

The final stamp on the S-1 registration forms of the spot Ethereum ETF issuers came two months after the regulator approved the listing of the crypto instruments on the Nasdaq, New York Stock Exchange, and Chicago Board Options Exchange.

WazirX $230M Crypto Hack Shakes India's Crypto Scene: “Horrifying Situation”

A recent security breach at WazirX, resulting in a staggering $230 million loss, sent shockwaves through India's cryptocurrency ecosystem. This incident has led to intense scrutiny of current security practices and crucial discussions about safeguarding digital assets in an increasingly risky environment. Users are concerned about the ease with which fraudsters can manipulate exchanges.

The incident ranks among the major hacks in the history of crypto exchanges and has left the crypto community pondering how easily fraudsters can manipulate crypto exchanges. One X user named Chandrashekhar wondered how “hackers can withdraw funds from the exchange, but legitimate exchange users cannot withdraw their own tokens or hold them in self-custody.”

The irony with Indian 🇮🇳 exchanges is that hackers can withdraw funds from the exchange, but legitimate exchange users cannot withdraw their own tokens or hold in self custody. WTH. @CoinDCX @WazirXIndia @WazirXCares @CoinSwitch #BTC #WazirXhacked #Wazirx @cryptoamanclub pic.twitter.com/PwFGNBN8cG

— Chandrashekhar B (@shekharbhujbal8) July 19, 2024

FCA Penalizes Coinbase's CBPL £3.5 Million for Violating High-Risk Customer Restrictions

CB Payments Limited (CBPL), part of the Coinbase Group, operates a global cryptoasset trading platform and was fined £3,503,546 by the Financial Conduct Authority (FCA) for breaching a regulatory requirement. The fine resulted from CBPL's failure to comply with a rule that prevented it from offering services to high-risk customers.

While CBPL itself does not handle cryptoasset transactions, it facilitates customer access to these transactions through other Coinbase Group entities. The firm is not registered for crypto asset activities in the UK.

Largest Bitcoin Miner on Wall Street Ordered to Pay $138 Million

Lastly, Marathon Digital Holdings, Inc., the largest Bitcoin mining company by market capitalization, was ordered to pay $138 million in damages this week following a unanimous jury verdict in a breach of contract lawsuit.

🚨JUST IN: A federal court jury *unanimously* ruled in favor of Michael Ho against $MARA @MarathonDH for $138M after finding that MARA breached a non-disclosure/non-circumvention agreement.

— RexFinance (@Rex_Finance) July 20, 2024

Not good. If you cut corners you end up getting cut yourself. https://t.co/v1S2YoXbpp

The verdict, issued in a federal court, concluded that Marathon had breached a non-disclosure, non-circumvention agreement with Michael Ho, the Chief Strategy Officer of Marathon's direct competitor, Hut 8.