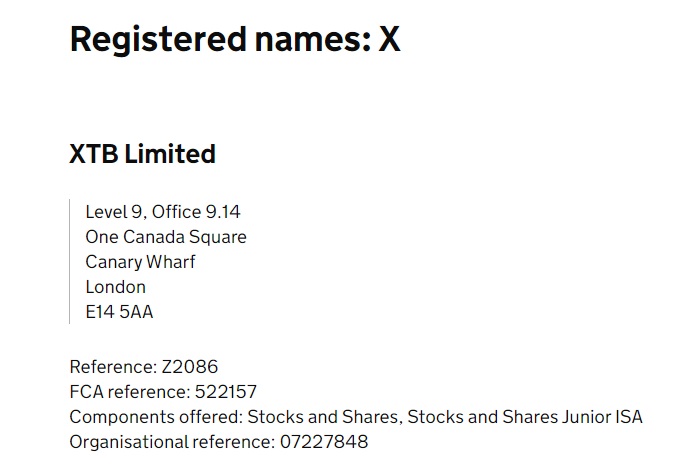

Just under three months after officially announcing its plans to enter the UK Individual Savings Accounts (ISAs) market, XTB has joined the ranks of registered managers authorized to offer this type of retail investment product, entering a market valued at £400 billion.

Finance Magnates learned that the Polish-based publicly-listed fintech (WSE: XTB) plans to offer its first ISA products in the UK by this autumn.

XTB Expands Beyond CFDs, Enters New Market in the UK

During the February earnings conference following the 2023 report, XTB CEO Omar Arnaout revealed that after debuting its first offering for future pensioners in Poland, XTB aims to enter the highly competitive market of tax-exempt investment products.

The UK ISA market serves 27 million people and holds £400 billion in stocks and share savings accounts. British citizens can invest up to £20,000 annually through their ISAs without tax obligations .

XTB, whose main KPI is the continuous expansion of its customer base, decided to obtain a license for this market, moving beyond its standard CFD offering. Initially focusing on stocks and then passive investing through ETFs, XTB is now gearing up for ISA offerings.

"As part of our commitment to broadening our investment and savings product range, I’m pleased to say our ISA licensing application has been approved by HMRC," Joshua Raymond, Managing Director at XTB UK, commented for Finance Magnates in an e-mailed statement.

He revealed that UK retail investors should expect the ISA offerings from XTB to be available around the third quarter of this year. "We are aiming to launch our ISA product to UK clients at the start of Autumn," Raymond added.

XTB UK Builds Client Base

In 2023, XTB increased its active client base to 312,000, and in 2024 it boasted of surpassing one million users. This was possible partly due to significant growth in the UK, where the number of active clients increased by 93% last year.

Although the scale of XTB UK's operations is still modest compared to the entire fintech , as the British branch generated a revenue of £4.7 million in 2023. However, entry into the ISA market is expected to change this.

"The UK ISA market has 12 million new subscriptions every year, constituting a significant opportunity for the business. Our entry into ISA accounts would mark yet another milestone for our products rollout in the UK, to complement what is already a broad offering which includes ETFs, stocks, Investment Plans, and CFD products," concluded Raymond.

XTB's expansion is not limited to the UK alone. At the end of March, the company also announced the acquisition of Indonesian broker Eagle Capital Futures, which is set to "become a Gateway to Asia."