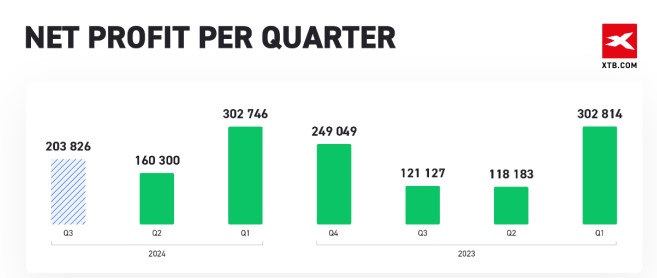

XTB released its preliminary and operating financial results for the third quarter, highlighting growth in client acquisition and profit during the period. The publicly listed Polish fintech company attracted over 108,000 new clients, a 60% increase year-over-year. It also reported a consolidated net profit of PLN 203.8 million, nearly doubling its earnings from the previous year.

Revenues and Profits

XTB's financial results for Q3 2024 revealed a consolidated revenue of PLN 470.2 million, marking a 67.3% increase compared to the same quarter in 2023. The firm attributed the significant revenue growth to heightened market volatility observed in July and August, which reportedly facilitated sustained trading activity.

Additionally, the active client base surged 68.7%, reaching 474,100 individuals. The volume of CFD transactions dipped slightly to 1,912,400 lots, down from 2,011,500 lots in the same period last year. However, profitability per lot increased, rising from PLN 140 to PLN 246.

XTB’s revenue mix further showed a shift in trading interests, with CFDs based on indexes now contributing 44.9% of total revenues, a significant jump from 25.4% the previous year. This shift reflected the rising profitability of indices like the US 100, German DAX, and US 500.

Operating Expenses

Operating expenses in Q3 2024 increased to PLN 208.5 million, a rise of PLN 43.5 million from the previous year. Key areas of expenditure included salaries, marketing, and commissions paid to payment service providers. The management board anticipates operational costs may rise by approximately 20% throughout 2024, driven by ongoing client acquisition efforts and geographical expansion.

The company aims to maintain its trajectory by acquiring an average of 65,000 to 90,000 new clients quarterly. With a total of 129,700 new clients in Q1, 102,600 in Q2, and over 108,100 in Q3, XTB is well-positioned to meet its ambitious targets.

XTB's management board reportedly plans to recommend dividend payments between 50% to 100% of the standalone net profit, contingent upon factors such as future profitability and capital adequacy ratios. As of Q3 2024, XTB's total capital ratio stood at a notable 207%, indicating a strong capacity to manage risk while fostering growth.