XTB (WSE: XTB), a Polish forex and CFDs brokerage group, published a robust financial report for the third quarter of 2022, reporting a net income of PLN 258.743 million. Tuesday's figures confirm the preliminary data published in late October and once again strengthen the broker's position on the Warsaw Stock Exchange. The share's price has returned to pandemic highs and is only 2% away from a new all-time record.

According to the company's final quarterly numbers, the total operating income stood at PLN 391.289 million, raising PLN 191.260 million compared to the same quarter a year earlier. Total operating expenses were also higher; however, not enough to negatively affect the net profit of PLN 236.219 million. Compared to the PLN 104.305 million profit reported last year, the numbers increased significantly by 126%.

From the beginning of 2022, XTB acquired 142,825 new clients, compared to 146,427 a year earlier. While it is a slight decrease, the number of active clients stood at a record high, reaching 224,300, compared to 160,600 a year earlier. It translates to a 39.7% year-over-year (YoY) increase.

"The ambition of the Management Board in 2022 is to acquire, on average, at least 40 thousand new clients quarterly. As a result of the implemented activities, the Group acquired in the first quarter of this year 55.3 thousand new clients and in the second quarter of this year nearly 45.7 thousand new clients, while in the third quarter of this year, almost 44.8 thousand new clients. In turn, in October 2022, XTB acquired 17.6 thousand new clients," the company stated in the financial report.

XTB Shares Touch a 28-Month High

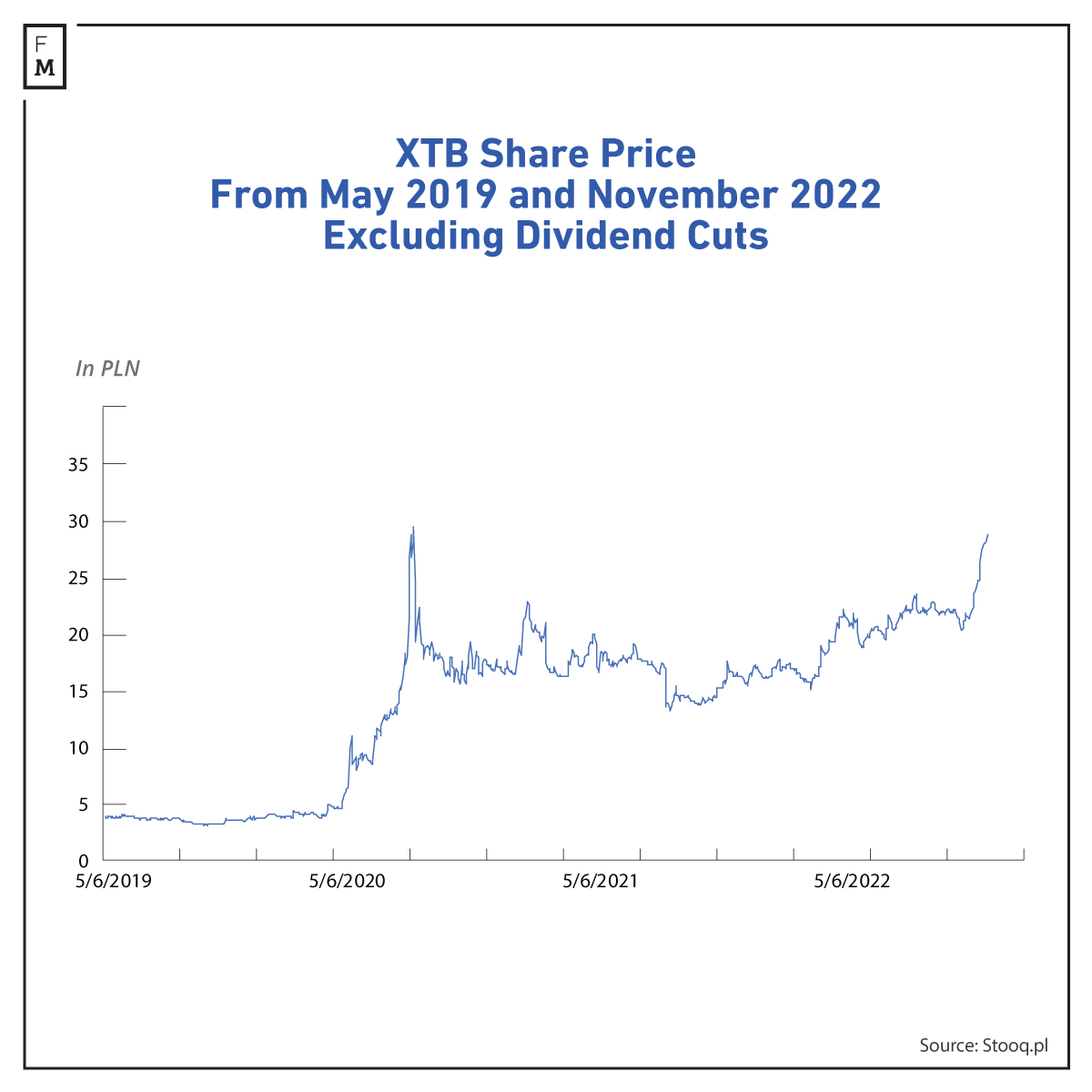

A report confirming preliminary results released in October caused XTB shares to rise for the fourth straight session on Tuesday. The intraday maximum was drawn at PLN 28.80, testing its highest levels since July 28, 2020. Back then, investors paid PLN 29.30 per share; currently, we are less than 2% away from a new all-time record.

XTB's shares have gained nearly 800% since the pandemic's beginning, while in 2022 alone, the shares are up by 67%. By comparison, another publicly traded broker, , has gained less than 200% since the pandemic low almost three years ago and is up 35% this year. is losing 4% year-to-date (YTD) and has gained 50% since March 2020.

"The development of technology makes investing more and more accessible and common. That is why we constantly modify our offer and introduce changes to it, which are to increase the interest in our services for both new and existing customers. Additionally, we intensified our advertising campaigns using brand ambassadors. With all this, we are strengthening our position on the market of global investment companies every quarter," Omar Arnaout, the CEO of XTB, said.