The Management Board of the publicly-traded broker XTB announced that it recommends paying a dividend of over PLN 590 million ($146 million) per share, which is historically the highest portion of profit distributed among shareholders.

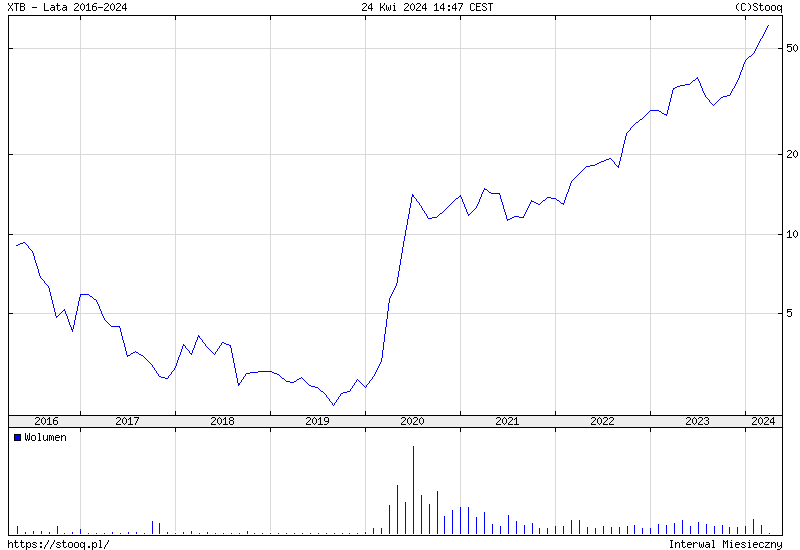

In response to the news, XTB's shares on the Warsaw Stock Exchange (WSE) tested historical highs on Wednesday.

75% of XTB’s 2023 Profit Allocated for Dividend

According to information published by the company this week, the Management Board of XTB adopted a resolution recommending the allocation of 75% of the company's net profit for 2023, amounting to PLN 787 million ($195 million), for dividend payment. The remaining part, PLN 197 million ($49 million), will supplement the company's reserve capital.

"The Management Board of XTB proposes a dividend record date of 5 June 2024 and a dividend payment date of 20 June 2024," the XTB statement read.

This means that XTB will pay PLN 5.02 ($1.24) per share, which gives a dividend yield of 7.2%. However, this yield is lower than in the previous year due to the strong increase in the share price on the WSE.

XTB's shares grew by nearly 22% last year and are already growing over 60% this year. The information about the dividend payment triggered another growth impulse, and on Wednesday, the shares briefly gained almost 2%, setting a new historical high at PLN 62.30.

However, the good streak does not only concern XTB itself. Plus, 500 shares on the LSE have been growing 30% since the beginning of the year, and historical highs, around 2200 pence per share, have also been tested.

Net profit is not the only factor contributing to investors' confidence in XTB. Primarily, it is the continuous increase in the number of clients and plans for product and geographical expansion.

XTB Has over One Million Clients

XTB, which no longer wants to be associated as an FX/CFD broker but as a "global fintech," certainly has many reasons for this. At the beginning of this month, the company announced that its number of clients had exceeded the milestone of one million, doubling over the past three years.

In the meantime, the company has introduced many new products, including passive trading tools based on ETFs. In 2024, it already put a social trading platform in users' hands. Soon, it will offer the possibility of trading bonds.

According to information from February, XTB counts on expansion in the British market, where it wants to join the £400 billion Individual Savings Accounts industry. The expansion goes beyond the old continent, and an example of this is the acquisition of a broker in Indonesia, which is to become a "Gateway to Asia" for the company.