Along with the virus spread, IT infrastructure provider Avelacom today said it had seen a 35 percent increase in the volume of data transferred between exchanges in March.

The Russian low-latency network operator added that demand from FX and cryptocurrency trading clients to use high-speed strategies to keep pace is particularly significant.

Avelacom expects global markets to remain hostage to developments involving the coronavirus with the Volatility of swings is driving unprecedented growth that rank with any past market crises.

With nobody has a clue so far, future scenarios depend on how the virus outbreak will play out. It is making investors worried about the severity of human and economic effects, which fuels tapping into high-speed price discovery and Execution tools to take advantage of any price movement.

The panic response has been apparent from banks, hedge funds, asset managers, broker-dealers, and proprietary trading firms, said the provider of connectivity and infrastructure solutions.

“Investors lose money when they lack knowledge of the market. There are lots of risks to consider in relation to this extremely volatile period that is spread across global markets. Our aim is to help financial services firms to get through all those price movements successfully, optimise the way they trade and get the best price when buying or selling financial assets,” said Aleksey Larichev, CEO of Avelacom.

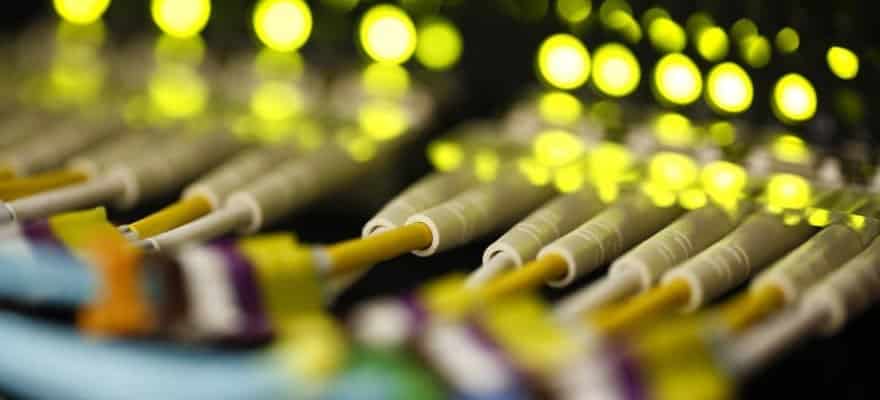

Avelacom offers dedicated connectivity for crypto exchanges

Avelacom’s network stretches over 30,000 miles of long-haul fiber routes across Europe, Russia, Asia, North America, South Africa, and Australia. The company uses 100 Gbps coherent DWDM technology upgradable to 400 Gbps, providing an array of products that are available in more than 25 major trading venues.

Avelacom provides proprietary trading firms, hedge funds, and other professional currency traders access multiple exchanges, delivered via a single provider. Users also benefit from access to pricing data while gaining a competitive advantage by executing orders faster than other market participants.

Most recently, it has launched a multi-cloud connectivity solution to simplify and accelerate how traders connect to cryptocurrency exchanges. As a result, the crypto community can benefit from diverse low-latency solutions, including market data delivery and order routing, cross-connect opportunities, and cloud strategies.