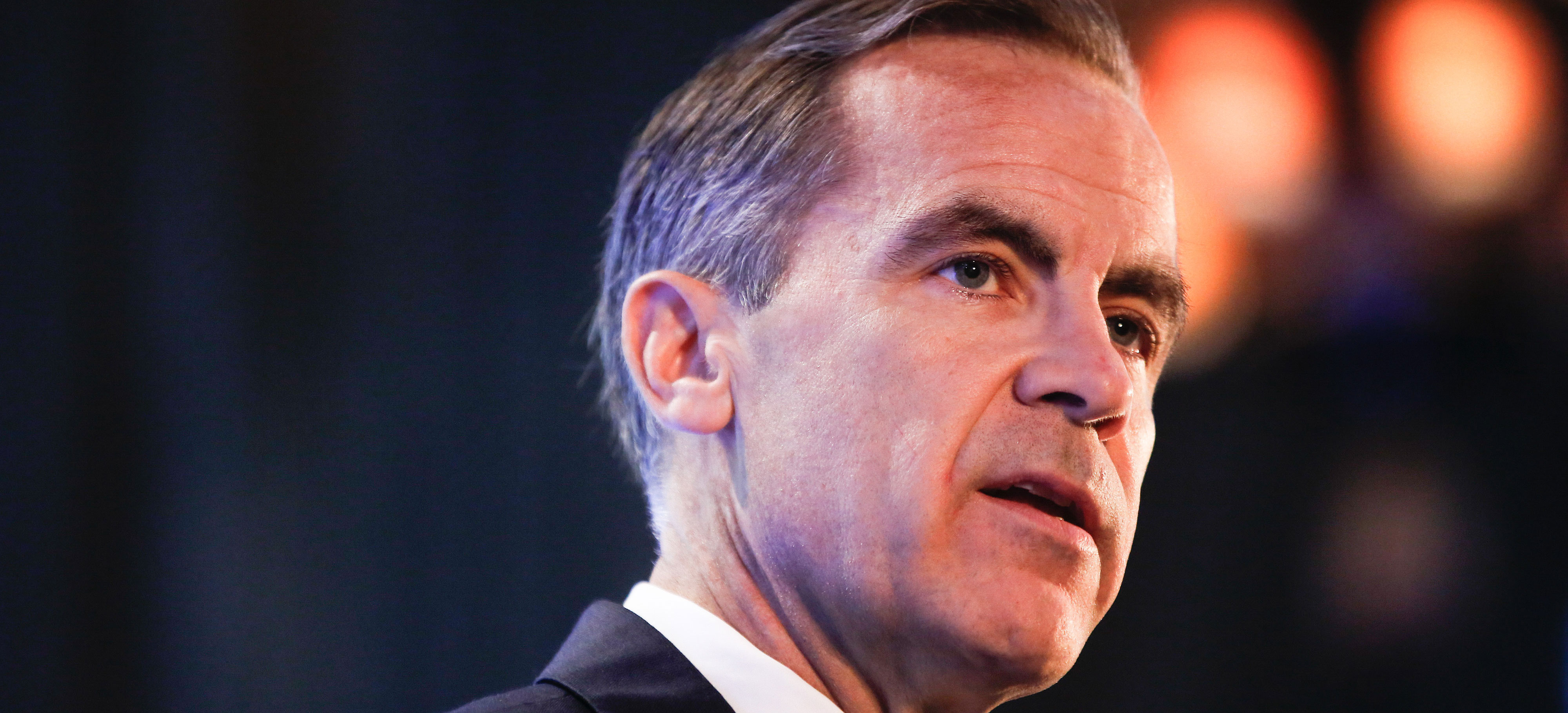

The Bank of England Governor, Mark Carney, has issued a statement following today’s EU referendum result highlighting the period of uncertainty and adjustment that is set to follow.

He stated: “There will be no initial change in the way our people can travel, in the way our goods can move or the way our services can be sold and that it will take some time for the United Kingdom to establish new relationships with Europe and the rest of the world.”

The new world of online trading, fintech and marketing - register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Carney added that some market and economic Volatility can be expected as this process unfolds but went on to say that “we are well prepared for this. The Treasury and the Bank of England have engaged in extensive contingency planning and the Chancellor and I have been in close contact, including through the night and this morning.”

Additional Measures

“The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward. These adjustments will be supported by a resilient UK financial system – one that the Bank of England has consistently strengthened over the last seven years.”

He explained that the capital requirements of the UK’s largest banks are now ten times higher than before the crisis. The Bank of England has stress tested them against scenarios more severe than the country currently faces.

As a result of these actions, UK banks have raised over £130 billion in capital, and now have more than £600 billion of high quality liquid assets.

Why it Matters

This substantial capital and huge Liquidity gives banks the flexibility they need to continue to lend to UK businesses and households, even during challenging times.

Moreover, as a backstop, and to support the functioning of markets, the Bank of England stands ready to provide more than £250 billion in additional funds through its normal facilities.

The Bank of England is also able to provide substantial liquidity in foreign currency, if required.

He continued: “We expect institutions to draw on this funding if and when appropriate, just as we expect them to draw on their own resources as needed in order to provide credit, to support markets and to supply other financial services to the real economy.”

In the coming weeks, the bank will assess economic conditions and will consider any additional policy responses.

Conclusion

A few months ago, the bank judged that the risks around the referendum were the most significant, near-term domestic risks to financial stability. To mitigate them, the Bank of England put in place extensive contingency plans.

These begin with ensuring that the core of the UK’s financial system is well-capitalised, liquid and strong. This resilience is backed up by the Bank of England's liquidity facilities in sterling and foreign currencies.

All these resources will support orderly market functioning in the face of any short-term volatility.

He went on to say that the bank will continue to consult and cooperate with all relevant domestic and international authorities to ensure that the UK financial system can absorb any stresses and can concentrate on serving the real economy. That economy will adjust to new trading relationships that will be put in place over time.

It is these public and private decisions that will determine the UK's long-term economic prospects. The best contribution of the Bank of England to this process is to continue to pursue relentlessly our responsibilities for monetary and financial stability. These are unchanged.

He concluded: “We have taken all the necessary steps to prepare for today's events. In the future we will not hesitate to take any additional measures required to meet our responsibilities as the United Kingdom moves forward.”

Traders

To assist traders with keeping track of the current status, Finance Magnates recently published a guide listing the margin and leverage changes across most of the key players in the trading industry.

The tightening of the trading conditions was a mandatory step to help ensure that their clients are provided with better protection against the predicted volatility surrounding this event. In light of the referendum results, traders can access a list of brokers that have since updated their trading requirements here.

The Bank of England Governor, Mark Carney, has issued a statement following today’s EU referendum result highlighting the period of uncertainty and adjustment that is set to follow.

He stated: “There will be no initial change in the way our people can travel, in the way our goods can move or the way our services can be sold and that it will take some time for the United Kingdom to establish new relationships with Europe and the rest of the world.”

The new world of online trading, fintech and marketing - register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Carney added that some market and economic Volatility can be expected as this process unfolds but went on to say that “we are well prepared for this. The Treasury and the Bank of England have engaged in extensive contingency planning and the Chancellor and I have been in close contact, including through the night and this morning.”

Additional Measures

“The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward. These adjustments will be supported by a resilient UK financial system – one that the Bank of England has consistently strengthened over the last seven years.”

He explained that the capital requirements of the UK’s largest banks are now ten times higher than before the crisis. The Bank of England has stress tested them against scenarios more severe than the country currently faces.

As a result of these actions, UK banks have raised over £130 billion in capital, and now have more than £600 billion of high quality liquid assets.

Why it Matters

This substantial capital and huge Liquidity gives banks the flexibility they need to continue to lend to UK businesses and households, even during challenging times.

Moreover, as a backstop, and to support the functioning of markets, the Bank of England stands ready to provide more than £250 billion in additional funds through its normal facilities.

The Bank of England is also able to provide substantial liquidity in foreign currency, if required.

He continued: “We expect institutions to draw on this funding if and when appropriate, just as we expect them to draw on their own resources as needed in order to provide credit, to support markets and to supply other financial services to the real economy.”

In the coming weeks, the bank will assess economic conditions and will consider any additional policy responses.

Conclusion

A few months ago, the bank judged that the risks around the referendum were the most significant, near-term domestic risks to financial stability. To mitigate them, the Bank of England put in place extensive contingency plans.

These begin with ensuring that the core of the UK’s financial system is well-capitalised, liquid and strong. This resilience is backed up by the Bank of England's liquidity facilities in sterling and foreign currencies.

All these resources will support orderly market functioning in the face of any short-term volatility.

He went on to say that the bank will continue to consult and cooperate with all relevant domestic and international authorities to ensure that the UK financial system can absorb any stresses and can concentrate on serving the real economy. That economy will adjust to new trading relationships that will be put in place over time.

It is these public and private decisions that will determine the UK's long-term economic prospects. The best contribution of the Bank of England to this process is to continue to pursue relentlessly our responsibilities for monetary and financial stability. These are unchanged.

He concluded: “We have taken all the necessary steps to prepare for today's events. In the future we will not hesitate to take any additional measures required to meet our responsibilities as the United Kingdom moves forward.”

Traders

To assist traders with keeping track of the current status, Finance Magnates recently published a guide listing the margin and leverage changes across most of the key players in the trading industry.

The tightening of the trading conditions was a mandatory step to help ensure that their clients are provided with better protection against the predicted volatility surrounding this event. In light of the referendum results, traders can access a list of brokers that have since updated their trading requirements here.