Dan Goldberg

This article was written by Dan Goldberg, Head of Training at FutexLive.

ECB meeting

On Thursday we see the last ECB meeting of the year. A reasonable amount of expectation surrounds this meeting as one of the ECB's “go live” meetings.

To unlock the Asian market, register now to the iFX EXPO in Hon

The recent pattern has been that Mr. Draghi has one holding meeting where he does his best, and he is very good at this, to not disappoint the market and keep hopes alive of further action, and then a meeting, in line with new staff forecasts being released, of actually pulling the trigger on some form of monetary policy.

In October we saw a lot of the same from Mr. Draghi. Rates were unchanged, asset purchases were held at 80 billion Euros per month expected to run until the end of March 2017. The promise again was there to extend this if needed until they see a “sustained adjustment in the path of inflation”.

He was, in my opinion, still a touch dovish in his added comments. Although Mr. Draghi felt that the euro area was recovering and showing resilience he added that this was largely down to their “comprehensive monetary policy measures” and that “the baseline scenario remained subject to downside risks”.

He also stated that the ECB “remained committed to the very substantial degree of monetary accommodation”. He hinted that December would be a “go live” meeting in accordance with receiving new staff projections. So this is why we expect some movement on Thursday.

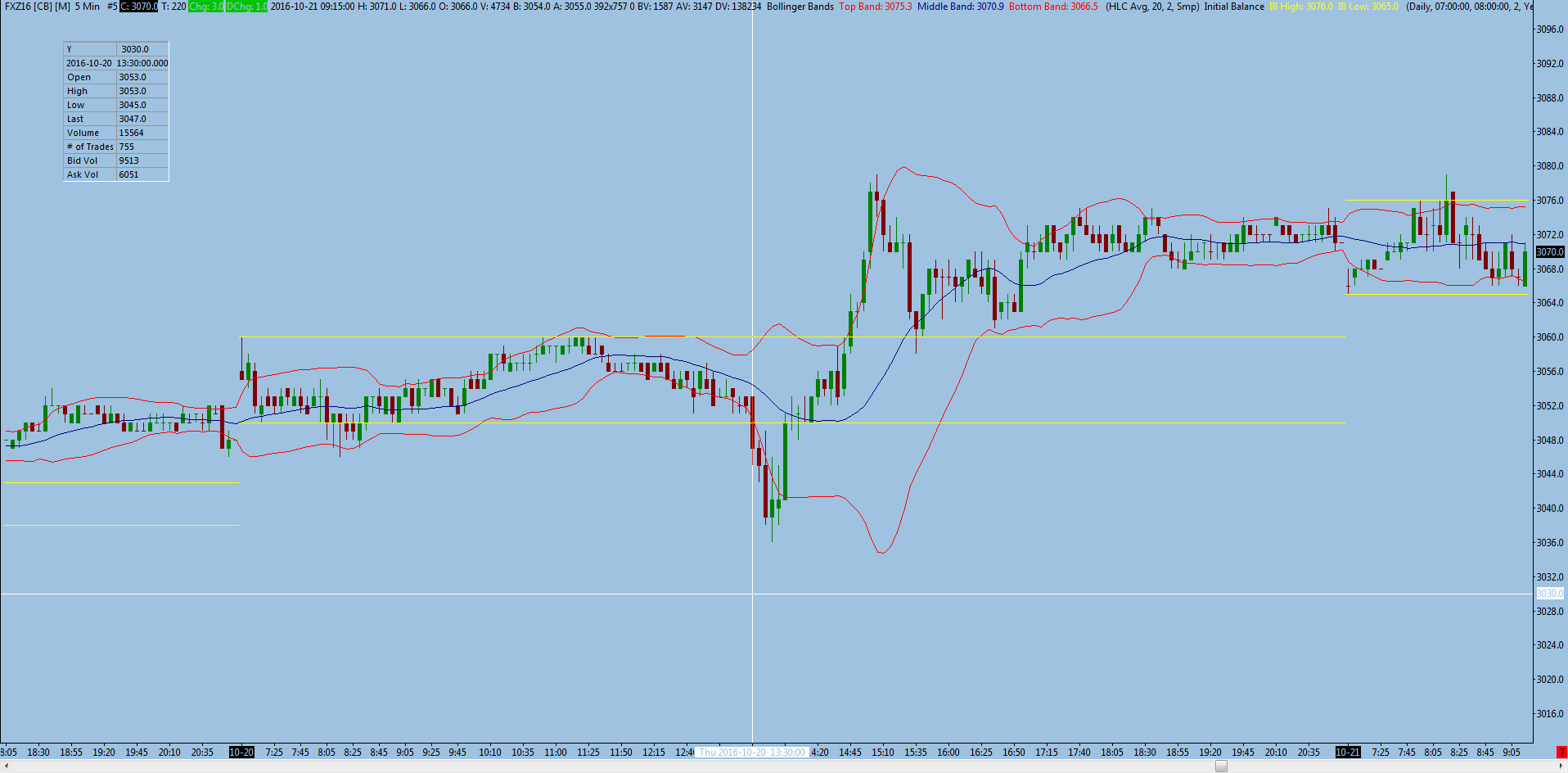

The reaction to the last meetings was interesting in the markets. We headed into this meeting also looking for some movement. This actually shocked me at the time. I didn't expect an extension of QE last month but the over-riding consensus at the time was against my opinion. The market was looking for a move and the result was some initial disappointment. As below the Bunds sold off at first before regaining some sense and understanding the dovish tone within.

And the Stoxx did the same, also shown below. The white marker signifies the beginning of the press conference and the selling on disappointment followed by the reality of hope in next time and the heavily dovish tone employed by Mr. Draghi.

So going into this month again the expectation is that Mr. Draghi will extend his monetary policy. Do not expect the market to be so lenient this time if he does nothing. A non-move will send bunds and Equities lower, pretty much by the third paragraph of his statement.

Most are looking for a 6 month extension of QE at the current pace of 80 billion per month. Supply is an issue but it is thought that there is enough, even in Germany, to cope with this extension. Tapering, the process of unwinding/weaning the markets off QE, is expected to begin in the 3rd quarter of 2017.

Most analysts feel the rise in inflation and the steady recovery will enable Mr. Draghi to take this course of action. However, to do so any sooner in light of the recent elections and political instability would be folly.

Recent data has also suggested that this middle-line of extending QE for 6 months is the correct stance. Unemployment has dropped, manufacturing activity has increased and this will all help the ECB reach its inflation target. The staff projections are expected to reiterate this.

We get our first look at 2019 forecasts and most are seeing price growth getting back in line with where the ECB wants it during 2019, close to 2%.

To sum up, consensus is for a 6 month QE extension at the current pace of activity.

Now comes the hard part. The market reaction! Mr. Draghi has always been fantastic at keeping the markets on the hook. Since the beginning of an extraordinary monetary policy he has always managed to delay giving the market what it wanted, undershooting what the market wanted yet keeping hope alive enough that the inevitable sell side reaction was short-lived. He will no doubt attempt this again.

We have heard numerous times that the ECB stands ready to use all the tools necessary to achieve its goal and it will act using all the tools in its mandate until it does. I feel that Mr. Draghi will bang very hard on this drum to stave off a negative market reaction.

Mr. Draghi will also get asked if tapering was discussed. So far he has maintained that tapering has never been discussed. This is the nuance that means the most to the market. If tapering has been discussed and he admits it then look to see bonds and equities sell off in line with each other. If he maintains that it hasn't been addressed then hope will be kept alive and the reaction may lose momentum quicker.

Scarcity of bonds

Most are expecting that to keep bond purchases going some changes may need to be implemented.

The move in yields has alleviated some concerns and should the initial idea be to run QE for only 6 months then it is unlikely to be an issue at this meeting. I would expect the answers to be vague and non-committal and certainly not a change to the capital key.

A move on this would have the largest implications in seeing bonds sell off compared to their periphery counterparts. Equities would love this sort of move.

I don't think we're there yet though and this bazooka will be kept stored until needed down the line.

More likely is that in time we will see issuer rules and limits changed to ensure enough Liquidity in the bond markets. And only in the event that we need to push QE beyond the expected 6 month horizon. And in answer to this question, if asked, expect more vague non-commitment.

Conclusion

In essence traders will be looking for the following :

No move in QE: unlikely - selling in bonds and equity markets. Good for the euro.

In line with expectation of 6 months at current pace: likely - resulting move will come down to tone.

6 months QE at a lower pace: unlikely - expect bond and equity disappointment and euro strength.

Talk of extending QE beyond this will be met with a positive response in bonds and equity.

Talk of tapering will be met with selling in bonds and equity markets.

One thing I have learnt in my time trading under Mr. Draghi's presidency is that he is very very good at his job. And his job is to do just enough, not over-commit the ECB, keep the markets in check and gradually recover the EU economy.

His balancing act rarely goes wrong. Only once this year has he misjudged the markets expectation in September when bonds and stocks sold off following his ECB conference. I doubt he will make the same mistake again.