This article was written by Aayush Jindal, currency analyst at Titan FX.

The euro sellers were seen struggling lately due to a weaker US dollar. The technical front for the EUR/USD pair looks constructive and signals a major break going forward.

Take the lead from today’s leaders. FM London Summit, 14-15 November, 2016. Register here!

The recent moves in the US dollar caught many traders by surprise, as it declined heavily against most its counterparts, including the euro. However, the greenback soon managed to recover and traded higher.

The euro versus the US dollar recently failed to break the 1.1320 resistance area, which sparked a downside move in EUR/USD. However, we cannot discard the shared currency buyers yet, as I see a few constructive patterns forming on the daily chart. Let’s have a look at it to understand why the euro sellers may face a lot of heat moving forward.

EUR/USD technical analysis and why the euro is heading towards a break

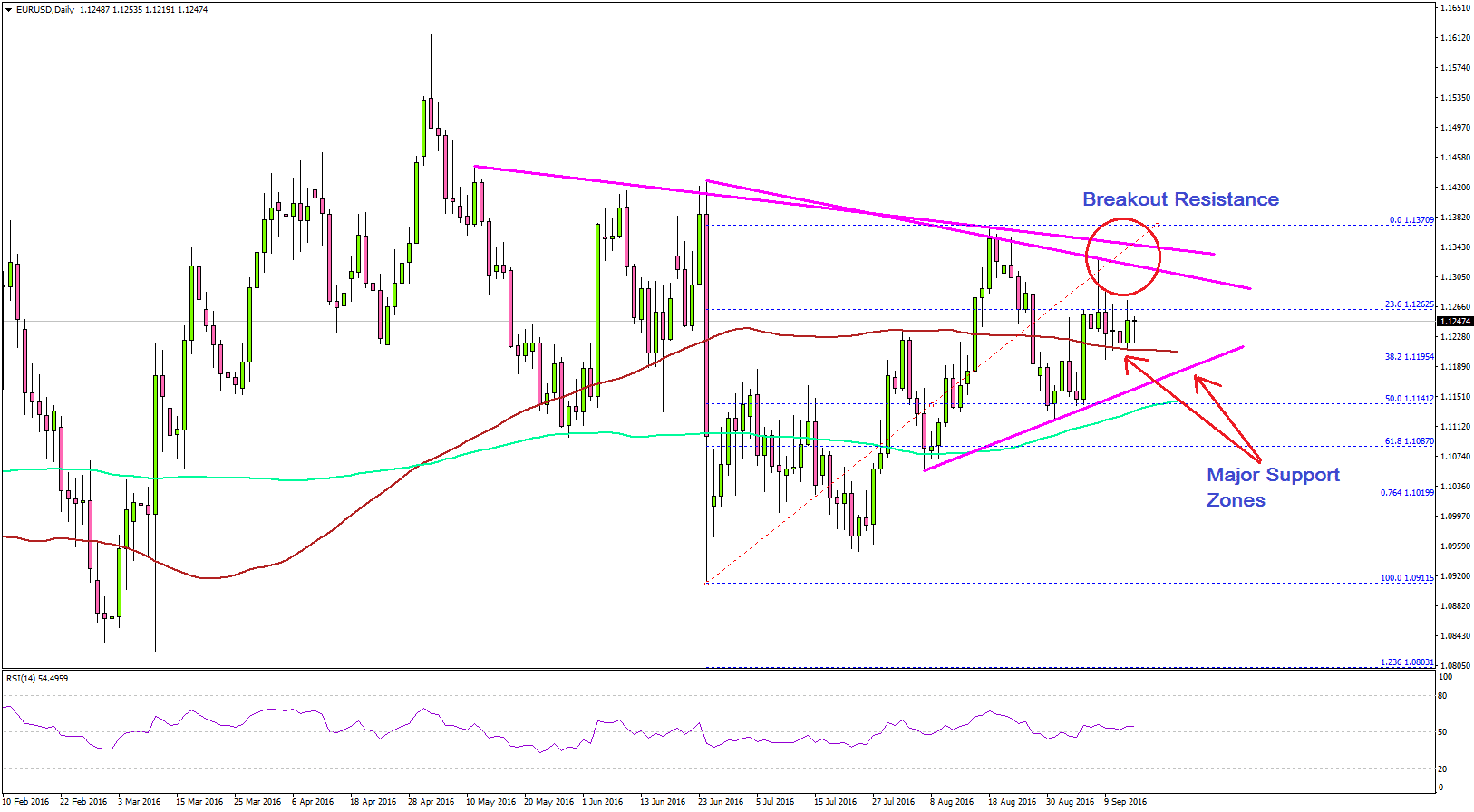

This week the EUR/USD pair tested a monster support area formed on the daily chart on a couple of occasions, but sellers failed to break it. The mentioned support is highlighted in the daily chart.

This was formed with a few important elements - first, the 100-day simple moving average, which is acting as a barrier. Second, there is a bullish trend line formed on the daily chart. Lastly, the 38.2% Fibonacci retracement level of the last wave from the 1.0910 low to 1.1370 high.

So, a major support zone is in place, which is a hurdle for the euro sellers. Now, we need to see what challenges the bulls face in order to push the EUR/USD pair higher.

EUR/USD

Can euro buyers make it?

On the upside, there are a couple of bearish trend lines waiting to protect gains. These trend lines won’t easily allow buyers to push the pair higher. However, the daily RSI is above the 50 level, raising hopes for an upside drift.

In the short term, there is a chance of an upside ride towards the highlighted resistance zone. Then, it would depend on the euro seller’s resilience if they can manage to defend further gains.

Fundamentally, the US Consumer Price Index will be reported by the US Bureau of Labor Statistics on Friday. It may impact the US dollar in the short term if the actual result falls below the forecast of a 1% rise in the CPI in August 2016 (YoY).