The Nigerian economy is currently the largest economy in Africa with an estimated GDP of $568.5 billion. The economy is highly dependent on revenue from crude oil export to the global market, which accounts for more than 90% of Nigerian’s income.

Over the past couple of years, Nigeria’s currency (the naira) has been under pressure due to falling oil prices, which is the major source of revenue.The Central Bank of Nigeria has introduced a number of policies in an attempt to defend the naira amidst falling oil prices.

Many emerging economies like China have devalued their currency in order to boost export and reduce import. Kazakhstan (largest oil exporter in central Asia) is the latest country to devalue its currency against the USD because of falling oil prices. On the back of this, many economists and analysts have urged the central bank to follow suit by devaluing the naira against the USD. But instead of devaluation, the central bank has introduced some policy measures to defend the naira.

The Central Bank of Nigeria published a list of 41 items which will not be allowed to be imported into the country anymore. This included toothpicks, tomato paste, rice, vegetable oil etc. The central bank's governor argues that these commodities can be produced locally and this will help boost local industry in terms of production. The central bank has also put a ban on foreign Exchange services available to importers. Importers of other commodities which are not included on the list are forced to use other means to fund their foreign transactions.

Furthermore, the Central Bank of Nigeria also reduced daily cash withdrawal limits from cash points across the country. The daily available withdrawal limit has been reduced to 60,000 naira a day. In addition, the central bank has also placed a restriction on foreign cash deposits into any bank in Nigeria, as well as reducing daily withdrawal from a domiciliary account to $300 a day.

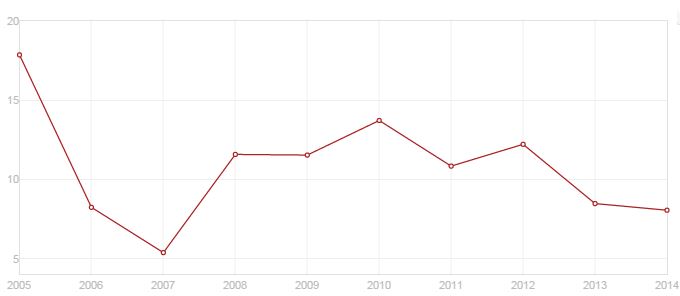

Inflation in Nigeria has been below double digits for more than 2 years. The new policies of the central bank are likely to push inflation higher, which in turn will probably force the central bank to relax some of its policies in other to keep inflation at a single digit. Also, for how long will the central bank of Nigeria continue to defend the naira?

Many economies, especially emerging economies, are already embarking on direct devaluation by removing their currency peg to the USD and allowing market forces of demand and supply to determine prices. China is Nigeria’s biggest trade partner and the Chinese economy is slowing down at the moment. This means the Nigerian economy will be adversely affected which will put more pressure on the naira.

Another major factor which will affect the naira is the oil price. Oil prices continue to dive, prices now at the 2009 level. This has impacted Nigeria’s external reserve negatively, by dropping from over $50 billion to less than $30 billion. If the price of oil continues to drop, the central bank will have no choice but to eventually devalue the naira in order to boost growth through exports.

Nigerian Inflation, (annual %) *Source: World Bank