Making astrology respectable

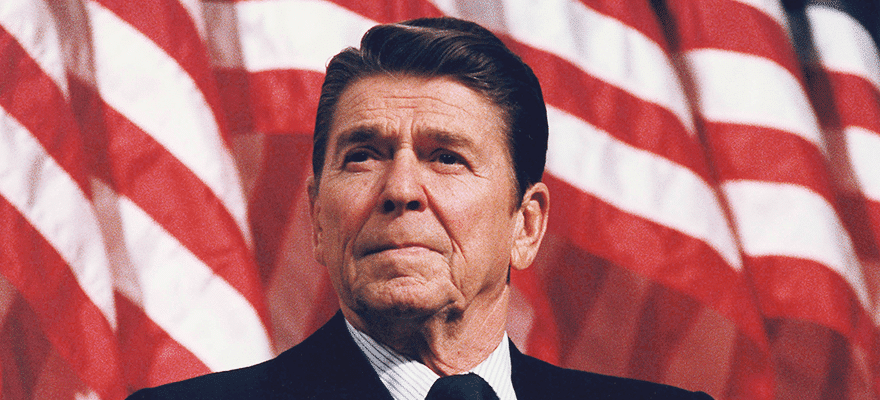

The current or demised crop of Republican U.S. presidential candidates persist in referring to the name of former president Reagan and his economics. This reminiscence invokes a kind of ideological amnesia as to the realities of 'Reaganomics'.

In his book, "The Great Crash," the peerlessly erudite John Kenneth Galbraith adds to the vigorous discourse as to the possible causes of the Great Crash and suggests some parallels for the "small crash" of 1987. Galbraith famously wrote: "The only function of economic forecasting is to make astrology look respectable."

He also wrote about economic amnesia and economic delusion. Galbraith explains the penchant for economic delusion as "a tribute only to a recurrent preference in economic matters, for formidable nonsense." In more biological terms, he refers to economic "trickle-down" as the "unlovely saying that when the horse dies in the street, the oats no longer pass through for the sparrows."

So much for trickle-down economics.

Crashes, great and small

I will not bore the reader with Galbraith's superb analysis of the Great Crash, the Great Depression. Nor will I bore the reader with yet another explanation of why 2008 occurred. I need to simply remind readers that there are no firewalls against economic foolishness and that there is value in what we can learn from past financial and economic catastrophes.

I will try to invigorate the narrative, the critically important discussion of how to make America economically great again. We do not do this by emulating trickle-down economics. It didn't and doesn't work and the proof is in the economic recession of 1987, during the term of president Reagan (20 Jan 1981 - 20 Jan 1989).

One final quote from Galbraith: "Who is to make wise those who are required to have wisdom?" In the more modest words of the U.S. Marines, there are times when the corporals must tell the colonels what to do.

The recession of 1987

Mergers and acquisitions, leveraged buyouts and junk bonds were prevalent throughout the pre-1987 economic slowdown. Leverage was at the core of the action. "Fixed interest-bearing Obligations to banks and bond holders replaced dividend-paying securities on which non-payment does not portend bankruptcy or lesser fiscal disaster." The further result was a heavy increase in corporate debt before the 1987 crash. (Sports Authority?)

Economic ideology

In the fall of 1987, it was generally held that the federal budget deficit was the cause of an economic hiccup the previous summer. This deficit had been large and even larger throughout nearly all the years of the Reagan administration. Wall Street blamed Reagan. In the measured words of Galbraith: "there was something markedly ungracious in the way that community (Wall Street) so gratuitously laid responsibility for its troubles on its old friend."

Income inequality and economic idolatry

I promised not to bore the reader with the presumed causes of the Great Depression. I will relate on another occasion how now as then, international trade relates directly to such economic cataclysms, in terms that the layman (and woman) can understand. It is in light of the weakness of the economy that the role of the stock market crash of the '30s and what it portends for today must be seen. Galbraith describes the role of "respectable importance" and its psychological effect at the time presaging the Great Depression. Eminent economists, governors of the Federal Reserve Bank system, noted academics from our nation's finest colleges and politicians avowed that the economy was just fine, up to the time of the crash.

there are no firewalls against economic foolishness

The collapse in securities values affected in the first instance the well-to-do. In 1929, this was a vital group whose members disposed of a large proportion of consumer income; they were the lion's share of personal saving and investment. Anything that struck at the spending and investments of this group would of necessity have broad effects on the expenditures and income of the economy at large. Precisely such a blow was struck by the stock market crash. In addition, the crash promptly removed from the economy the support that it had been deriving from the spending of stock market gains.

According to Piketty, Rivkin, El-Erian, Friedman, etc., etc., the concentration of income has only increased in the US since 1929.

Empiricism and economics

There is a movement afoot to be empirical about political economics. This is not solely in response to the need to be impactful rather than delusional; the need to be competent rather than ineffective. It is more in response to a growing anger in the body politic, a growing disaffection with the self-entitled but incompetent, the shallow and vulgar pontificators and the bombastic self-elevators.

The economic trickle

Trickle-down economics is a disaster for a few simple reasons; the conflation of self-entitlement and greed, the idolatry of wealth and technology.

On this Sunday, the gospel of the Prodigal Son, the gospel of the Merciful Father, reminds us that personal relationships, and economics, are not about hatred and loathing and the size of our genitalia. It is about mercy and forgiveness, compassion and redemption... and the depth of our character. It is about love. Victor Hugo wrote and I paraphrase, the greatest thing on earth is that we are loved, not because of ourselves but despite ourselves.