This article was written by John E. Putman II. John is a full-time trader with over 15 years’ experience in FX modeling. His focus is blending fundamental, technical and machine learning models to identify areas of potential Exchange rate overshoot. He is a former money manager and technical consultant with a background in statistical modeling, econometrics, genetic programming and distributive computing. You can follow his daily updates on Twitter @FXAnalyst

The Fed Takes a Cautious Step Forward

After seven long years, the Fed has finally put an end to the era of free money. Whether agreed with or not, it cannot have come as a surprise to anyone who was watching. What happens next is up for debate and the forecasts range from four even increases this year, to a cut before the end of the year. The latter seems the least likely approach, although other countries have done just that, as it doesn’t fit the Fed’s slow, steady approach to managing growth and inflation.

John Putman II

What makes this increase different is the current rate of inflation along with the strength of the US dollar. Estimates on inflation are 0.5%, well below the Fed’s target of 2%, which may suggest that they are using a range as opposed to a hard target. This may also indicate a delicate touch going forward, and will not make it any easier to forecast their next move.

Additionally, the dollar isn’t trending north prior to the first rate increase. If the buck continues its advance on stronger rates of return, the impact on US exports could be heavy. Of course, the opposite will be true and US based consumers will have an easier time buying imported items, if they actually have disposable income. Despite stronger jobs data, there is still a large part of the middle class that is struggling, which shines a different light on the rate increase and what effect it may really have.

Recession 2016? Many Think So

Yellen has made it clear that part of the decision to increase rates now is to avoid a recession later, and to do it in a gradual way that will keep growth and inflation in check without tanking the economy. That may not be possible. By the summer of 2015, the 'recovery', anaemic as it was, was getting a little long in the tooth and there were signs that a recession, or at least some contraction, should be in the what-if analysis of every company who cared.

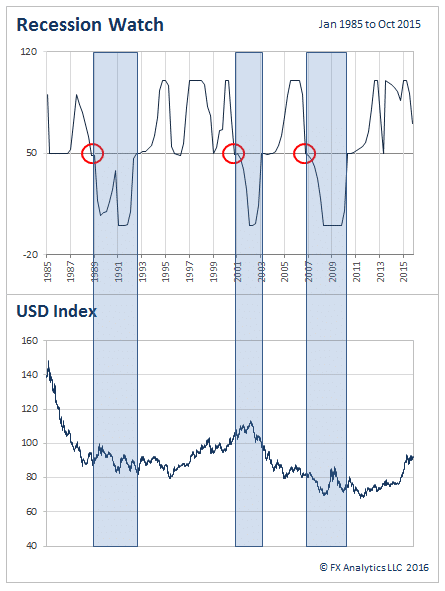

The question was not if, but when this natural part of the business and economic cycle would occur. While there is some disagreement on when, this year or the next feels like a safe bet. Internally, 2016 Q3/4 are the best estimates for the mid-point in the cyclical analysis below. This is the make or break area, and the following quarter is critical. A bounce off that area would indicate some new life in the economy and push the recession off the table for another year, while if readings fall below fifty the economy will likely slip into recession.

The Recession Watch measures cyclical economic activity and tends to be an early indicator for economic expansion, contraction and recession.

In the three prior recessions, indicated here by a move below 50 – the make or break line – the US Dollar Index exhibits a lot of Volatility, but overall finishes lower each time. Given the strength of the dollar right now and anticipated rate cuts that would come with a recession, this scenario could easily play out again.

USD - Will the March Continue?

Although there is some discussion right now about how a recession could be bullish for the greenback given current and expected interest rate differentials, historically that isn’t the case, not by the end of the cycle. In the last three recessions, the dollar finished lower overall and displayed more cyclical price action and volatility then trend. If the economy does cool off, with it will come speculation about rate cuts, and whether they materialize or not, the anticipation could drive the dollar lower.

If there is no recession, the path higher for the dollar is much easier but you have to wonder at what point does the combination of small increases in the home rate, versus no increase in the foreign rate, run its course. If the market has at all overshot in its estimation, any hiccup could provide a sharp correction and a period of excessive volatility. We’ll know for certain next year.