The article was written by Nick Nesbitt who is the Consulting Services Director at Tagetik UK.

The annual budgeting process can either accelerate or weigh down business responsiveness to market changes. If your competition has a dynamic and transparent planning process and the ability to quickly create drivers and scenarios and to reallocate resources accordingly, they are ahead of you.

This is particularly relevant for the banking and finance sectors, where planning is part of the Compliance process.

So how can you be more responsive?

The answer is, automate. Adopt a flexible, dynamic planning approach that incorporates business modelling and delivers real-time access to the right information and to the right people at the right time.

Nick Nesbitt

Each of your lines of business needs to be planned in a way that makes sense for its specific needs while adhering to global standards and calculations. However, being autonomous does not mean using separate planning systems.

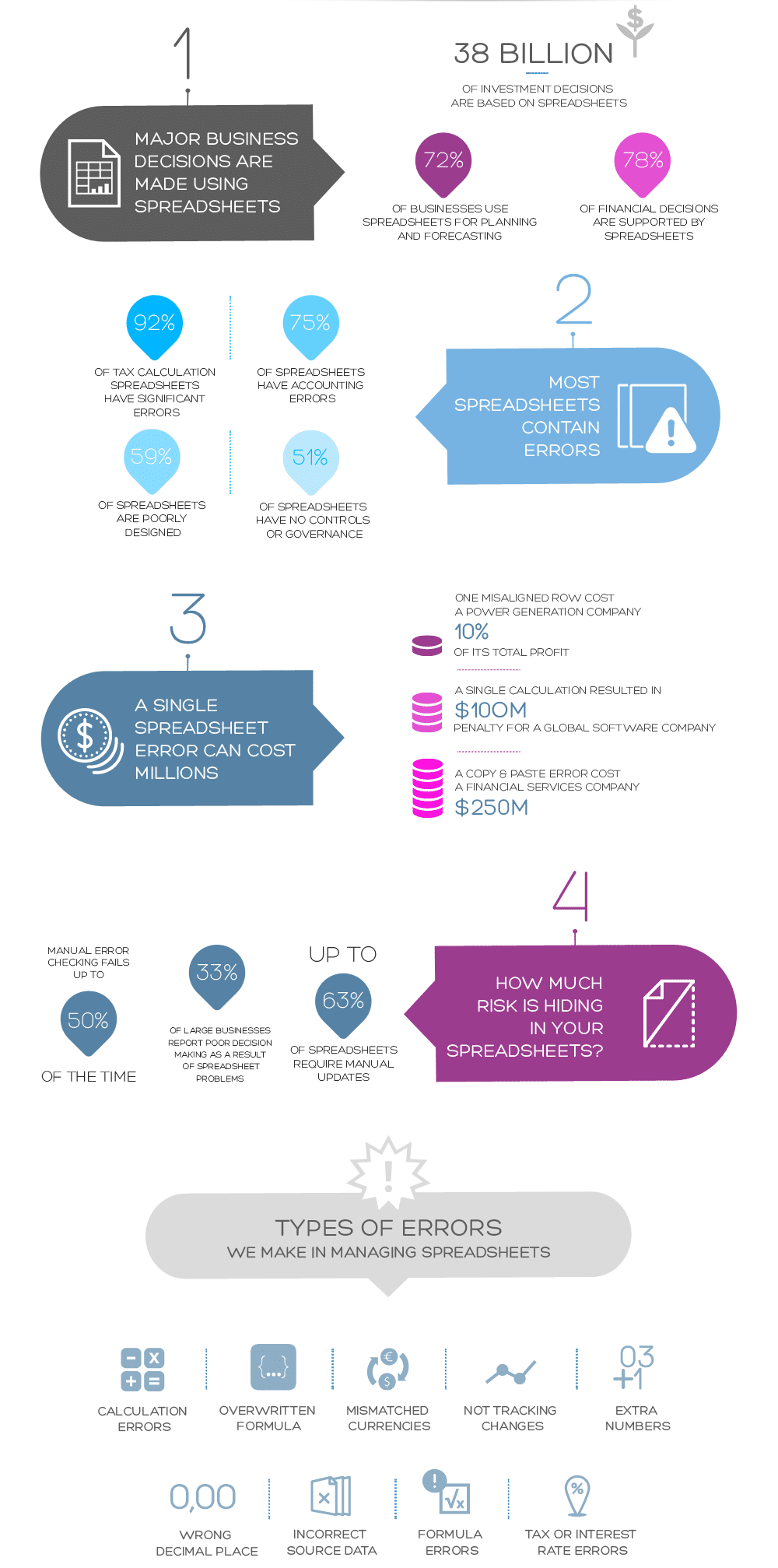

To eliminate risk and cost, a single application should be employed. Separate spreadsheets or applications make workflow, accuracy, consistency and auditability more difficult and time consuming. A single source ensures consistent definitions and calculations and also warrants that forecasts are based on the latest data guaranteeing reliable and accurate information, all the time.

If you are using Excel as your default system, it is time to move to one that provides the flexibility of Excel but with added control, workflow, capability and security. If you are using a legacy system, or a new system you have already and quickly outgrown, you should not just replace it.

Plan carefully for the future considering today’s pressing needs and changing markets. Automate and turn tips into reality and into a winning planning process for your company.