July 6th: We have entered day one after the negative Greek referendum outcome, the country’s economy remains frozen, banks and financial institutions are still shut, with capital controls in place and a 60 euro daily ATM withdrawal limit causing scarcity of cash, therefore all forms of transactions are coming to a standstill.

Although markets around the world started the day with a mild sell-off and relative calm compared to last Monday’s reaction, it is still too soon to predict the full ramifications of yesterday’s result.

With 61 percent of Greek voters rejecting further austerity yesterday, European leaders urgently need to decide whether a financial rescue for Greece is feasible as the clock ticks away for the country towards a total financial breakdown, and the possibility of a Grexit rising to over 60%.

German Chancellor Angela Merkel is meeting with French President Francois Hollande in Paris today, in order to draw up a common plan regarding the Euro region’s response ahead of tomorrow’s emergency Euro Area leaders’ summit. Furthermore, the European Central Bank will decide today whether it is going to further extend emergency Liquidity to the collapsing Greek banks.

The real question going forward is whether there is a possibility of striking a meaningful debt relief deal for Greece this week. While the International Monetary Fund announced last week that Greece needs an additional 60 billion euros in order to meet its payment obligations until 2018, and writing-off part of the country’s debt seems unavoidable. If Greece’s creditors agree to such a debt relief solution, a precedent will be created for more countries of Southern Europe to come forward with similar demands and contagion will not be a distant theoretical scenario anymore.

The implications of such an event occurring could be severe not only for Greece’s economy, but for international stock, bond and currency markets as well. In particular, contagion could spread among bond markets of the European periphery and consequently to other regions, as well as to European stock market indices. Most importantly, it could trigger considerable euro weakness as developments unfold this week, unless some form of Greek debt deal is confirmed.

Eurozone Moving into Uncharted Territory

Furthermore, it is clear that Europe is facing an unprecedented situation. The Eurozone’s Maastricht Treaty was never designed to have an exit plan, with no previous mention or expectations for a country to pull out of the euro project. In the meantime, history has done little to assist, given that the last time a currency union broke up was in 1918 with the Austro-Hungarian Empire.

Nowadays, Greece can remain a member of the Eurozone or decide to opt out altogether. In the latter case, the question to ask would be what can we consider to be feasible currency arrangements for Greece?

We came up with 5 possible options. First of all, to issue a new currency peg to the euro. In our opinion, this option is unlikely as it will impose strong disciplinary measures over Greece’s government as the amount of money available would be linked to the money reserves.

The second option would be to implement a digital currency. It would be historical, but this issue seems credible especially as a transition phase towards the introduction of drachma notes and coins. There is speculation that Greece may adopt Bitcoin as an alternative currency, but nothing official yet.

The third option would be to have a dual system where the new drachma and euro could circulate. Technically this is very likely, especially if the Greek government runs out of money and has to issue IOUs to source liquidity.

Another option could be the introduction of the “new drachma”. Even if history has stated that it is not favorable, (JPMorgan Chase & Co. strategist John Normand estimated on average, that countries in economic crisis, saw their currencies slide 55 percent against the dollar in the first year after the rupture and 53 percent two years later), we believe that this case would be more likely as it would give Greece full control over its monetary policy.

It is a great certainty that as soon as the new drachma is allowed to freely-float against major currencies it will depreciate considerably. A weak currency is a strong driver for growth because it stimulates exports, but in the meantime inflation could become a major threat, leaving the government questioning the subject of salaries and pensions.

Finally, but very unlikely, a return to a Gold Standard. This would give the country credibility and would attract investors from all over the world. However, the country would not benefit from a competitive shockwave and it would add further pressure on the government in terms of fiscal reforms.

It is difficult to determine which scenario will be implemented and which one would be the most effective solution, but it is fair to say that there is no straightforward option given today’s turmoil of events.

EUR/USD Technical Outlook

The single currency is one of the worst performers in the G10 so far this year, as it is down more than 8 percent versus the US dollar and 9 percent against the British pound. It also plunged more than 5 percent versus the Japanese yen following the aggressive sell-off which started slightly below the psychological level of 150.00.

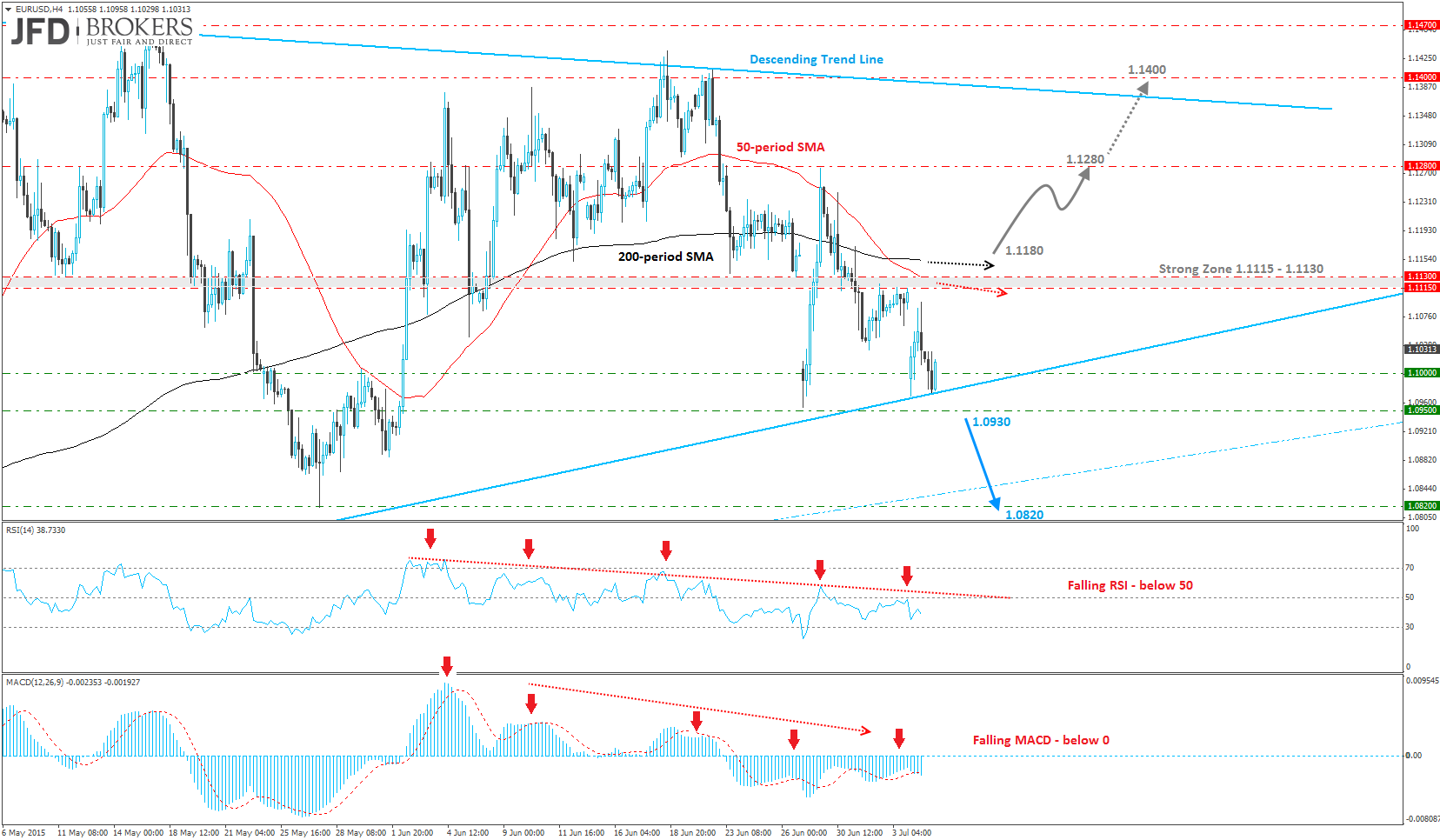

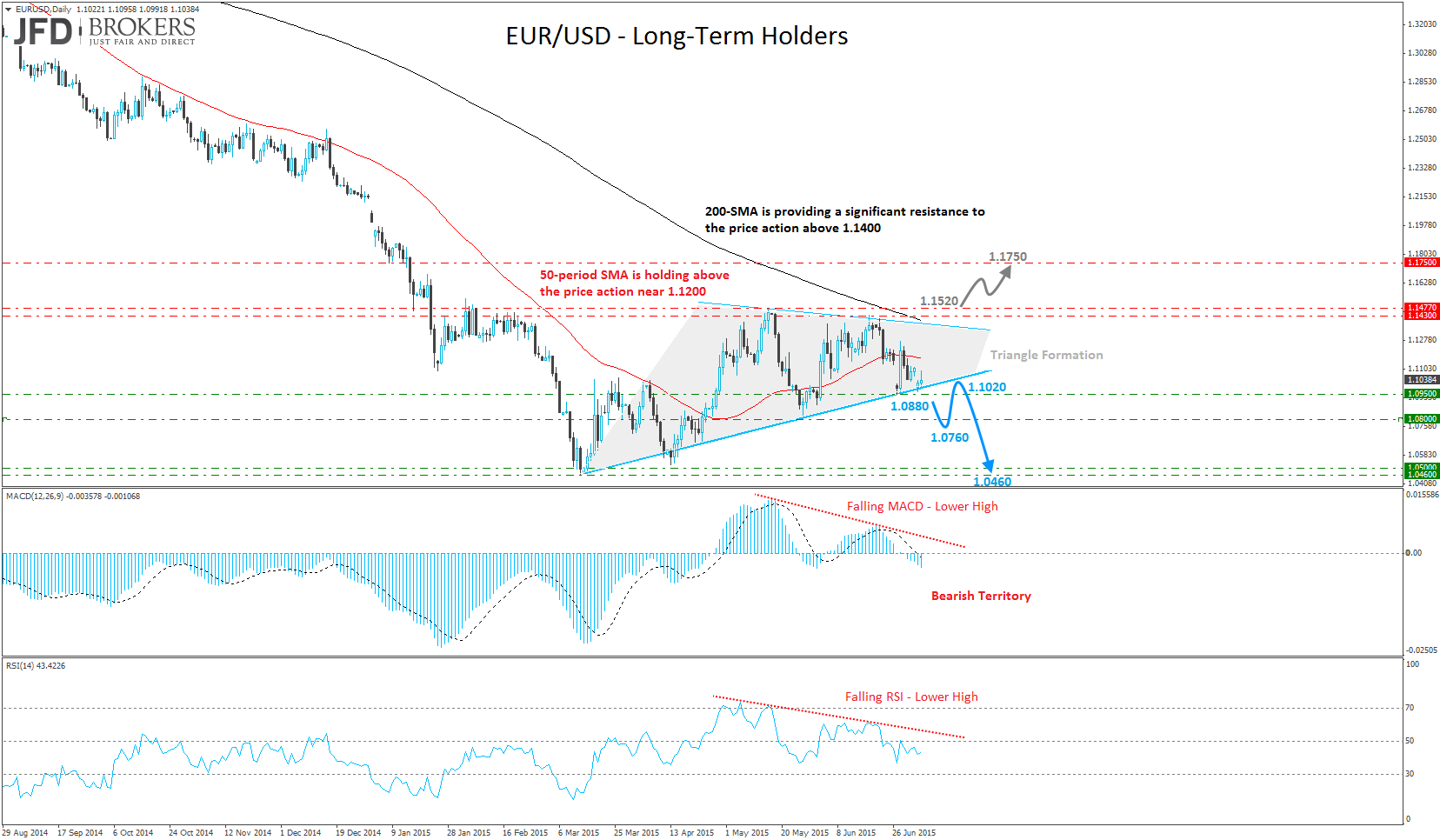

Even the EUR, which has been weighed down by the ongoing Greek sovereign debt crisis, has managed to sustain some of its previous gains above the 1.1000 level despite the developments around the Greek crisis.

The EUR/USD pair is now trading slightly below last Friday’s closing level, however it is still struggling to break through the significant resistance level of 1.1130. At the same time we are still seeing support from the ascending trend line which started back in mid-March, where the 1.0950 barrier and the psychological level of 1.1000 are combined to provide a significant support to the bulls in an effort to keep the positive momentum and the technical correction above the significant zone of 1.0460 – 1.0500.

The EUR/USD pair could test and fail the key support level of 1.0820, depending on the developments around finding common ground for discussing the details of a Greek debt relief deal unfolding this week.

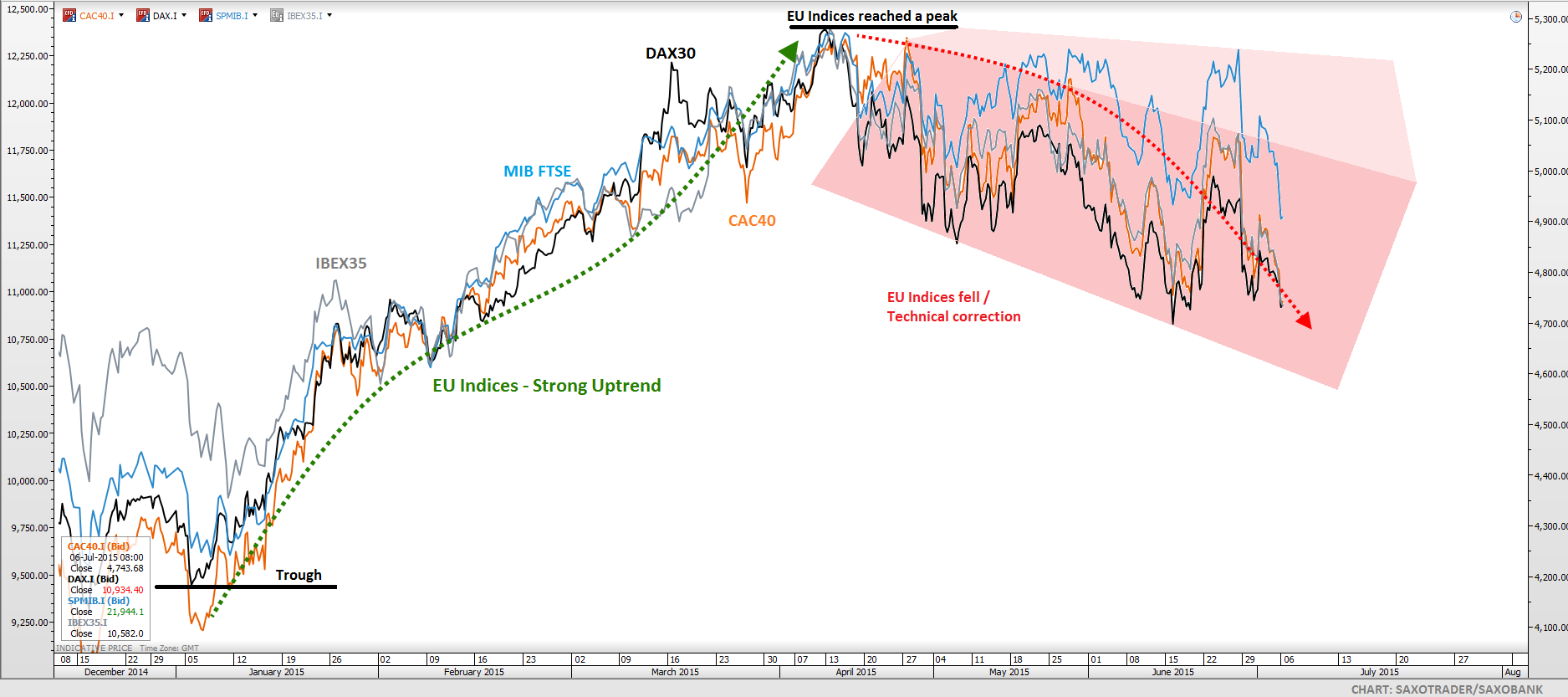

European Stock Market Indices Outlook

A similar picture prevails in European stocks with the German DAX 30 recording a fresh 5-month low, slightly below the key support level of 1.0860 which coincides with the 200-period SMA on the daily chart. DAX 30 slipped for a sixth straight week. The aggressive sell-off which started back after the index peaked at 1.2400 represents the longest monthly rally since July 2011. The next key test for the index will be the 1.0500 level which coincides with the 50-period SMA and then 1.0100, the 2014 highs. European stocks fell the most in three weeks, with French, Spanish and Italian gauges leading declines.

It is clear that European indices are still affected by the bearish sentiment on the back of the melting situation in Greece. The Italian IBEX 35 slid more than 2 percent below the psychological level of 2.1900 while the CAC40 opened with a gap of more than 1.5 percent. The Spanish index which suffered six triple-digit losses this month, ended yesterday’s session 0.60 percent lower and recorded a 4 percent decline for June. Technically, the indices are expected to close the gap pattern.

Given the negative sentiment towards the euro, it is likely that the European indices could fall further, unless a deal between the Greek government and its creditors is reached, that could boost the value of the European indices for a gradual recovery towards their recent highs.