Algorithms Spreading on the FX Markets

Algorithms are responsible for up to 60 to 70% of equity markets volumes, while it goes up to 34% in Forex according to research published by Greenwich Associates last year. However, we notice a very strong disparity between hedge funds of which 53% of FX volumes are algorithmically executed, while only 3% of the corporate volumes are, according to the Greenwich report.

So times have changed, and algorithms are now also spreading on the FX markets. From the alpha generation ones used by the buy-side, to the executions oriented ones on the sell-side.

However, until quite recently, on the buy-side, the focus was only about automating systematic, but until now manual, trading strategies. This was driven by some obvious key factors such as: cost saving, productivity, speed, respect of rules, “quantification” of the strategies, etc. So we can say efforts were mainly done on the alpha generation side. It was basically up to the sell-side to work out the Execution .

Change of Paradigm

Lately, I have witnessed things changing quite a lot, challenging the above statement. The buy-side seems to have started investing more and more into execution oriented algorithms, taking gradual control of the whole chain from signal generation to execution.

Interestingly, this personal observation seems to be confirmed by the (relatively) recent “FX Trading and Technology Survey 2014” from Tibco.

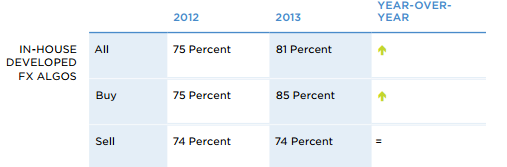

Among the buy-side firms using algos in FX, usage of in-house developed FX algorithms have increased over the past years (from 75 to 85%).

Source: FX Trading and Technology Survey 2014

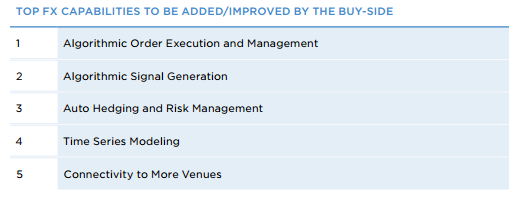

Furthermore interestingly, the top aspect buy-side expected to be worked on improving is...the “algorithmic order execution and management” aspect.

Source: FX Trading and Technology Survey 2014

So one can wonder why the buy-side is progressively starting to invest not only in alpha automation but also in order execution and management, which was meant to be the sell-side bread and butter… I believe there are several reasons that are fueling this new trend which will be amplified in the future.

Lack of Trust and Transparency in the FX Industry

Firstly, no one today can disagree that there is a global lack of trust in the FX industry, more particularly towards the sell-side. Originating from the lack of transparency in this OTC market where “best execution” concept is pretty much just a marketing term, it has recently been accentuated by the latter industry-wide scandals.

How can one really believe he gets the “best execution” in this market perceived as “rigged”? Absence of execution timestamps, last-look, and manipulations have now started to be reported by regulators (last one being the Bank of England's FEMR report), but it is a little too late and buy-side has already taken things in hand.

Second Generation of Predictive Algorithms

But it is of course not just a question of trust. Another reason is that execution algorithms, especially the sell-side ones, are becoming more and more evolved and proprietary signals or predictive components (such as evolved AI) are being added to them. It can make the execution quite an erratic “adventure” with potential rewards of course, but it comes at the price of extra risks being added in the execution element of the trading activity… With predictive elements, we all know that things can be great, but they can also go wrong sometimes… And of course buy-side wants, and above all needs, to understand and manage these risks, which used to be only in the alpha component.

But, even more important, you do not want the proprietary signal of the execution algorithm starting to interfere with the nature of the alpha of the strategy. Degree of passiveness or aggressiveness of the execution algorithm must be carefully determined depending on the strategy goal and the market conditions. You do not want the execution algorithm going in a passive mode to save spread cost when the opportunity cost of missing the trade would be way superior.

Competitive Advantage

So, it is important for the execution algorithms to be fully integrated and adapted to the buy-side strategy using them. That is why I believe it is better to avoid black boxes and build white box logic instead.

On the other hand, if you develop your execution algorithms in-house (or make developed following your specifications), the possibility to adapt the right execution algorithm to the right alpha signal can become a very important competitive advantage, while most of your competitors are using standardized all over the place, and consequently commoditized, sell-side algorithms. Moreover, in the trading industry it is well known that rewards are only granted to the leaders and the innovators, not the followers!

The Regulatory Push

However, it is not just about pure business reasons. MiFID in Europe and Dodd-Frank in the US are now also pushing to require buy-side FX traders to provide transparency and “best execution” to their clients. This is giving another justification to the in-house algo move.

Indeed, by definition, it is done more easily with a white box algo than a sell-side black box one. With in-house algos, there are clear rules that can be exposed. This however needs to be a bit tempered with the possible new requirements being drafted towards algo users, for example with MiFID II.

Technology Available

We can not finish listing the justification of this move towards in-house algorithm development by not stating the obvious. Barriers to enter the algo games have been dramatically reduced in the last years. Affordable technology is now available to whoever decides to make the move and seriously invest in execution.

Of course, it does not mean that things are simple, and obviously there are some challenges specific to the nature of the FX market. This could be discussed in a next article.

If after all you are still not convinced about the need for the buy-side to use and take control of the execution algorithms, maybe you will trust the famous Sun Tzu’s “Art of War”, which in 500 BC was already preaching the necessity of a very tight integration and inter-dependency between strategies and tactics (execution):

“Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.”

All has been said!