Deutsche Bank’s CEO John Cryan has had one of the toughest jobs in the business, being tasked with authoring a turnaround for the bank’s lagging business in the United States and Europe. Since assuming the lead role in 2015, Mr. Cryan has embarked on an increasingly ambitious recovery plan that he hopes will help transform the bank into a more sustainable construct moving forward.

Mr. Cryan was appointed to the role in June 2015, having succeeded co-CEOs Jürgen Fitschen and Anshu Jain. This period for Deutsche Bank was marred by increased regulatory scrutiny, culminating in record fines and a series of debilitating scandals facing the bank.

Groundwork Laid for Cost-Cutting Strategy

One of the watershed moments of Mr. Cryan’s tenure was his October 2015 announcement that the lender would be embarking on a broad-based restructuring plan to help reverse Deutsche Bank’s fortunes and profits. The group unveiled a plan that would axe upwards of 35,000 jobs over the next few years across its global operations – the announcement at the time was the first in a wave of strategies adopted by other lenders in a bid to reduce costs.

H2 2015 for Deutsche Bank was especially painful, resulting in fines of almost $3.0 billion – this stemmed from past LIBOR scandals and violations, as well as a failure to adhere to sanctions. The crisis came to a nadir in early 2016 when shareholders’ worst fears were confirmed with a staggering -$6.8 billion loss for the year, prompting further action.

Reuters, Deutsche Bank Headquarters in Frankfurt

Since then Mr. Cryan has doubled and tripled down on his approach to keep cutting jobs and lagging segments of Deutsche Bank’s business. Most cuts have been confined to back office or IT roles, namely in London, though the group has also seen a number of its trading desks – specifically across foreign Exchange (FX) and fixed income space – consolidate into other units or disappear entirely.

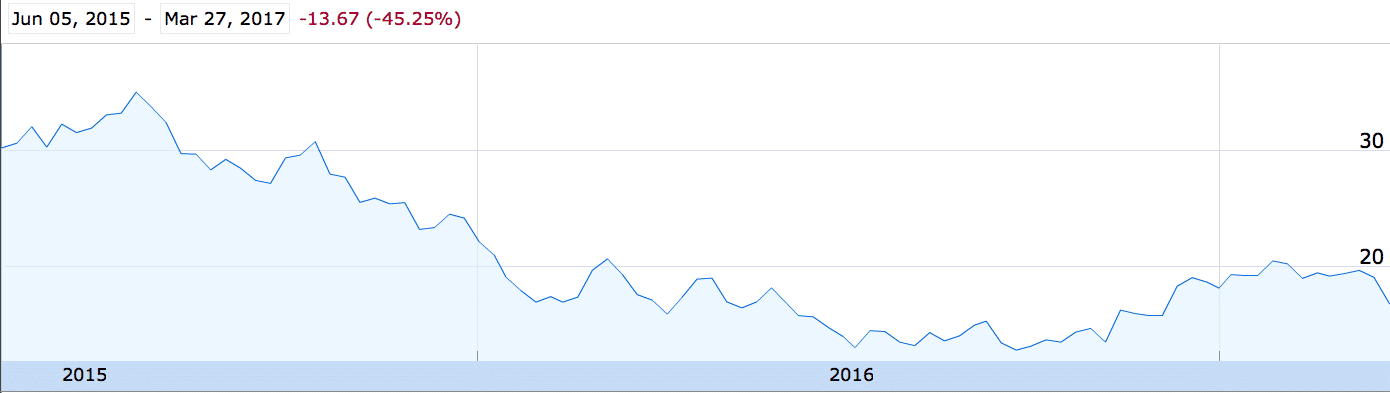

Deutsche Bank (NYSE:DB) Share prices

Recovery Year

For Mr. Cryan’s part, he helped stabilize what had been tanking share prices and a loss of shareholder confidence in 2016, on several occasions steadying investors to stay the course. For the most part, 2016 was devoid of any major catastrophes for the bank, despite the steady leeching of talent and thousands of jobs across its business.

In a sign that the worst had passed, share prices even managed to rebound during H2 2016, though an internal scandal and investigation from the UK’s Financial Conduct Authority (FCA) cast a shadow over the bank for the latter part of the year. In December, Mr. Cryan also was also forced to settle for $7.2 billion with the US Department of Justice, following the mis-selling of mortgage-backed securities.

The aftermath saw Mr. Cryan publicly reaffirming Deutsche Bank’s capital strength, attesting to the severity of the situation. However, investors were given an early-year boost following a year-end earnings report that showed losses had narrowed to just -$1.35 billion, down from -$6.8 billion in the year prior. This was the largest endorsement yet that the plan put into place might be succeeding or starting to take shape, as Mr. Cryan himself had repeatedly pressed for caution and patience in authoring a turnaround.

In yet another effort to help streamline costs, Deutsche Bank also recently went lean with its bonus pool, cutting it a full 80 percent this month in a move that would affect upwards of 100,000 employees. Additionally, the bank called for wide cuts to its staff, estimated at 6 percent of its fixed income staff and 17 percent of its equities personnel globally.

2017 Outlook and US Emphasis

Mr. Cryan himself mapped out several key issues facing the bank and the industry in its earnings report, though on a more isolated basis is gearing up for a duality of fines from US regulators into its FX activities. Deutsche Bank had managed to dodge a fine with the US Department of Justice earlier this month, which helped bolster the group’s outlook for Q1 2017.

It is unknown what sort of material impact or fine the investigations from the Federal Reserve and New York’s Department of Financial Services (DFS) will yield, though for now, Deutsche Bank’s business appears to have stabilized. Amidst these developments, Deutsche Bank has made concerted efforts to attract more talent, focusing on more competitive salaries to offset lower bonuses.

Bloomberg

Looking ahead, Deutsche Bank also has more cash to work with after raising over $8.0 billion in new capital recently, its fourth instance in the past few years. The group is also banking on enticing top industry talent with special long-term incentives that it has used as a carrot in light of a leaner bonus pool.

At the core of Deutsche Bank’s revival strategy is its US business, which has lagged behind its rivals over the past two years. Mr. Cryan has pointed to this area as one of his paramount focuses for 2017 and beyond, at a time when the group is also grappling with a Brexit strategy that may very well see it relocate a large portion of its personnel – an issue most European lenders face.