Bank of America has taken a different course from other US lenders in terms of its Brexit relocation plans. While Citigroup and Morgan Stanley have honed in on Frankfurt as their new EU trading hubs, Bank of America is leaning towards Dublin for life after Brexit.

The London Summit 2017 is coming, get involved!

Bank of America is the latest member of the population of lenders operating in the UK to formalize the relocation of its EU base of operations ahead of Brexit. The timing of the decision was in many ways dictated by the Bank of England calling for a mid-July deadline for UK-based banks to provide the regulator with detailed plans about their Brexit strategy. This coincided with a string of recent announcements from a plethora of lenders all publicizing their plans after months of speculation.

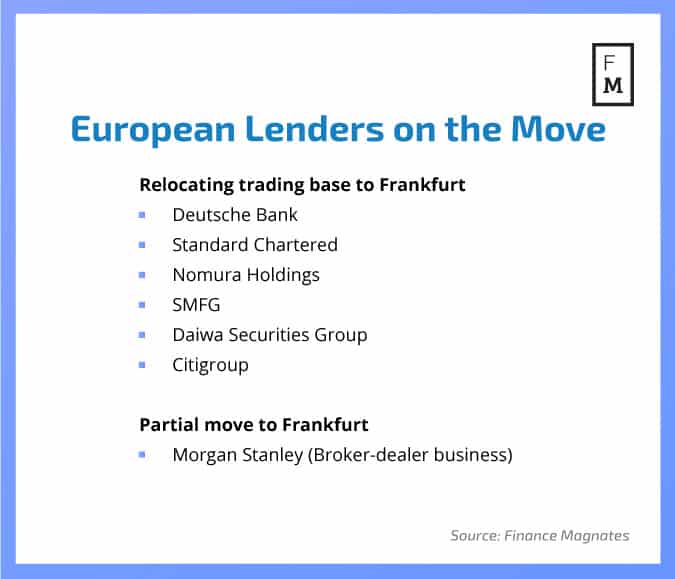

Dublin and Frankfurt have emerged as the top two cities to absorb global lenders operating in the UK that are relocating due to the possible rollback of passporting rights. While Dublin initially jumped out as the primary destination for banks, it has more recently been Frankfurt that has secured most marquee lending groups.

While both cities present advantages and disadvantages for prospective lenders, neither is capable of absorbing the thousands of aggregate personnel ready for a move from London. For example, Frankfurt is slated to see upwards of 9,000 roles move to the city, a number that is expected to meet a shortage of office space.

In terms of Dublin, Bank of America will be looking to fill several hundred jobs in the Irish capital, joining other lenders in strengthening their operations there. More detailed plans are expected to follow in the coming weeks from Bank of America.

Bloomberg

One of the ironies surrounding many the relocation of banks is the uncertainty back in the UK itself. While UK PM Theresa May has insisted that passporting would be curtailed for lenders, her recent electoral setbacks have led to signs of a softened Brexit, leading to a possibility of retaining these rights.

The addition of Bank of America to Irish shores is also the first update this month of a major lender opting for Dublin. Last month, nearly twelve banks and asset managers in the UK signed deals to relocate elements of their operations to Dublin. Such a move still requires a tremendous amount of preparation and planning, with all entrants needing to procure banking licenses, real estate space, trading floors, and other measures.